The Australian market has shown resilience with the ASX200 rising by 0.5% to 8,445 points, while the IT sector leads with a notable 1.4% increase amidst broader economic discussions such as potential U.S. tariffs on China. In this dynamic environment, high growth tech stocks like Data#3 are particularly appealing due to their ability to capitalize on technological advancements and sector momentum, making them noteworthy in today's investment landscape.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Pureprofile | 14.31% | 71.53% | ★★★★★☆ |

| Pro Medicus | 20.42% | 22.46% | ★★★★★★ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| AVA Risk Group | 25.54% | 77.32% | ★★★★★★ |

| Mesoblast | 49.13% | 55.01% | ★★★★★★ |

| Wrkr | 37.21% | 98.46% | ★★★★★★ |

| Opthea | 52.75% | 60.67% | ★★★★★★ |

| SiteMinder | 18.83% | 60.68% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our ASX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Data#3 (ASX:DTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Data#3 Limited provides IT solutions and services across Australia, Fiji, and the Pacific Islands, with a market capitalization of approximately A$1.03 billion.

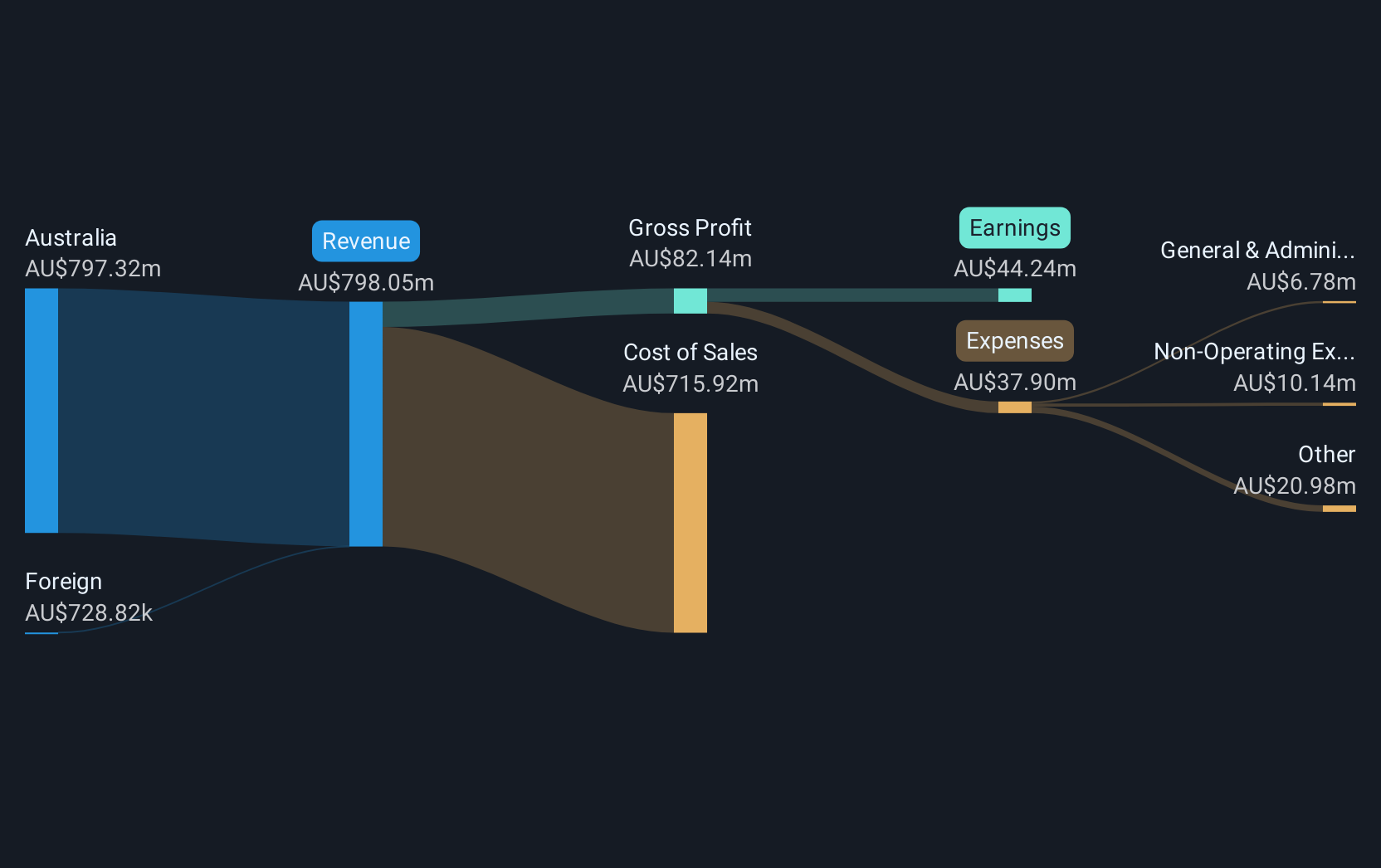

Operations: The company operates as a value-added IT reseller and solutions provider, generating revenue of approximately A$805.75 million. This segment forms the core of its business model, reflecting its focus on delivering comprehensive IT services across its operational regions.

Data#3, a player in Australia's tech scene, is experiencing notable growth with annual revenue and earnings increases of 23.8% and 9.6%, respectively. This performance outpaces the broader Australian market's growth rates, highlighting its competitive edge in a robust IT industry where the average earnings expansion stands at just 8%. The recent appointment of Bronwyn Morris to its board underscores a strategic push towards strengthening corporate governance—an essential move as Data#3 navigates the complexities of rapid expansion and innovation in technology sectors. With R&D expenses consistently aligned with industry demands, Data#3 is well-positioned to sustain its growth trajectory amidst evolving market dynamics.

- Unlock comprehensive insights into our analysis of Data#3 stock in this health report.

Assess Data#3's past performance with our detailed historical performance reports.

Iress (ASX:IRE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Iress Limited designs and develops software and services for the financial services industry across the Asia Pacific, United Kingdom, Europe, Africa, and North America with a market cap of A$1.74 billion.

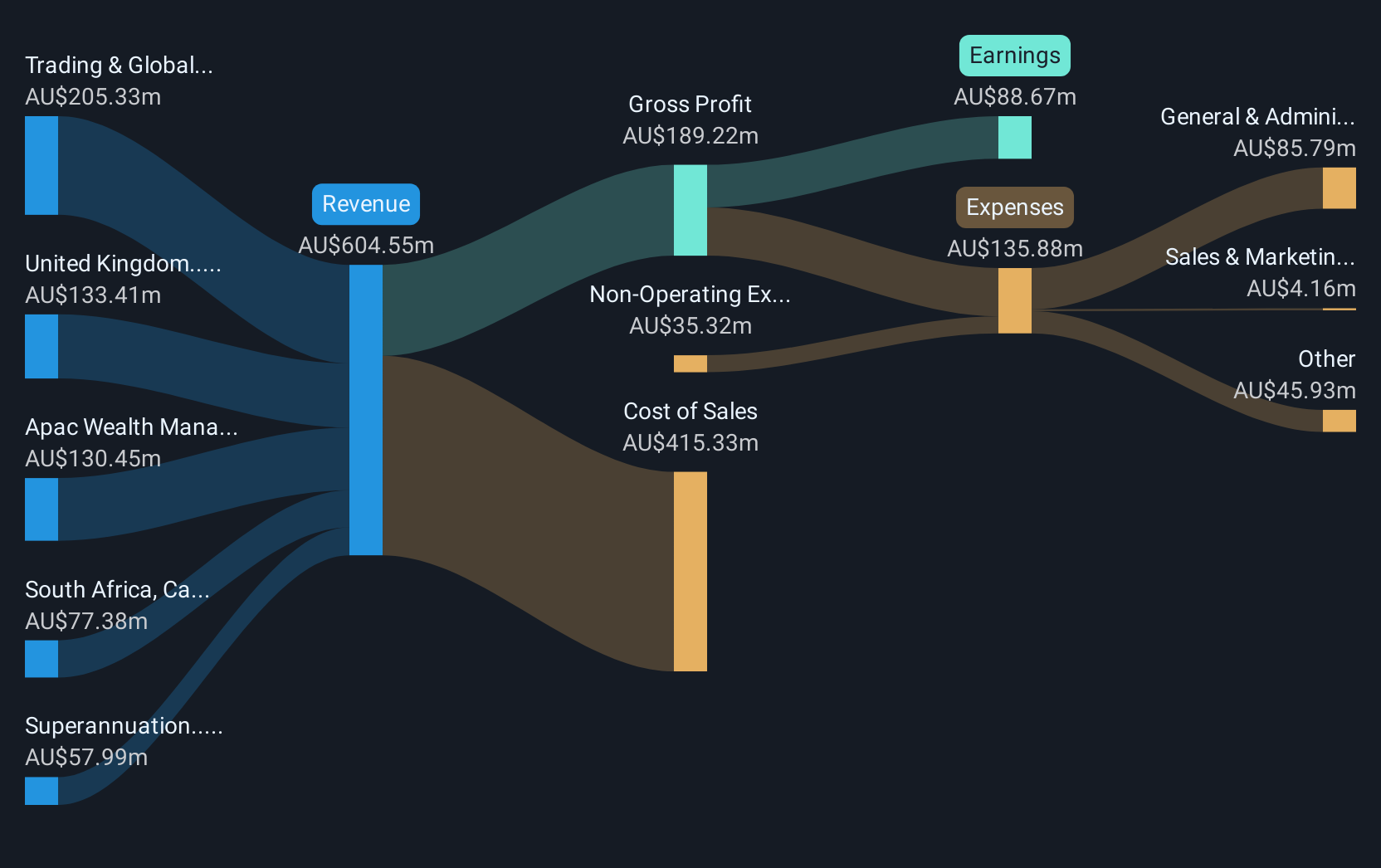

Operations: Iress generates revenue primarily through its software and services for financial services, with key segments including APAC Wealth Management (A$132.02 million), Managed Portfolio in the UK (A$173.43 million), and APAC Trading & Global Market Data (A$179.20 million).

Iress, amidst a challenging landscape, showcases robust potential with an impressive 29.2% forecast in annual earnings growth, significantly outpacing the broader Australian market's projection of 12.7%. Despite a modest revenue growth forecast of 1.5%, which trails the national average of 6%, Iress has turned profitable this past year, setting a promising precedent for its financial trajectory. The company's strategic emphasis on innovation is evident from its R&D commitments, ensuring it remains at the forefront of technological advancements within the software sector. This focus not only enhances Iress's competitive edge but also aligns with industry trends towards increased digitalization and efficiency solutions for businesses globally.

SEEK (ASX:SEK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SEEK Limited operates as an online employment marketplace service provider across Australia, South East Asia, New Zealand, the United Kingdom, Europe, and other international markets with a market cap of A$7.98 billion.

Operations: SEEK Limited generates revenue primarily through its online employment marketplace services, with A$840.10 million from the ANZ region and A$244 million from Asia. The company focuses on connecting job seekers and employers across multiple international markets.

Amidst a competitive landscape, SEEK is poised to transition from unprofitability with an anticipated profit growth that outstrips average market projections. Forecasted to grow earnings by 37.9% annually, the company's strategic focus on innovation is evident in its R&D investments, which are crucial for maintaining technological relevance in the interactive media and services sector. Despite revenue growth projections of 7.7% per year—modest compared to some high-growth benchmarks but still above Australia's overall market rate of 6%—SEEK demonstrates potential through its adaptive strategies and robust market positioning. This blend of financial health and strategic foresight suggests a promising horizon for SEEK as it navigates towards profitability and beyond.

- Click to explore a detailed breakdown of our findings in SEEK's health report.

Gain insights into SEEK's past trends and performance with our Past report.

Next Steps

- Investigate our full lineup of 57 ASX High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DTL

Data#3

Engages in the provision of information technology (IT) solutions and services in Australia, Fiji, and the Pacific Islands.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives