- Australia

- /

- Metals and Mining

- /

- ASX:MAH

ASX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

The Australian market has shown resilience with the ASX200 up 0.5% at 8,445 points, despite global trade tensions following the U.S. consideration of tariffs on China. As investors navigate these market dynamics, penny stocks continue to capture attention for their potential to offer both affordability and growth opportunities. Although considered a somewhat outdated term, penny stocks still highlight smaller or less-established companies that may provide value when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.91 | A$241.27M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.555 | A$108.99M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.95 | A$107.87M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.975 | A$321.56M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$5.00 | A$493.36M | ★★★★☆☆ |

| IVE Group (ASX:IGL) | A$2.13 | A$329.91M | ★★★★☆☆ |

| Centrepoint Alliance (ASX:CAF) | A$0.325 | A$64.64M | ★★★★★☆ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Boom Logistics (ASX:BOL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Boom Logistics Limited offers lifting solutions across various sectors including mining, infrastructure, and energy in Australia and the Pacific region, with a market cap of A$54.93 million.

Operations: The company's revenue is primarily derived from its Lifting Solutions segment, which generated A$259.23 million.

Market Cap: A$54.93M

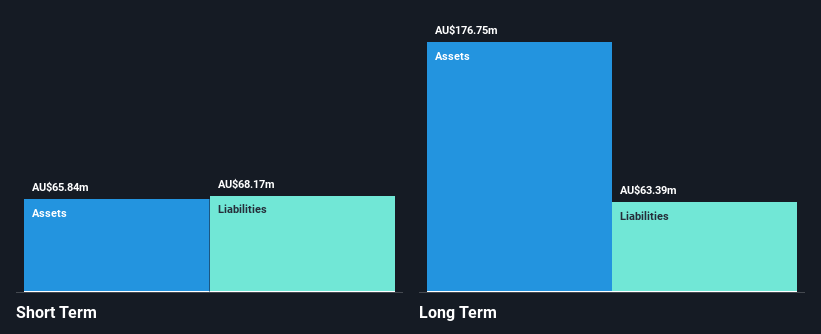

Boom Logistics Limited, with a market cap of A$54.93 million, has shown profitability growth over the past five years, achieving an annual earnings increase of 49.3%. The company's debt is well covered by operating cash flow at 272.1%, and its debt to equity ratio has improved significantly from 28.3% to 12% over five years. However, short-term assets do not fully cover short-term liabilities (A$68.2M), and interest payments are not well covered by EBIT (2.1x). Trading at a significant discount below its estimated fair value, Boom's recent adoption of a new constitution reflects ongoing corporate governance updates.

- Unlock comprehensive insights into our analysis of Boom Logistics stock in this financial health report.

- Gain insights into Boom Logistics' historical outcomes by reviewing our past performance report.

GR Engineering Services (ASX:GNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services to the mining and mineral processing sectors both in Australia and globally, with a market cap of A$453.08 million.

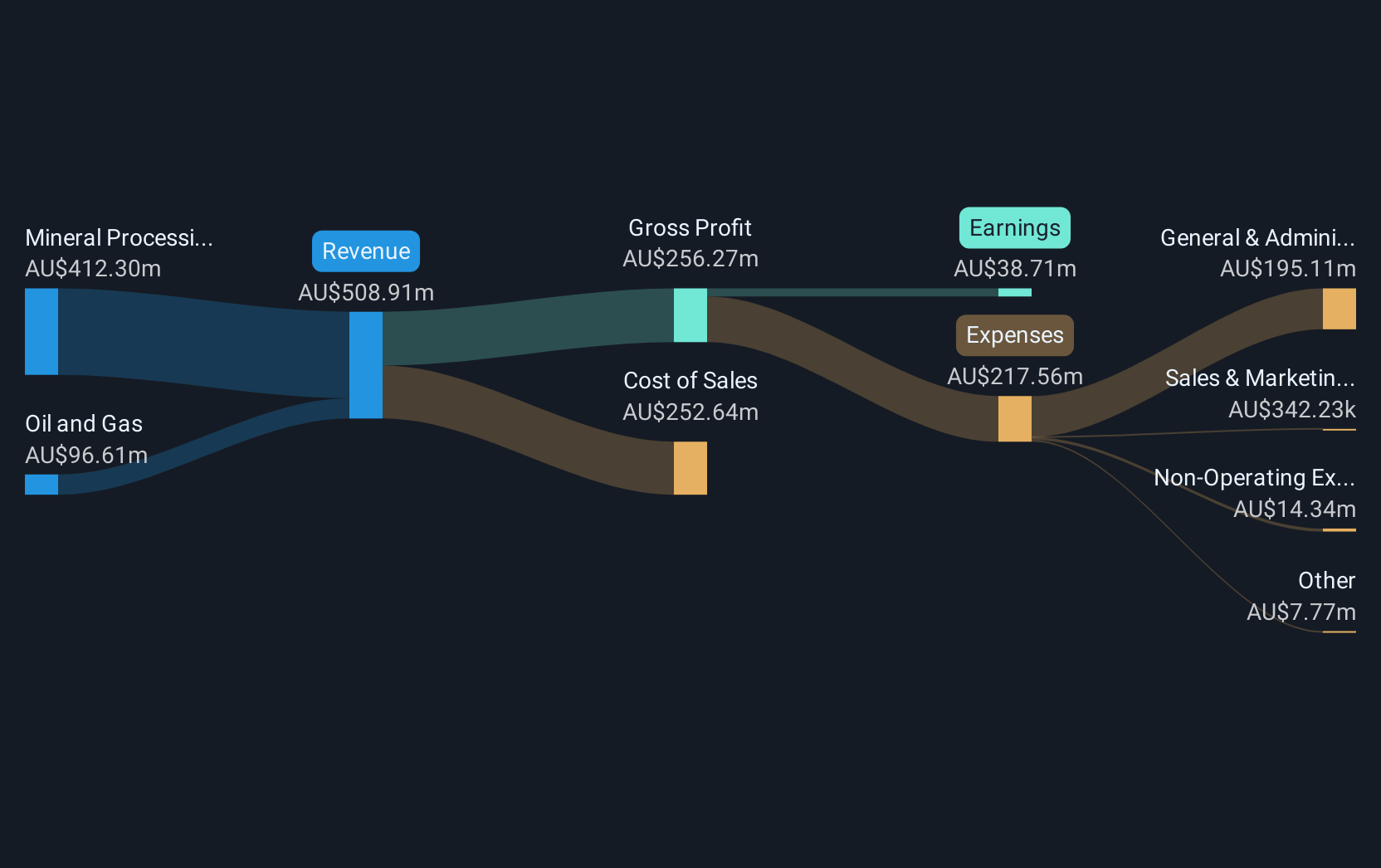

Operations: The company's revenue is derived from two main segments: Mineral Processing, which contributes A$346.21 million, and Oil and Gas, accounting for A$77.86 million.

Market Cap: A$453.08M

GR Engineering Services Limited, with a market cap of A$453.08 million, operates debt-free and demonstrates strong financial health. Its earnings have grown significantly at 38.9% annually over the past five years, with recent growth outpacing the industry average at 13.4%. The company's net profit margins improved to 7.4%, and its return on equity is outstanding at 47%. Despite a sustainable management team and board tenure, its dividend yield of 7.01% is not well covered by earnings or free cash flow, which may be a concern for income-focused investors considering this stock in their portfolio.

- Navigate through the intricacies of GR Engineering Services with our comprehensive balance sheet health report here.

- Learn about GR Engineering Services' historical performance here.

Macmahon Holdings (ASX:MAH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Macmahon Holdings Limited offers surface and underground mining, mining support, and civil infrastructure services to the mining sector in Australia and Southeast Asia, with a market cap of A$696.79 million.

Operations: The company generates revenue of A$2.03 billion from its mining and civil operations.

Market Cap: A$696.79M

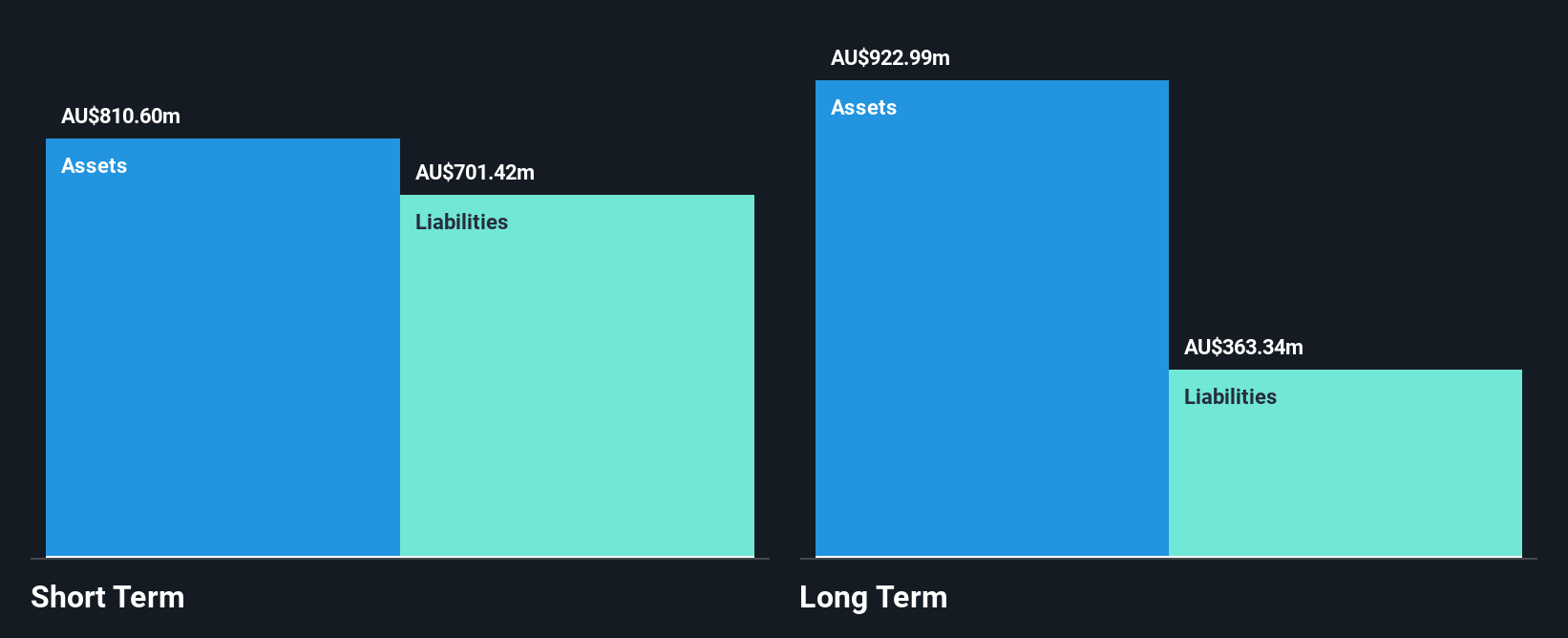

Macmahon Holdings, with a market cap of A$696.79 million, shows financial resilience in the penny stock realm. Its operating cash flow effectively covers its debt at 140.4%, and short-term assets surpass both long-term (A$259.7M) and short-term liabilities (A$558.2M). The company maintains high-quality earnings despite a slight decline in profits over five years and negative growth last year. While the return on equity is low at 8.4%, interest payments are well covered by EBIT at four times coverage, indicating solid debt management. Recent board changes suggest a strategic shift with new directors appointed in November 2024.

- Click here to discover the nuances of Macmahon Holdings with our detailed analytical financial health report.

- Assess Macmahon Holdings' future earnings estimates with our detailed growth reports.

Make It Happen

- Explore the 1,027 names from our ASX Penny Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MAH

Macmahon Holdings

Provides surface mining, underground mining and mining support, and civil infrastructure services to mining companies in Australia and Southeast Asia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives