- Australia

- /

- Oil and Gas

- /

- ASX:BPT

Could Recent Lapse in Management Incentives Shift Perceptions of Beach Energy's Strategy (ASX:BPT)?

Reviewed by Sasha Jovanovic

- Beach Energy Limited recently announced the lapse of 14,338 matched rights and 567,673 performance rights after certain conditions were not satisfied by the end of September 2025.

- This development may alter how stakeholders view Beach Energy’s management performance targets and influence assessments of its capital structure and long-term incentives.

- We'll now explore how the lapse in performance rights could shape views on Beach Energy’s management incentives and operational outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Beach Energy Investment Narrative Recap

To hold Beach Energy shares, investors typically need confidence in the company's ability to offset natural reserve declines and deliver on production growth, with the Waitsia Gas Project ramp-up seen as a major near-term catalyst. The recent lapse of matched and performance rights, stemming from unmet performance conditions, appears unlikely to materially impact either the Waitsia catalyst or the key operational risk of reserve downgrades, given that the core operational and financial drivers remain unchanged.

One recent announcement with relevance is the reporting of a full-year net loss of A$43.8 million, which reflects ongoing challenges from field declines and production setbacks. While this underlines some of the operational risks the company faces, it places extra emphasis on the importance of major projects like Waitsia in supporting future earnings and offsetting current headwinds.

Yet, in contrast to the perceived margin uplift from new gas projects, investors should also be mindful of the company’s declining reserve life and what it could mean for...

Read the full narrative on Beach Energy (it's free!)

Beach Energy's outlook anticipates A$2.0 billion in revenue and A$537.5 million in earnings by 2028. This forecast implies a 1.6% annual revenue decline and a turnaround in earnings from A$-43.8 million today, representing an increase of about A$581 million.

Uncover how Beach Energy's forecasts yield a A$1.24 fair value, a 10% upside to its current price.

Exploring Other Perspectives

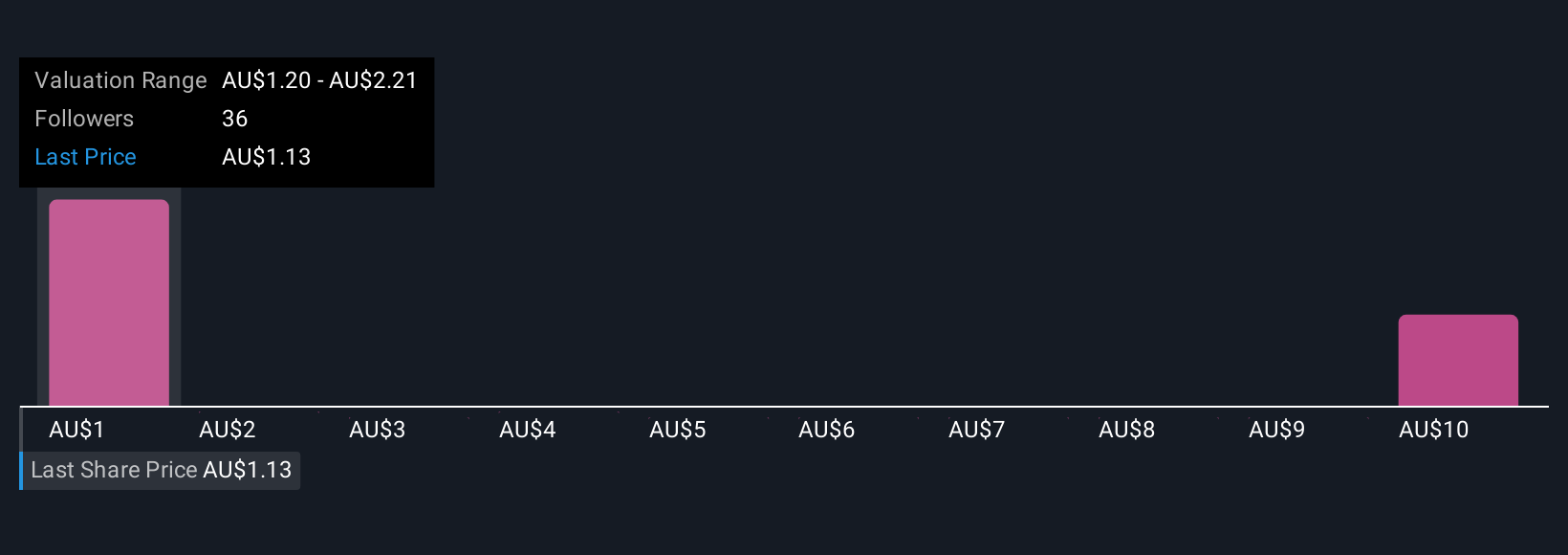

Simply Wall St Community members provided eight different fair value estimates for Beach Energy, from A$1.20 to A$11.84 per share. With forecasts hinging on new project deliveries, views underline how investor expectations around reserve life and production initiatives can set the tone for Beach Energy’s outlook.

Explore 8 other fair value estimates on Beach Energy - why the stock might be worth just A$1.20!

Build Your Own Beach Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beach Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Beach Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beach Energy's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beach Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BPT

Beach Energy

Operates as an oil and gas exploration and production company.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives