- Australia

- /

- Capital Markets

- /

- ASX:EZL

ASX Penny Stocks To Consider In January 2025

Reviewed by Simply Wall St

The Australian market is poised for a positive start, with ASX 200 futures indicating a potential gain following encouraging U.S. inflation data that has buoyed global investor sentiment. In this context, penny stocks—though an older term—remain relevant as they often represent smaller or newer companies that can offer growth opportunities when backed by strong financial health. Let's explore several penny stocks that might pair balance sheet strength with long-term potential in the current market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.92 | A$242.1M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.99 | A$111.58M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.965 | A$319.94M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.885 | A$104.27M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$242.07M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.285 | A$109.71M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.92 | A$485.43M | ★★★★☆☆ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Boss Energy (ASX:BOE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boss Energy Limited is involved in the exploration and production of uranium deposits in Australia and the United States, with a market capitalization of approximately A$1.12 billion.

Operations: There are no reported revenue segments for this company.

Market Cap: A$1.12B

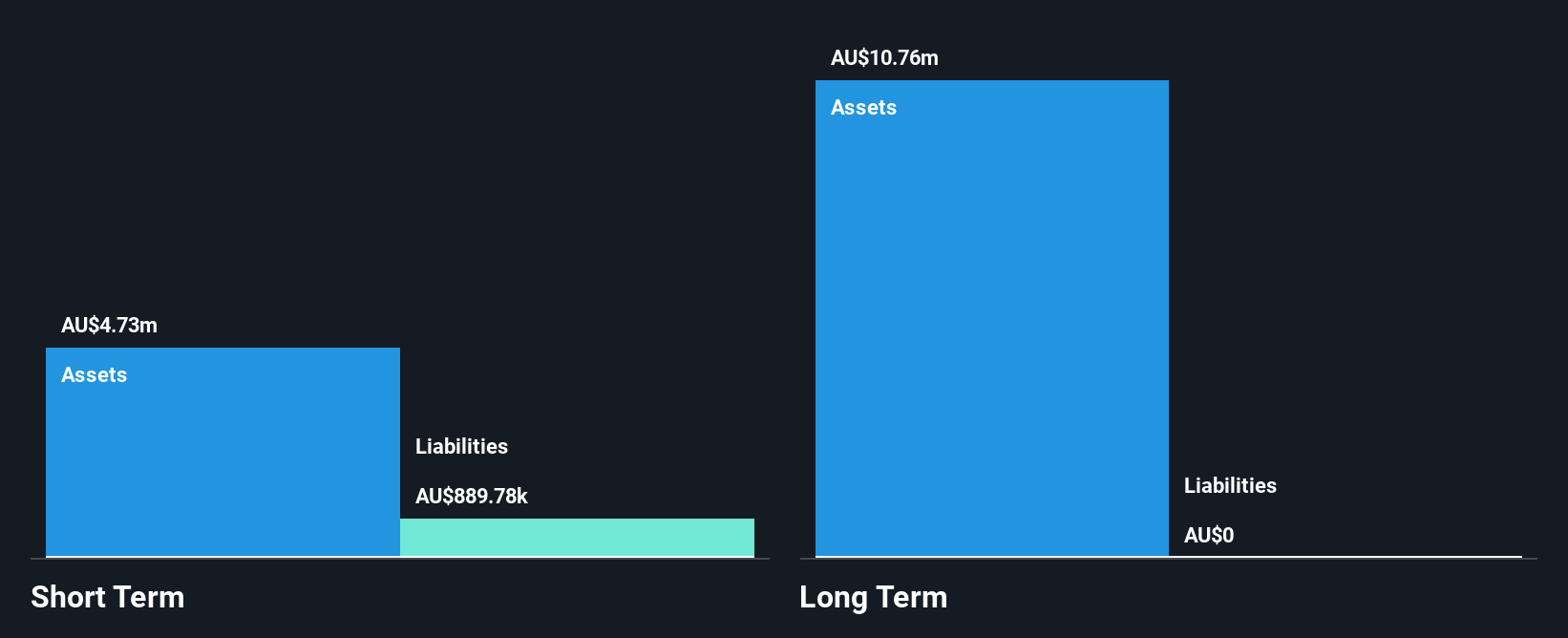

Boss Energy Limited, with a market cap of A$1.12 billion, is currently trading significantly below its estimated fair value. Despite being pre-revenue, the company has shown impressive earnings growth of 255.4% over the past year and maintains a debt-free balance sheet. Its short-term assets of A$133.1 million comfortably cover both short and long-term liabilities, indicating solid financial health for a penny stock. However, the management team is relatively new with an average tenure of 1.3 years, which may present some operational challenges moving forward as they establish themselves in the industry.

- Click here to discover the nuances of Boss Energy with our detailed analytical financial health report.

- Examine Boss Energy's earnings growth report to understand how analysts expect it to perform.

Chilwa Minerals (ASX:CHW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Chilwa Minerals Limited is involved in the exploration and development of heavy mineral sands projects in Africa, with a market capitalization of A$60.70 million.

Operations: Chilwa Minerals Limited does not have reported revenue segments.

Market Cap: A$60.7M

Chilwa Minerals Limited, with a market cap of A$60.70 million, is pre-revenue and currently unprofitable, reflected in its negative return on equity. Despite this, the company has no long-term liabilities and maintains more cash than total debt, suggesting a strong balance sheet for a penny stock. Recent capital raises have bolstered its cash runway beyond eight months. However, shareholder dilution occurred over the past year with an 8.8% increase in shares outstanding. The board's average tenure of 2.3 years indicates relative inexperience which could impact strategic direction as they navigate their mineral sands projects in Africa.

- Get an in-depth perspective on Chilwa Minerals' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Chilwa Minerals' track record.

Euroz Hartleys Group (ASX:EZL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Euroz Hartleys Group Limited is a diversified financial services company offering stockbroking, corporate finance, funds management, investment advice, financial advisory, and wealth management services to private, institutional, and corporate clients in Australia with a market cap of A$136.56 million.

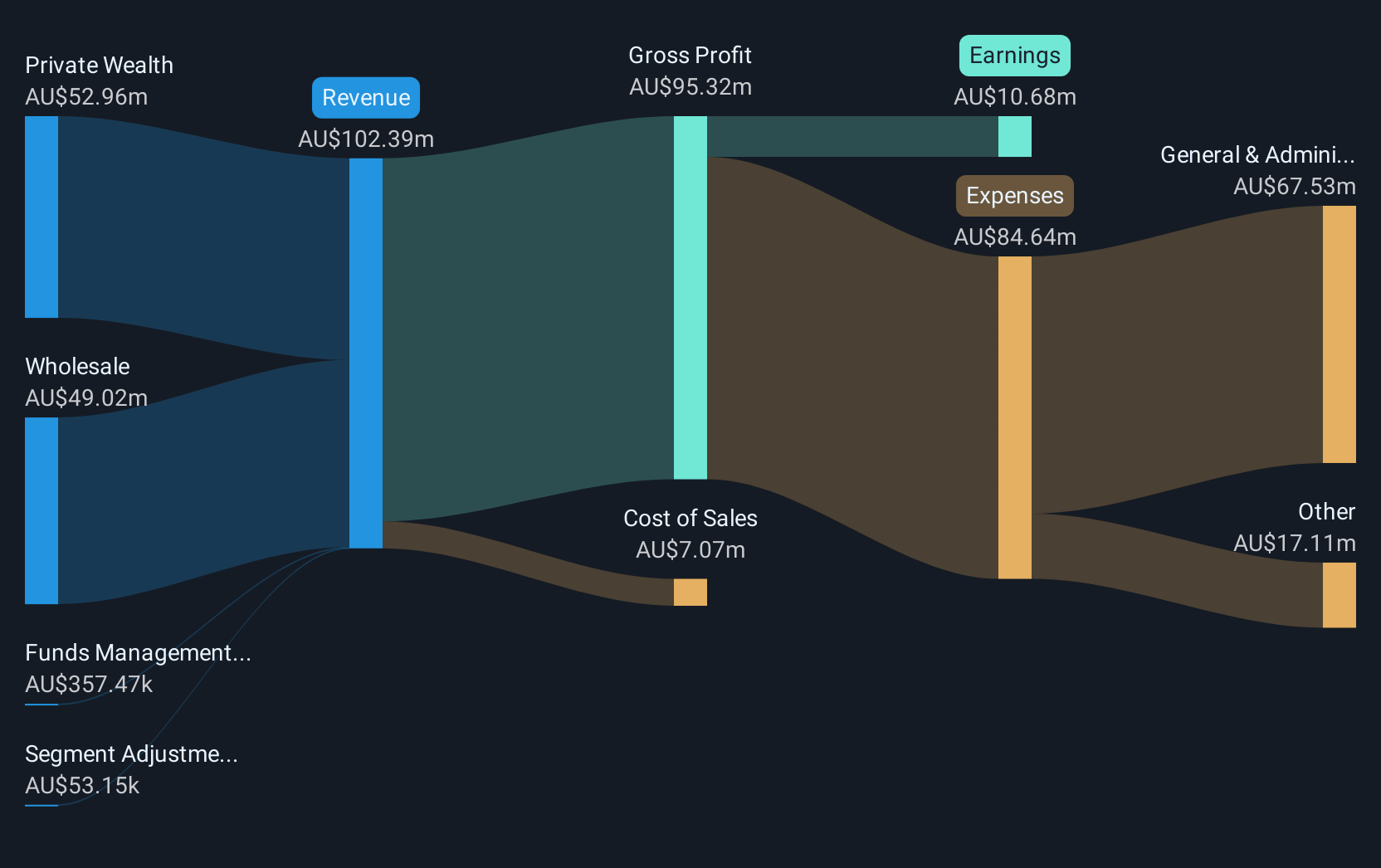

Operations: The company's revenue is primarily derived from Private Wealth at A$49.95 million, followed by Wholesale services contributing A$38.58 million, and Funds Management generating A$0.35 million.

Market Cap: A$136.56M

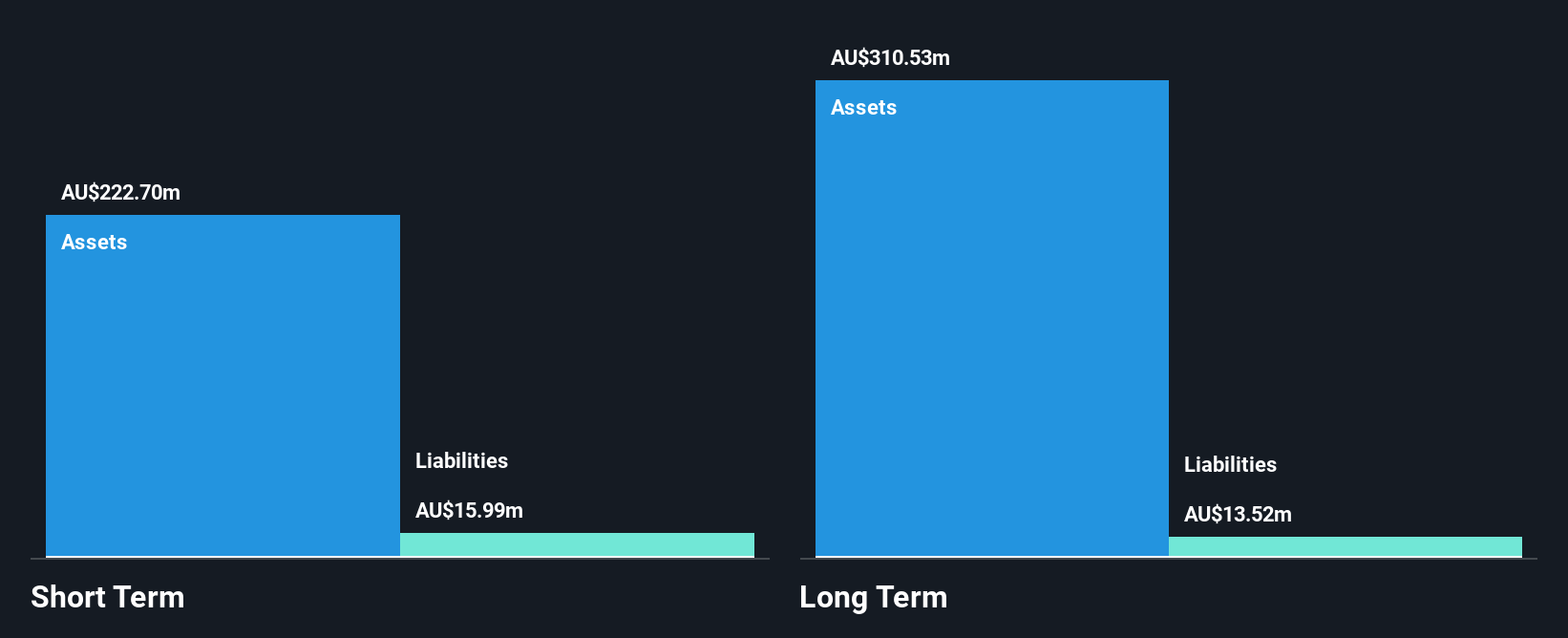

Euroz Hartleys Group Limited, with a market cap of A$136.56 million, presents a mixed picture for investors in penny stocks. The company is debt-free and its short-term assets exceed both short and long-term liabilities, indicating strong liquidity. However, recent financial performance shows negative earnings growth and declining profit margins impacted by a significant one-off loss of A$4.6 million. Despite trading significantly below estimated fair value, the dividend yield of 5.37% is not well covered by earnings. Recent leadership changes include Tim Bunney's appointment as Managing Director, bringing stability with his 13-year tenure at the company.

- Click to explore a detailed breakdown of our findings in Euroz Hartleys Group's financial health report.

- Explore historical data to track Euroz Hartleys Group's performance over time in our past results report.

Summing It All Up

- Navigate through the entire inventory of 1,027 ASX Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Euroz Hartleys Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EZL

Euroz Hartleys Group

A diversified financial services company, provides stockbroking, wealth and funds management, and investing services in Australia.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)