- Australia

- /

- Oil and Gas

- /

- ASX:AXP

Shareholders Will Probably Not Have Any Issues With AXP Energy Limited's (ASX:AXP) CEO Compensation

Key Insights

- AXP Energy will host its Annual General Meeting on 29th of November

- Salary of US$150.0k is part of CEO Tim Hart's total remuneration

- Total compensation is 47% below industry average

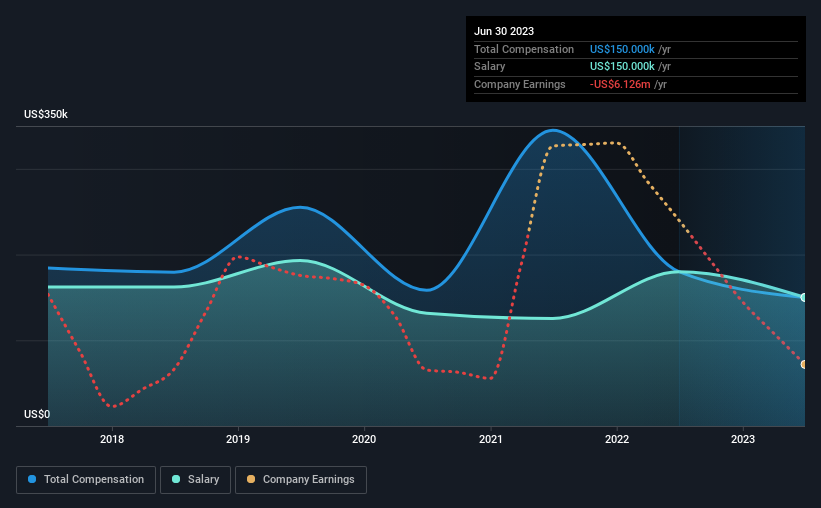

- AXP Energy's three-year loss to shareholders was 67% while its EPS grew by 61% over the past three years

Shareholders may be wondering what CEO Tim Hart plans to do to improve the less than great performance at AXP Energy Limited (ASX:AXP) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 29th of November. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for AXP Energy

Comparing AXP Energy Limited's CEO Compensation With The Industry

Our data indicates that AXP Energy Limited has a market capitalization of AU$5.8m, and total annual CEO compensation was reported as US$150k for the year to June 2023. Notably, that's a decrease of 17% over the year before. Notably, the salary of US$150k is the entirety of the CEO compensation.

On comparing similar-sized companies in the Australian Oil and Gas industry with market capitalizations below AU$304m, we found that the median total CEO compensation was US$283k. Accordingly, AXP Energy pays its CEO under the industry median. Furthermore, Tim Hart directly owns AU$82k worth of shares in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$150k | US$180k | 100% |

| Other | - | - | - |

| Total Compensation | US$150k | US$180k | 100% |

On an industry level, roughly 62% of total compensation represents salary and 38% is other remuneration. On a company level, AXP Energy prefers to reward its CEO through a salary, opting not to pay Tim Hart through non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at AXP Energy Limited's Growth Numbers

Over the past three years, AXP Energy Limited has seen its earnings per share (EPS) grow by 61% per year. It saw its revenue drop 4.6% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has AXP Energy Limited Been A Good Investment?

Few AXP Energy Limited shareholders would feel satisfied with the return of -67% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

AXP Energy rewards its CEO solely through a salary, ignoring non-salary benefits completely. The fact that shareholders are sitting on a loss is certainly disheartening. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. A key focus for the board and management will be how to align the share price with fundamentals. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 2 warning signs for AXP Energy that investors should be aware of in a dynamic business environment.

Important note: AXP Energy is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AXP

AXP Energy

Operates as an oil and gas exploration, production and development company in the United States.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)