- Australia

- /

- Capital Markets

- /

- ASX:FID

Top ASX Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

The Australian market is currently grappling with the ripple effects of a hawkish stance from the U.S. Federal Reserve, leading to anticipated declines in ASX 200 futures and a weakened Aussie dollar. Amidst this uncertainty, dividend stocks can offer investors potential stability and income, making them an appealing consideration for those navigating volatile market conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.23% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.73% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.94% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.36% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.00% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.60% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.21% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.89% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 8.89% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.52% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

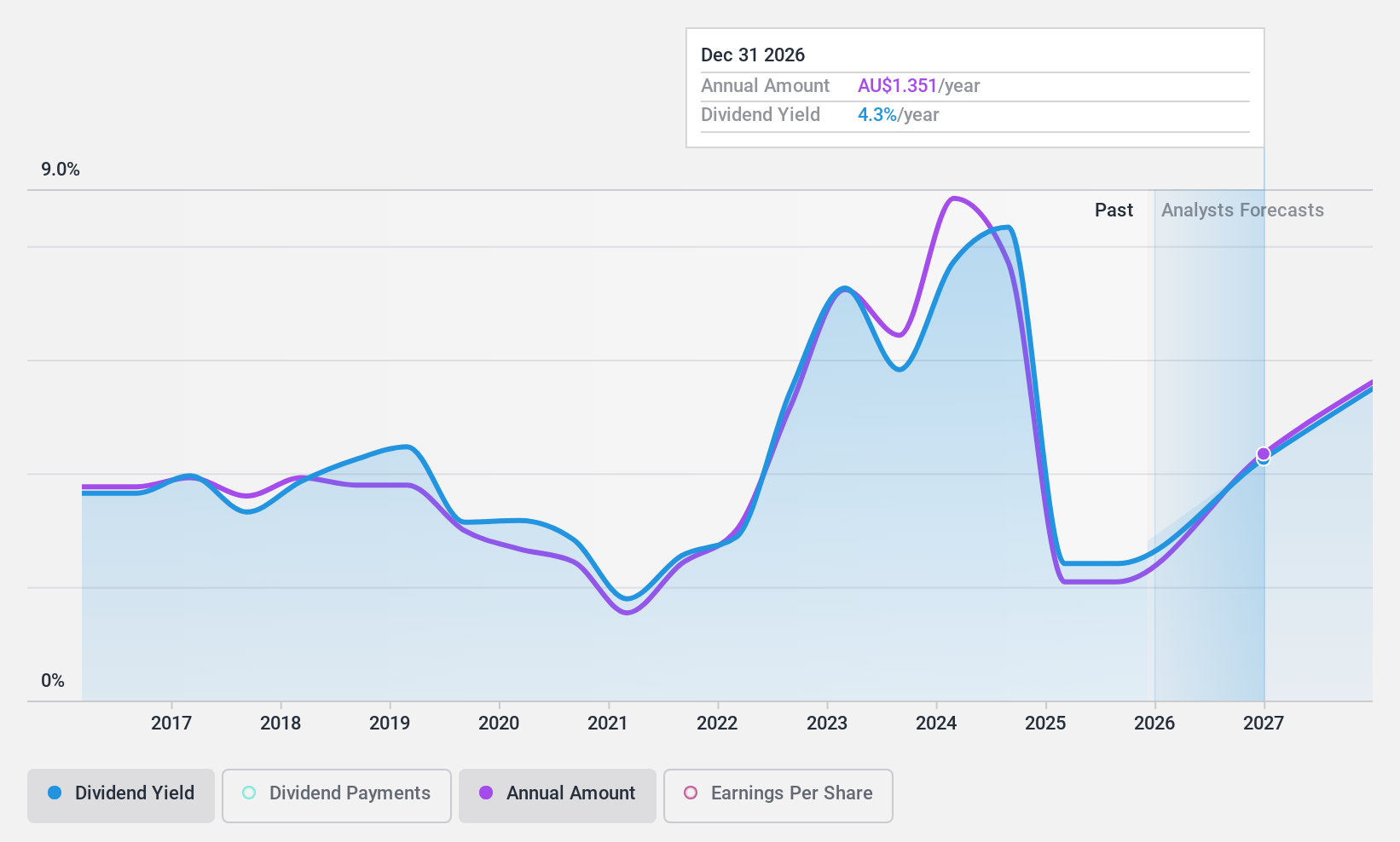

Ampol (ASX:ALD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampol Limited is engaged in the purchase, refining, distribution, and marketing of petroleum products across Australia, New Zealand, Singapore, and the United States with a market capitalization of A$6.37 billion.

Operations: Ampol Limited's revenue is primarily derived from its Fuels and Infrastructure segment at A$34.46 billion, followed by Convenience Retail at A$5.97 billion, and New Zealand operations at A$5.49 billion.

Dividend Yield: 9%

Ampol's dividend yield is among the top 25% in Australia, but its sustainability is questionable due to a high cash payout ratio of 115.2%, indicating dividends are not well covered by free cash flows. Despite past volatility and unreliability in dividend payments, earnings have shown significant growth recently. The stock trades at a good value compared to peers and below estimated fair value, but investors should be cautious given the company's high debt levels.

- Navigate through the intricacies of Ampol with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Ampol's share price might be too pessimistic.

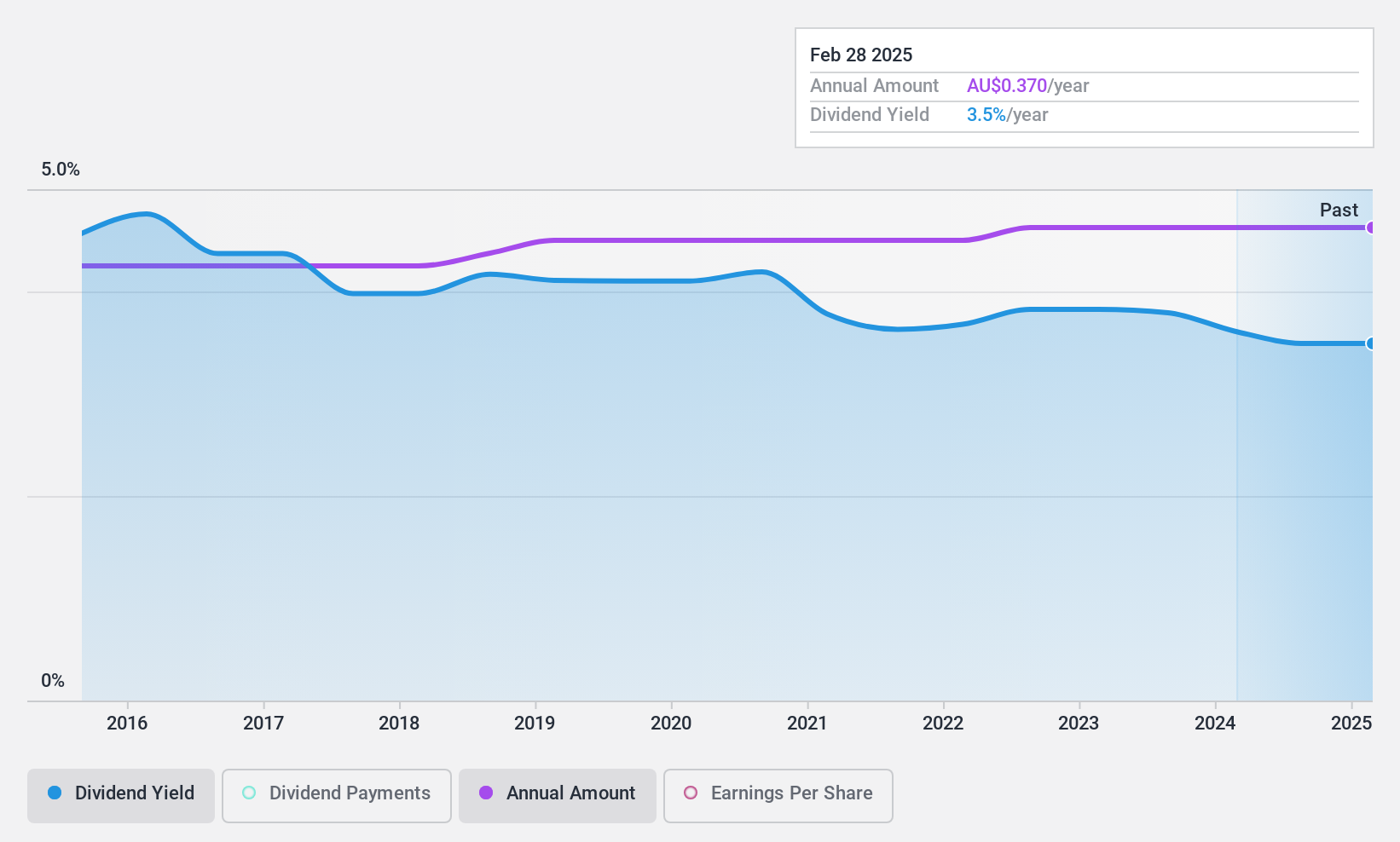

Australian United Investment (ASX:AUI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Australian United Investment Company Limited is a publicly owned investment manager with a market cap of A$1.31 billion.

Operations: Australian United Investment Company Limited generates its revenue primarily from investments, amounting to A$57.76 million.

Dividend Yield: 3.5%

Australian United Investment's dividend yield of 3.52% is below the top 25% in Australia. While dividends have been stable and reliable over the past decade, with consistent growth, their sustainability is concerning due to a high payout ratio of 95%, indicating they are not well covered by earnings. However, with a cash payout ratio of 89.7%, dividends are supported by cash flows, suggesting some level of financial prudence despite lower yield competitiveness.

- Unlock comprehensive insights into our analysis of Australian United Investment stock in this dividend report.

- Our valuation report here indicates Australian United Investment may be overvalued.

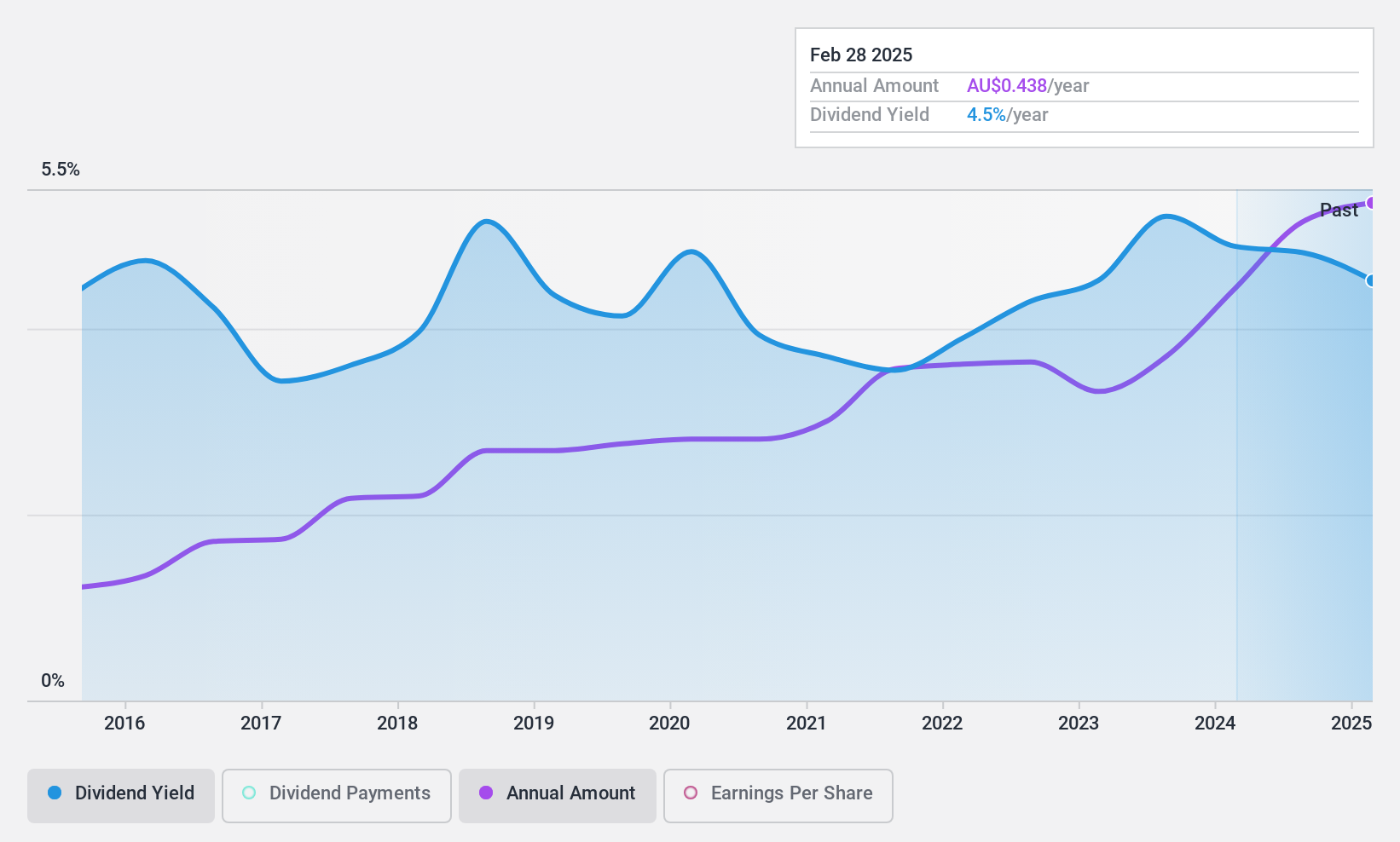

Fiducian Group (ASX:FID)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fiducian Group Ltd, with a market cap of A$283.61 million, operates through its subsidiaries to offer financial services in Australia.

Operations: Fiducian Group Ltd generates revenue through its subsidiaries in Australia, with segments including Funds Management (A$22.08 million), Corporate Services (A$15.06 million), Financial Planning (A$27.69 million), and Platform Administration (A$15.97 million).

Dividend Yield: 4.4%

Fiducian Group offers a dividend yield of 4.36%, which is modest compared to the top 25% in Australia. Over the past decade, dividends have been stable and growing, supported by an earnings payout ratio of 82.3% and a cash payout ratio of 63.8%. This indicates sustainability as they are well-covered by both earnings and cash flows. However, recent significant insider selling may raise concerns about future confidence despite strong earnings growth of 22.1% last year.

- Get an in-depth perspective on Fiducian Group's performance by reading our dividend report here.

- According our valuation report, there's an indication that Fiducian Group's share price might be on the expensive side.

Turning Ideas Into Actions

- Get an in-depth perspective on all 31 Top ASX Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FID

Fiducian Group

Through its subsidiaries, provides financial services in Australia.

Outstanding track record with flawless balance sheet and pays a dividend.