- Australia

- /

- Capital Markets

- /

- ASX:TIP

If You Like EPS Growth Then Check Out Teaminvest Private Group (ASX:TIP) Before It's Too Late

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Teaminvest Private Group (ASX:TIP). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Teaminvest Private Group

How Fast Is Teaminvest Private Group Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. You can imagine, then, that it almost knocked my socks off when I realized that Teaminvest Private Group grew its EPS from AU$0.012 to AU$0.052, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

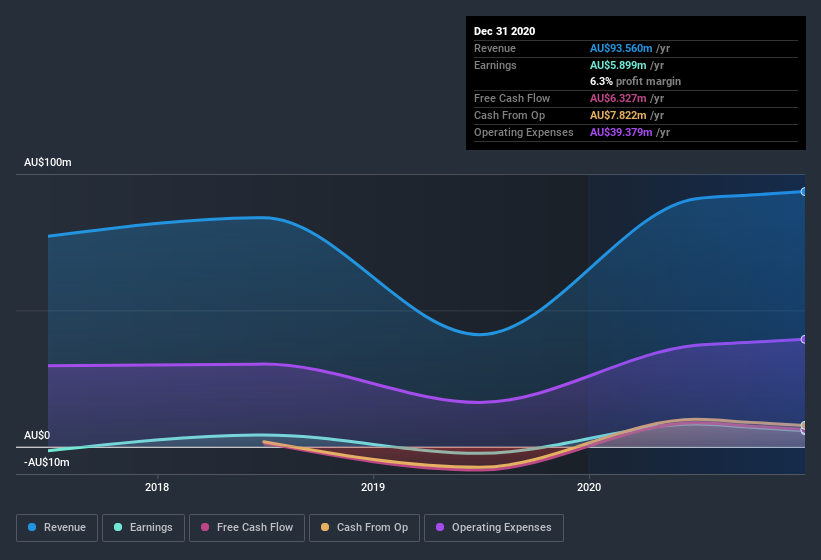

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Teaminvest Private Group maintained stable EBIT margins over the last year, all while growing revenue 41% to AU$94m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Teaminvest Private Group isn't a huge company, given its market capitalization of AU$85m. That makes it extra important to check on its balance sheet strength.

Are Teaminvest Private Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see Teaminvest Private Group insiders walking the walk, by spending AU$457k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the Non-Executive Director, Howard Coleman, who made the biggest single acquisition, paying AU$98k for shares at about AU$0.65 each.

Is Teaminvest Private Group Worth Keeping An Eye On?

Teaminvest Private Group's earnings have taken off like any random crypto-currency did, back in 2017. Growth investors should find it difficult to look past that strong EPS move. And in fact, it could well signal a fundamental shift in the business economics. For me, this situation certainly piques my interest. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Teaminvest Private Group that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Teaminvest Private Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Teaminvest Private Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Teaminvest Private Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:TIP

Teaminvest Private Group

A private equity firm specializing in middle market and mature companies providing buyout and growth capital transactions.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives