The Australian market has shown positive momentum, with the ASX200 up 1.1% and all sectors gaining, led by IT and Materials. While the term 'penny stock' might seem outdated, it still represents smaller or newer companies that can offer substantial value when they possess strong financials and growth potential. This article explores three such penny stocks that demonstrate balance sheet resilience and promising opportunities for investors seeking to uncover hidden gems in the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$301.21M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.555 | A$344.18M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.82 | A$100.68M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.195 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.49 | A$132.44M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.32 | A$112.68M | ★★★★★☆ |

Click here to see the full list of 1,037 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Engenco (ASX:EGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Engenco Limited, with a market cap of A$58.46 million, provides transportation solutions through its subsidiaries.

Operations: The company's revenue is derived from several segments, including Drivetrain (A$65.05 million), Gemco Rail (A$93.60 million), Convair Engineering (A$31.58 million), Workforce Solutions (A$18.05 million), and Hedemora Turbo & Diesel (A$8.32 million).

Market Cap: A$58.46M

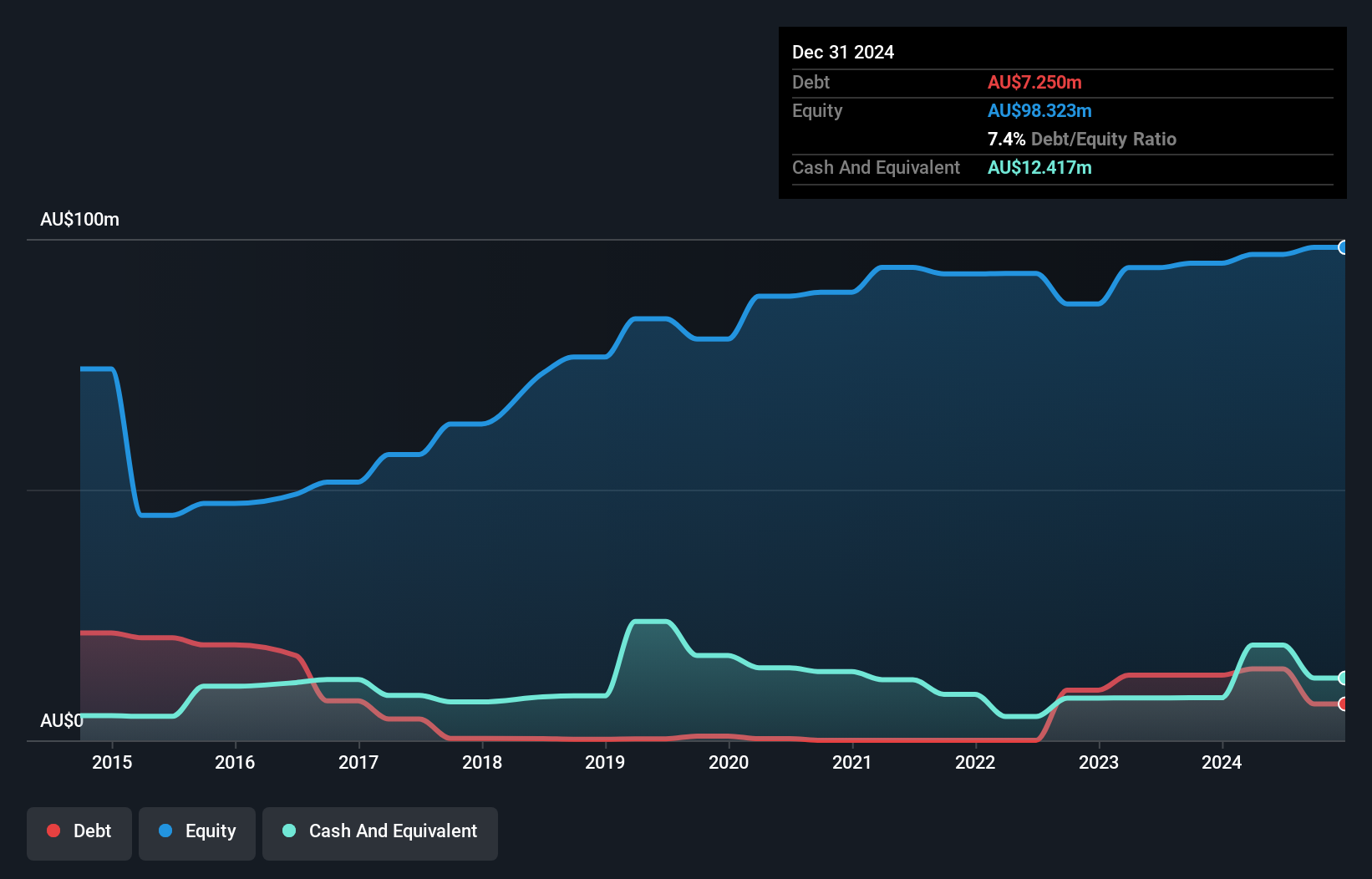

Engenco Limited, with a market cap of A$58.46 million, reported sales of A$214.85 million for the year ended June 30, 2024. Despite a decline in net income from A$5.93 million to A$3.93 million and reduced profit margins from 2.7% to 1.8%, the company maintains more cash than its total debt and covers short-term liabilities with assets totaling A$122.4 million against liabilities of A$65.6 million. The stock trades at a significant discount to estimated fair value but faces challenges with declining earnings over five years and low return on equity at 4.1%.

- Click here and access our complete financial health analysis report to understand the dynamics of Engenco.

- Learn about Engenco's historical performance here.

Sandon Capital Investments (ASX:SNC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sandon Capital Investments Limited is a publicly owned investment manager with a market cap of A$111.25 million.

Operations: The company generates revenue of A$20.72 million from its investing activities.

Market Cap: A$111.25M

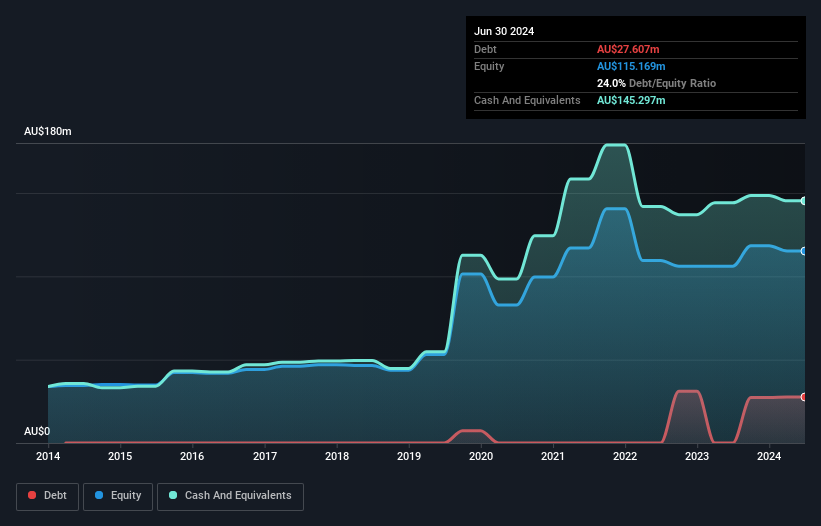

Sandon Capital Investments Limited, with a market cap of A$111.25 million, has demonstrated impressive earnings growth of 657.1% over the past year, significantly outpacing the industry average. The company reported revenue of A$20.72 million and net income of A$14.36 million for the fiscal year ending June 30, 2024, reflecting strong profitability with high-quality earnings and improved profit margins from the previous year. Despite shareholder dilution by 2.5%, Sandon maintains more cash than its total debt and covers both short-term and long-term liabilities effectively. However, it faces challenges with an unstable dividend track record and low return on equity at 12.5%.

- Dive into the specifics of Sandon Capital Investments here with our thorough balance sheet health report.

- Explore historical data to track Sandon Capital Investments' performance over time in our past results report.

Straker (ASX:STG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Straker Limited, along with its subsidiaries, provides language services and technology solutions across the Asia Pacific, Europe, the Middle East, Africa, and North America with a market cap of A$28.95 million.

Operations: The company generates NZ$50.01 million in revenue from its Business Services segment.

Market Cap: A$28.95M

Straker Limited, with a market cap of A$28.95 million, operates in the language services sector and generates NZ$50.01 million in revenue annually. Despite being currently unprofitable, it maintains a robust financial position with no debt and short-term assets of NZ$23.1 million exceeding both short-term (NZ$12.1M) and long-term liabilities (NZ$1M). The company has managed to reduce its losses by 6.7% per year over the past five years while maintaining positive free cash flow, providing it with a cash runway exceeding three years without significant shareholder dilution recently. Revenue growth is forecasted at 7.47% annually but profitability remains elusive for now.

- Click to explore a detailed breakdown of our findings in Straker's financial health report.

- Explore Straker's analyst forecasts in our growth report.

Where To Now?

- Investigate our full lineup of 1,037 ASX Penny Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Engenco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EGN

Moderate and good value.

Similar Companies

Market Insights

Community Narratives