- Australia

- /

- Capital Markets

- /

- ASX:SEC

3 ASX Penny Stocks With Market Caps Over A$100M To Consider

Reviewed by Simply Wall St

Hesitation from Jerome Powell and the Federal Reserve regarding U.S. rates has led to a ripple effect in the Australian markets, with ASX 200 futures expected to open lower. In such uncertain times, investors often look for opportunities that balance potential growth with financial stability. Penny stocks, though an older concept, remain relevant as they can offer significant returns when backed by strong fundamentals. Today, we'll explore three penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.515 | A$319.37M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.77 | A$97.91M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.91 | A$310.98M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.87 | A$237.96M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.565 | A$766.97M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.78 | A$99.83M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.42M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.28 | A$109.28M | ★★★★★☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

NRW Holdings (ASX:NWH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NRW Holdings Limited, with a market cap of A$1.75 billion, offers diversified contract services to the resources and infrastructure sectors in Australia through its subsidiaries.

Operations: The company's revenue is primarily derived from its Mining segment at A$1.52 billion, followed by MET at A$791.81 million and Civil at A$655.46 million.

Market Cap: A$1.75B

NRW Holdings Limited, with a market cap of A$1.75 billion, presents a mixed picture in the context of penny stocks. The company has not experienced significant shareholder dilution over the past year and boasts high-quality earnings with improved net profit margins from 3.2% to 3.6%. Its debt level is manageable, with more cash than total debt and short-term assets exceeding liabilities. However, its dividend yield of 4.08% is not well-covered by free cash flows, indicating potential sustainability concerns. Despite trading below estimated fair value and having stable weekly volatility, its return on equity remains low at 16.1%.

- Click to explore a detailed breakdown of our findings in NRW Holdings' financial health report.

- Understand NRW Holdings' earnings outlook by examining our growth report.

Spheria Emerging Companies (ASX:SEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Spheria Emerging Companies Limited is an Australian investment company with a market capitalization of A$138.13 million, focusing on emerging companies.

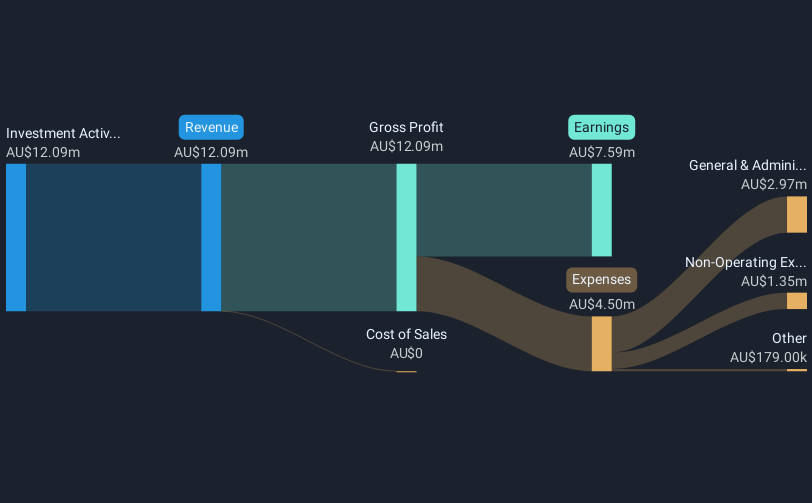

Operations: The company generates revenue of A$12.09 million from its investment activities.

Market Cap: A$138.13M

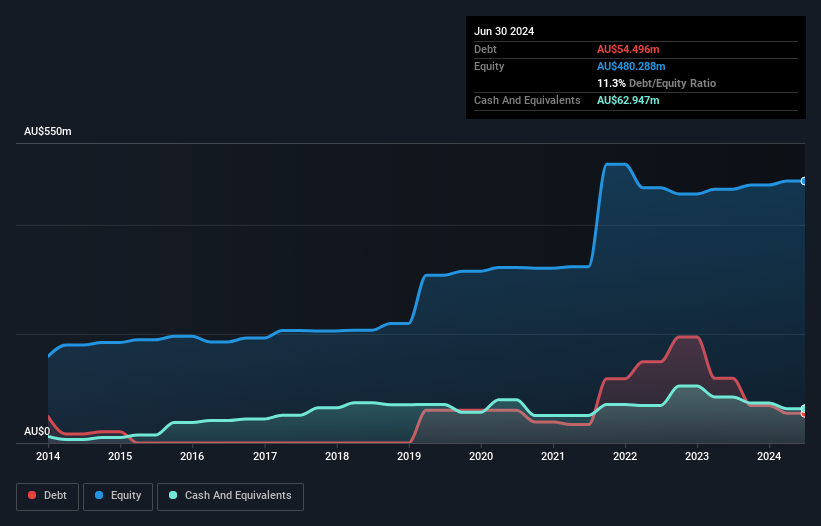

Spheria Emerging Companies Limited, with a market cap of A$138.13 million, offers a nuanced perspective for penny stock investors. The company is debt-free and has experienced management and board teams with average tenures of 3.7 and 5.2 years respectively. Despite high-quality earnings, its net profit margins have slightly decreased from the previous year, while earnings growth has been negative at -21.2%. Short-term assets comfortably cover both short- and long-term liabilities, yet the dividend yield of 5.19% is not well supported by earnings, raising sustainability concerns even as it trades below estimated fair value by 6.8%.

- Jump into the full analysis health report here for a deeper understanding of Spheria Emerging Companies.

- Evaluate Spheria Emerging Companies' historical performance by accessing our past performance report.

Service Stream (ASX:SSM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Service Stream Limited operates in Australia, focusing on the design, construction, operation, and maintenance of infrastructure networks in the telecommunications, utilities, and transport sectors with a market cap of A$971.33 million.

Operations: The company generates revenue from three main segments: Telecommunications (A$1.20 billion), Utilities (A$969.59 million), and Transport (A$119.16 million).

Market Cap: A$971.33M

Service Stream Limited, with a market cap of A$971.33 million, presents a mixed picture for penny stock investors. The company has demonstrated substantial earnings growth of 623.8% over the past year, surpassing industry averages and improving its net profit margins from 0.2% to 1.4%. Despite this growth, its return on equity remains low at 6.7%, and insider selling has been significant recently. Service Stream's financial health is bolstered by having more cash than debt and well-covered interest payments, though dividend stability is lacking due to an unstable track record. The management team is experienced with an average tenure of 5.8 years, while the board lacks experience with a tenure of just 2.7 years on average.

- Dive into the specifics of Service Stream here with our thorough balance sheet health report.

- Examine Service Stream's earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,044 more companies for you to explore.Click here to unveil our expertly curated list of 1,047 ASX Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Spheria Emerging Companies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SEC

Spheria Emerging Companies

Operates as an investment company in Australia.

Flawless balance sheet low.

Market Insights

Community Narratives