The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Raiz Invest Limited (ASX:RZI) share price is 13% higher than it was a year ago, much better than the market return of around 0.6% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Raiz Invest hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for Raiz Invest

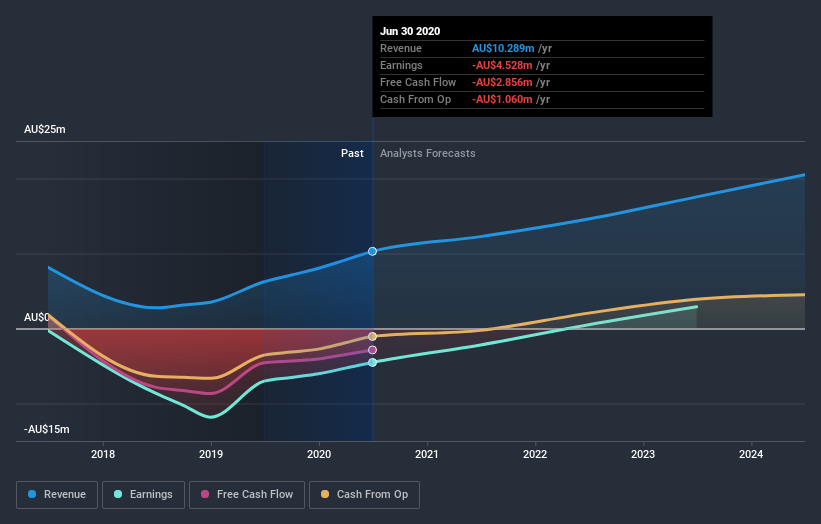

Raiz Invest wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Raiz Invest grew its revenue by 65% last year. That's a head and shoulders above most loss-making companies. The solid 13% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. If that's the case, now might be the time to take a close look at Raiz Invest. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Raiz Invest shareholders should be happy with the total gain of 13% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 25% in that time. This suggests the company is continuing to win over new investors. It's always interesting to track share price performance over the longer term. But to understand Raiz Invest better, we need to consider many other factors. For example, we've discovered 2 warning signs for Raiz Invest that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Raiz Invest, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:RZI

Raiz Invest

Provides financial services and products through its mobile micro investing platform in Australia.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives