- Australia

- /

- Capital Markets

- /

- ASX:RPL

3 Undervalued Small Caps In Australia With Insider Action

Reviewed by Simply Wall St

The Australian market has climbed 1.4% in the last 7 days and is up 15% over the past 12 months, with earnings expected to grow by 12% per annum in the coming years. In this favorable environment, identifying undervalued small-cap stocks with insider action can present compelling opportunities for investors seeking growth potential amidst robust market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.1x | 1.5x | 42.78% | ★★★★★★ |

| Bigtincan Holdings | NA | 1.2x | 47.26% | ★★★★★☆ |

| Tabcorp Holdings | NA | 0.4x | 24.76% | ★★★★★☆ |

| Centuria Capital Group | 23.7x | 5.3x | 42.53% | ★★★★☆☆ |

| Corporate Travel Management | 21.2x | 2.5x | 0.03% | ★★★★☆☆ |

| Eagers Automotive | 10.5x | 0.3x | 38.71% | ★★★★☆☆ |

| SHAPE Australia | 14.1x | 0.3x | 35.08% | ★★★☆☆☆ |

| Dicker Data | 20.4x | 0.7x | -67.76% | ★★★☆☆☆ |

| Megaport | 122.5x | 6.0x | 45.55% | ★★★☆☆☆ |

| BSP Financial Group | 7.9x | 2.8x | 0.68% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Corporate Travel Management (ASX:CTD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Corporate Travel Management is a global provider of travel services, operating in Asia, Europe, North America, and Australia/New Zealand with a market cap of A$2.53 billion.

Operations: The company generates revenue primarily from its travel services across Asia, Europe, North America, and Australia/New Zealand. For the period ending 2023-09-30, it reported a net income margin of 13.70% on revenue of A$688.70 million and gross profit of A$276.73 million with a gross profit margin of 40.18%.

PE: 21.2x

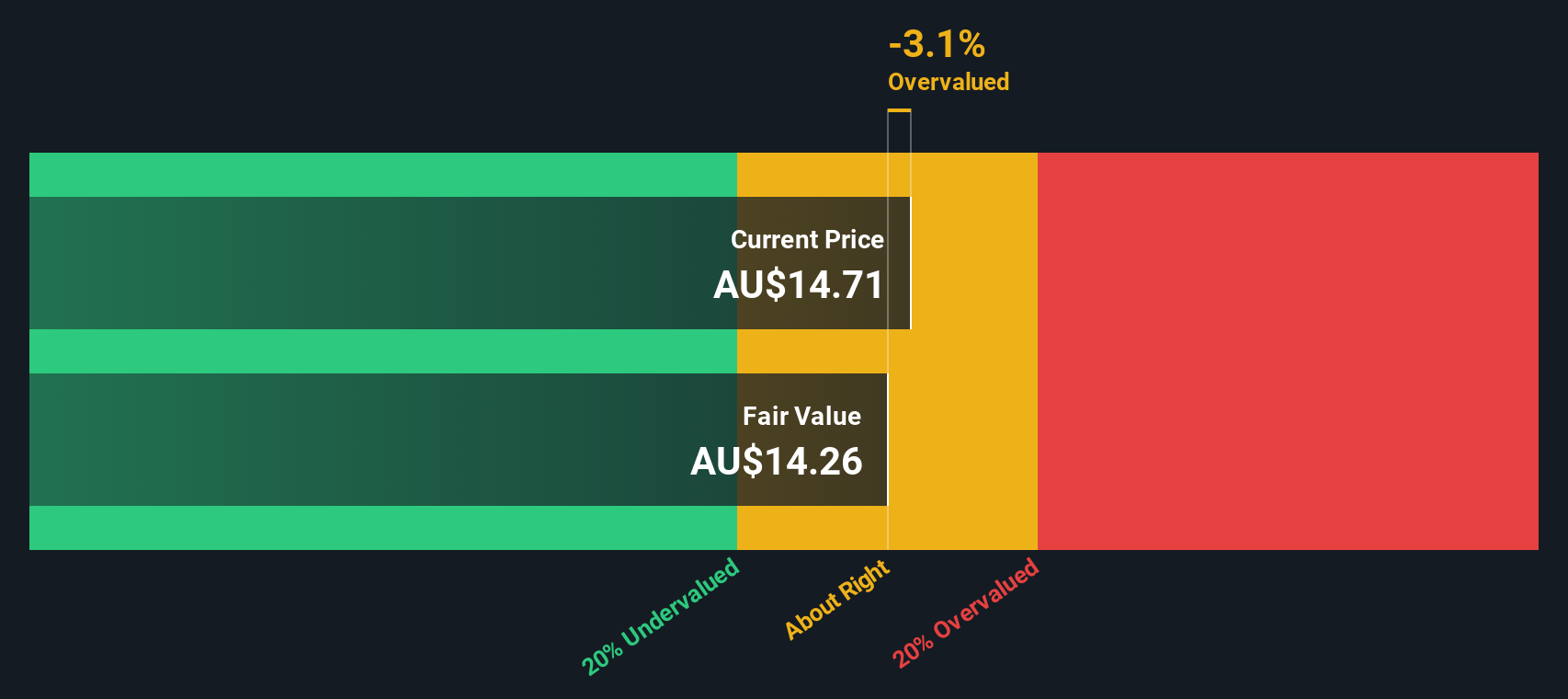

Corporate Travel Management, a notable player in the travel sector, has shown insider confidence with Jamie Pherous purchasing 87,500 shares worth A$1.4 million recently. The company reported earnings growth with revenue reaching A$716.86 million for the year ending June 30, 2024, up from A$660.08 million previously. Additionally, it repurchased 1.65 million shares for A$26.1 million and extended its buyback plan until June 2025. Despite higher risk funding sources and a slight dividend decrease to A$0.12 per share, the forecasted annual earnings growth of 12% suggests potential for future value appreciation.

Regal Partners (ASX:RPL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Regal Partners is a company that provides investment management services with a market cap of A$1.17 billion.

Operations: Regal Partners generates revenue primarily from investment management services, with recent figures showing A$198.50 million in revenue. The company experienced a notable fluctuation in its net income margin, which peaked at 28.07% and dropped to as low as 1.52%. Operating expenses include significant allocations for R&D and D&A, impacting overall profitability.

PE: 20.4x

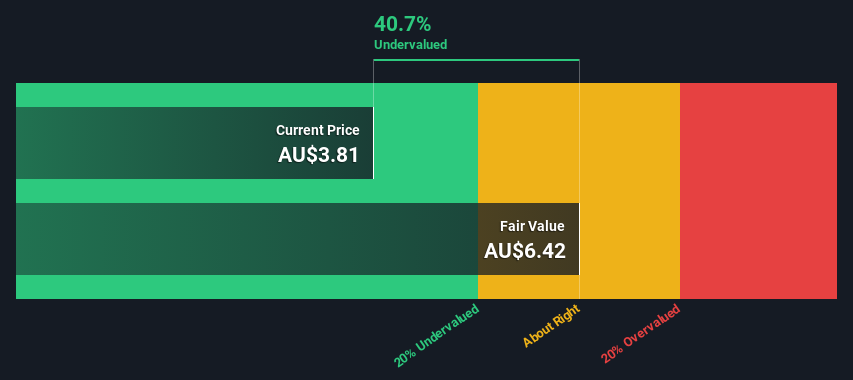

Regal Partners, a small cap in Australia, has shown promising signs of being undervalued. The company reported revenue of A$140.82 million for H1 2024, a significant increase from A$47.6 million the previous year, with net income rising to A$50.23 million from a net loss of A$3.89 million. Insider confidence is evident as they have been purchasing shares throughout 2024, indicating strong belief in future growth potential despite reliance on external borrowing for funding sources.

Sims (ASX:SGM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sims operates in the metal recycling industry with divisions including Global Trading, SA Recycling, North America Metals, Sims Lifecycle Services, and Australia/New Zealand Metals; it has a market cap of A$2.50 billion.

Operations: The company's primary revenue streams are derived from North America Metals (A$4.49 billion), Australia/New Zealand Metals (A$1.60 billion), and Global Trading (A$771.20 million). The cost of goods sold (COGS) consistently impacts gross profit, with the latest reported gross profit margin at 9.40%. Operating expenses include significant depreciation and amortization costs, which have recently reached A$236.80 million.

PE: 1290.7x

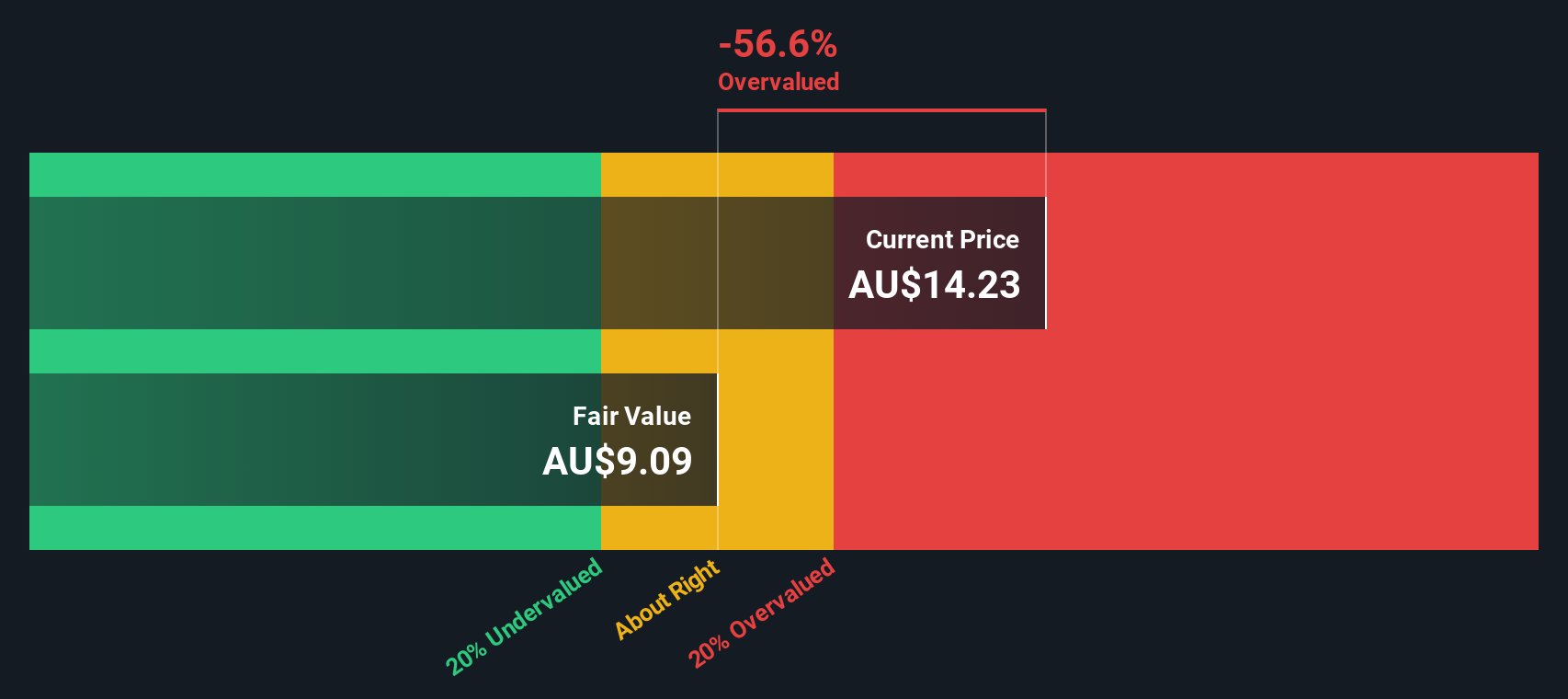

Sims, an Australian small-cap stock, recently reported a net loss of A$57.8 million for the year ending June 30, 2024, despite increasing sales to A$7.22 billion from A$6.66 billion the previous year. Profit margins have decreased significantly from 3% to 0.02%. Notably, insider confidence is evident with significant share purchases over recent months. The company also announced a reduced dividend of A$0.10 per share payable on October 16, 2024.

- Get an in-depth perspective on Sims' performance by reading our valuation report here.

Assess Sims' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Gain an insight into the universe of 24 Undervalued ASX Small Caps With Insider Buying by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RPL

Flawless balance sheet and undervalued.

Market Insights

Community Narratives