- Australia

- /

- Capital Markets

- /

- ASX:NWL

Netwealth Group Insiders Sell AU$78m Of Stock, Possibly Signalling Caution

Over the past year, many Netwealth Group Limited (ASX:NWL) insiders sold a significant stake in the company which may have piqued investors' interest. Knowing whether insiders are buying is usually more helpful when evaluating insider transactions, as insider selling can have various explanations. However, shareholders should take a deeper look if several insiders are selling stock over a specific time period.

Although we don't think shareholders should simply follow insider transactions, logic dictates you should pay some attention to whether insiders are buying or selling shares.

The Last 12 Months Of Insider Transactions At Netwealth Group

Over the last year, we can see that the biggest insider sale was by the Non Executive Director, Michael Heine, for AU$32m worth of shares, at about AU$29.00 per share. That means that an insider was selling shares at slightly below the current price (AU$30.16). We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. It is worth noting that this sale was only 1.0% of Michael Heine's holding.

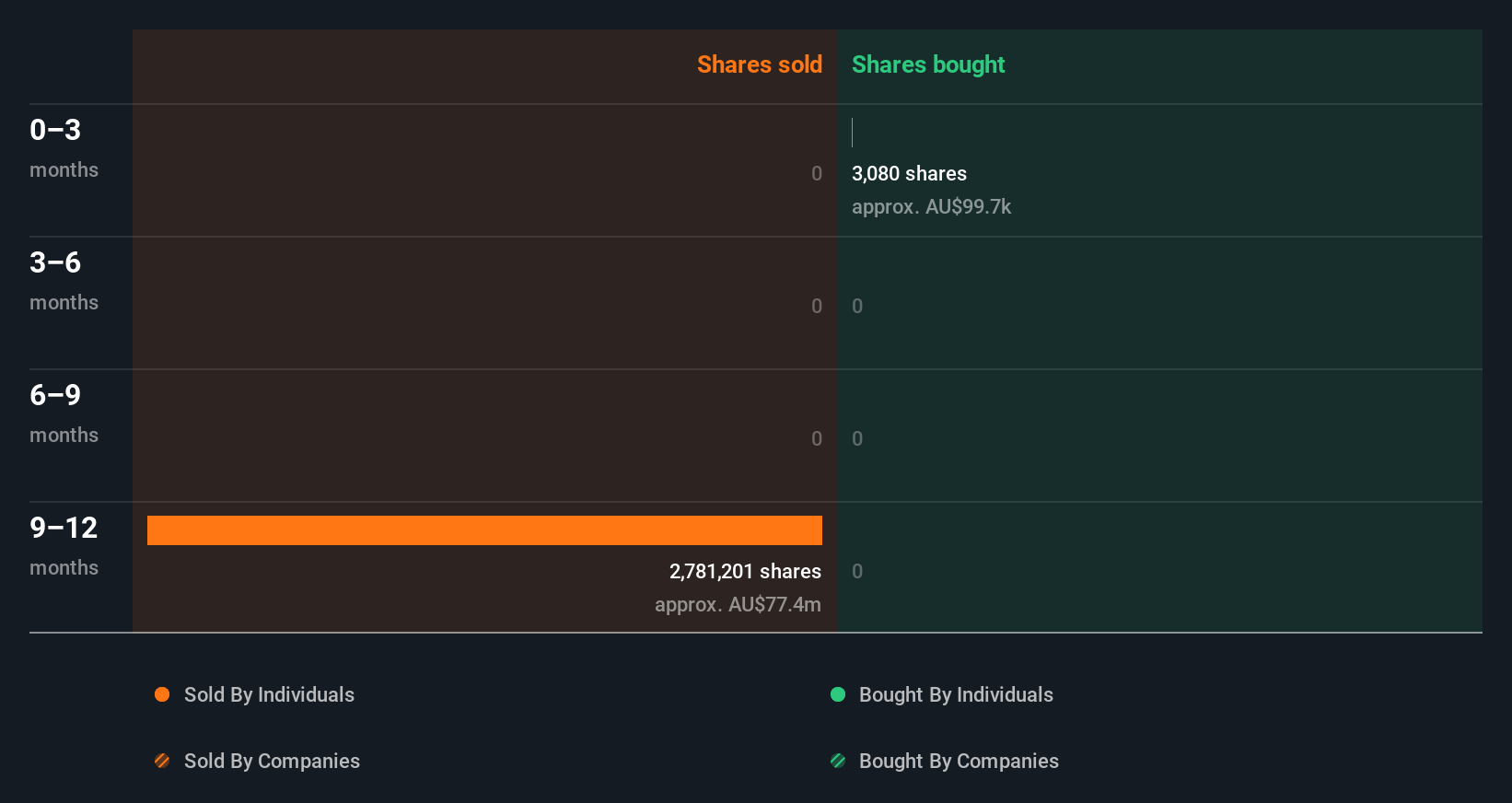

Over the last year we saw more insider selling of Netwealth Group shares, than buying. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

View our latest analysis for Netwealth Group

I will like Netwealth Group better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

Netwealth Group Insiders Bought Stock Recently

Over the last quarter, Netwealth Group insiders have spent a meaningful amount on shares. We can see that Independent Non-Executive Director Sarah Brennan paid AU$100k for shares in the company. No-one sold. This makes one think the business has some good points.

Insider Ownership

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. Netwealth Group insiders own 48% of the company, currently worth about AU$3.5b based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

What Might The Insider Transactions At Netwealth Group Tell Us?

The recent insider purchase is heartening. But we can't say the same for the transactions over the last 12 months. Overall, we'd prefer see a more sustained buying from directors, but with a significant insider holding and more recent purchases, Netwealth Group insiders are reasonably well aligned, and optimistic for the future. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

But note: Netwealth Group may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Netwealth Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NWL

Netwealth Group

A financial services company, engages in the wealth management business in Australia.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)