- Australia

- /

- Capital Markets

- /

- ASX:NWL

Netwealth Group (ASX:NWL) Is Up 7.0% After Record September Quarter Flows and FUA Growth – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Netwealth Group Limited has announced a strong performance for the September 2025 quarter, with Funds Under Administration reaching A$120.8 billion, reflecting a 26.6% year-on-year increase and record net flows of A$4.1 billion, supported by organic growth and market movements.

- This quarter marks the first time non-custodial Funds Under Administration surpassed A$1.0 billion, reflecting significant momentum in the company’s service offerings and underpinning its refreshed guidance for the coming year.

- We’ll now examine how this record growth in Funds Under Administration shapes the outlook for Netwealth’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Netwealth Group Investment Narrative Recap

To be a shareholder in Netwealth Group, you need to believe in the company’s continued ability to attract strong net inflows and drive platform adoption among advisers and clients, benefiting from digital investment, new product offerings, and the structural tailwinds of an expanding advice industry. This quarter’s record Funds Under Administration bolsters the short-term outlook by confirming the momentum behind organic growth, but it doesn’t materially change the biggest near-term risk: a potential slowdown in net inflows if market sentiment turns or competition intensifies.

Among recent company announcements, Netwealth’s addition to the S&P/ASX 100 Index in September 2025 stands out as particularly relevant, as it may increase visibility and liquidity while reflecting the company’s elevated market position. However, this milestone does not directly address ongoing market-driven revenue risks, which remain critical for shareholders tracking the company’s operating leverage and future growth.

By contrast, investors should carefully consider the unpredictability of market-driven, non-recurring revenue streams and how...

Read the full narrative on Netwealth Group (it's free!)

Netwealth Group's narrative projects A$515.3 million revenue and A$186.7 million earnings by 2028. This requires 16.7% yearly revenue growth and a A$70.2 million increase in earnings from A$116.5 million.

Uncover how Netwealth Group's forecasts yield a A$32.48 fair value, in line with its current price.

Exploring Other Perspectives

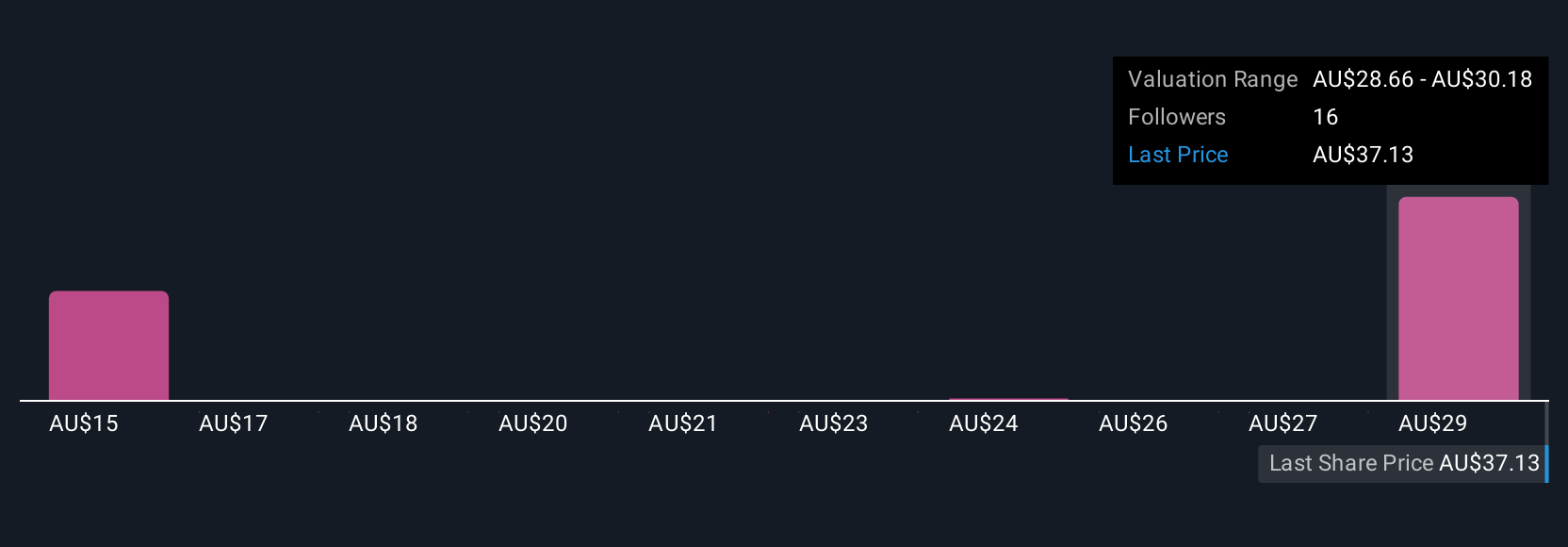

Simply Wall St Community members provide four fair value estimates on Netwealth Group, ranging from A$14.79 to A$32.48 per share. Reflecting this diversity of opinion, continued strong net inflows are widely seen as a key catalyst for future performance, but opinions differ on the sustainability of recent growth rates and valuation levels, explore how these contrasting viewpoints inform the broader conversation.

Explore 4 other fair value estimates on Netwealth Group - why the stock might be worth less than half the current price!

Build Your Own Netwealth Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Netwealth Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Netwealth Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Netwealth Group's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netwealth Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NWL

Netwealth Group

A financial services company, engages in the wealth management business in Australia.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives