Last Update27 Aug 25Fair value Increased 3.09%

Despite a notable reduction in consensus revenue growth forecasts, a slight decrease in Netwealth Group’s future P/E suggests improving valuation efficiency, supporting a minor increase in the analyst price target from A$31.99 to A$32.98.

What's in the News

- Netwealth Group announced an ordinary fully franked final dividend of AUD 0.21 per share for the six months ended June 30, 2025, payable on September 25, 2025.

Valuation Changes

Summary of Valuation Changes for Netwealth Group

- The Consensus Analyst Price Target has risen slightly from A$31.99 to A$32.98.

- The Consensus Revenue Growth forecasts for Netwealth Group has significantly fallen from 18.6% per annum to 16.7% per annum.

- The Future P/E for Netwealth Group has fallen slightly from 56.34x to 53.89x.

Key Takeaways

- Enhanced digital capabilities, adviser productivity, and expanded product offerings position Netwealth for sustained platform growth and new revenue opportunities.

- Improved operating leverage and adviser relationships support recurring income, profitability, and resilient long-term earnings.

- Rising regulatory scrutiny, fee competition, and reliance on volatile revenue streams threaten Netwealth's margins, making sustainable growth and earnings increasingly challenging.

Catalysts

About Netwealth Group- A financial services company, engages in the wealth management business in Australia.

- Netwealth's continued investment in best-in-class digital experience, platform functionality, and data analytics aligns with the ongoing digitisation of financial services and increasing regulatory focus on transparency, positioning the company to capture greater adviser and client net inflows, bolster revenue growth, and strengthen platform stickiness.

- Demographic expansion, with millions of Australians expected to require more complex advice by 2050 and a limited adviser pool, is driving increased adviser platform adoption and the need for scalable, efficient technology; Netwealth's focus on making advisers more productive should boost average FUA per adviser and account, supporting sustained revenue and fee growth.

- Broadening the platform's product capabilities (e.g., new managed account models, 'Netwealth Private' for high-net-worth clients, expanded trading, and new broking solutions) enables Netwealth to tap into the large pools of assets still held off-platform and the growing private wealth segment, unlocking new revenue streams and supporting future earnings growth.

- Strengthened operating leverage, as evidenced by expenses growing slower than revenue and incremental profitability of new revenue streams (especially ancillary and transaction fees with high margins), points to improved net margins and higher cash conversion as the business scales.

- Ongoing market share gains and deepening relationships with independent advisers (including benefiting from industry consolidation and migration from incumbents) supports higher recurring fee income, resiliency of earnings, and underpins medium

- to long-term top

- and bottom-line growth.

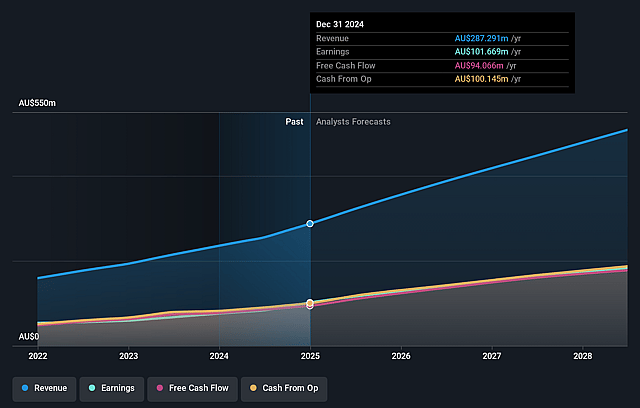

Netwealth Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Netwealth Group's revenue will grow by 16.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 35.9% today to 36.2% in 3 years time.

- Analysts expect earnings to reach A$186.7 million (and earnings per share of A$0.76) by about September 2028, up from A$116.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$206.9 million in earnings, and the most bearish expecting A$160.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.9x on those 2028 earnings, down from 64.9x today. This future PE is greater than the current PE for the AU Capital Markets industry at 21.6x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.57%, as per the Simply Wall St company report.

Netwealth Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened regulatory scrutiny and industry scandals (such as investigations involving trustees and platform providers) may increase compliance burdens and operating costs for Netwealth, potentially impacting net margins and earnings.

- Ongoing fee compression and competition in the Australian wealth platform sector are causing downward pressure on administration fee earn rates, threatening long-term revenue growth and profitability.

- Dependency on market-driven non-recurring revenue streams (such as transaction and FX fees, which benefited from recent volatility) may not be sustainable if market activity normalizes, leading to less predictable earnings.

- Reliance on continued net inflows and high market valuations exposes Netwealth to the risk of market corrections or a slower inflow environment, which could reduce funds under administration and negatively impact revenues and operating leverage.

- High and sustained capital expenditure in technology, product, and distribution to maintain industry leadership may weigh on net margins and free cash flow over time, especially if revenue growth slows or competitive pressures intensify.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$32.98 for Netwealth Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$41.5, and the most bearish reporting a price target of just A$15.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$515.3 million, earnings will come to A$186.7 million, and it would be trading on a PE ratio of 53.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$30.88, the analyst price target of A$32.98 is 6.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.