Key Takeaways

- Rising compliance costs, fee compression, and technology-driven competition are set to erode margins and constrain Netwealth Group's profit growth.

- Shifts toward passive investing and decentralized finance may bypass Netwealth's platform, undermining future revenue and fee income.

- Strategic investments in technology, expanding product offerings, and operational efficiency position Netwealth for sustained growth, higher margins, and increasing market share within a favorable industry landscape.

Catalysts

About Netwealth Group- A financial services company, engages in the wealth management business in Australia.

- The rising global regulatory and compliance burden is likely to increase Netwealth Group's operating costs substantially over the coming years, eroding operating margins and constraining profitability despite current revenue growth.

- The accelerating adoption of passive investment vehicles, direct indexing, and decentralized finance platforms outside of traditional wealth management could see core net inflows begin to bypass Netwealth's platform, directly impacting future revenue and fee income.

- New entrants leveraging cutting-edge technology such as AI, blockchain, and digital wallets are likely to intensify competition and compress Netwealth's margins, challenging the relevance and scalability of its current platform model and limiting earnings growth.

- Ongoing fee compression across the wealth management and platform industry, driven by client expectations and regulatory scrutiny on fees, is set to reduce Netwealth's administrative earn rate, pressuring both net earnings and its ability to grow dividends.

- The increasing scale of cyber security threats and heightened privacy concerns could force Netwealth to raise compliance and security spend significantly, resulting in sustained pressure on net margins and diminishing its long-term operational leverage.

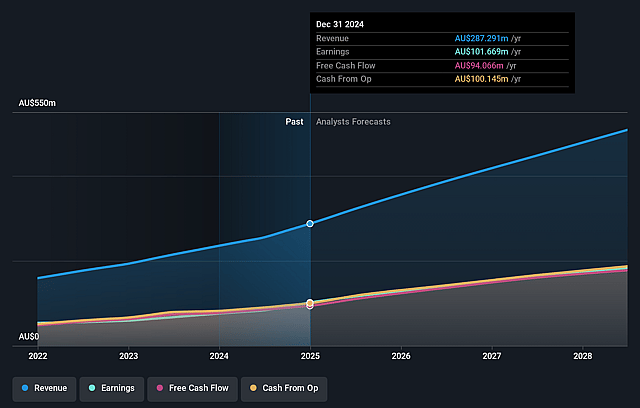

Netwealth Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Netwealth Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Netwealth Group's revenue will grow by 13.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 35.9% today to 34.1% in 3 years time.

- The bearish analysts expect earnings to reach A$163.4 million (and earnings per share of A$0.67) by about September 2028, up from A$116.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 36.9x on those 2028 earnings, down from 67.1x today. This future PE is greater than the current PE for the AU Capital Markets industry at 21.9x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.62%, as per the Simply Wall St company report.

Netwealth Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Structural tailwinds such as the multi-trillion-dollar intergenerational wealth transfer and the rapid digitalization of financial advice are expected to drive long-term growth in Netwealth's addressable market, increasing demand for its platform services and positively impacting revenue and net flows into the business.

- Consistent and significant increases in funds under administration, adviser numbers, and client accounts demonstrate a strong long-term growth trajectory, supporting recurring revenue, operating leverage, and improved net margins, which could underpin a sustainably higher share price.

- Netwealth's continued investment in proprietary technology, data analytics, and cloud-based platform innovation has enabled it to win market share and maintain industry-leading client and adviser satisfaction, which positions the company to benefit from industry and technology trends, strengthening revenue streams and operating margins over time.

- The broadening and diversification of Netwealth's product and service offerings-including new solutions for high net worth clients, managed accounts, and digital efficiency tools for advisers-support cross-sell opportunities, organic growth, and market share gains, contributing to resilient revenue growth and expanding earnings potential.

- Operational efficiency improvements and scalability have resulted in expanding EBITDA margins and strong cash conversion, allowing the company to invest in future growth while maintaining high returns to shareholders, a trend that can drive long-term earnings and dividend growth, thus creating positive pressure on the company's valuation and share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Netwealth Group is A$19.73, which represents two standard deviations below the consensus price target of A$32.98. This valuation is based on what can be assumed as the expectations of Netwealth Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$41.5, and the most bearish reporting a price target of just A$15.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$479.1 million, earnings will come to A$163.4 million, and it would be trading on a PE ratio of 36.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$31.89, the bearish analyst price target of A$19.73 is 61.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.