Key Takeaways

- Operational leverage, rapid AI adoption, and platform scalability position Netwealth for accelerating profitability and greater earnings growth than currently forecast.

- Industry disruption and generational wealth transfer give Netwealth a rare opportunity to rapidly gain market share via tech innovation and network-driven recurring revenue.

- Intensifying regulatory, competitive, and fee pressures threaten to erode profitability and slow growth, while advisor shortages and one-off revenue tailwinds raise sustainability concerns.

Catalysts

About Netwealth Group- A financial services company, engages in the wealth management business in Australia.

- Analysts broadly agree that Netwealth's platform investments and increasing headcount will drive growth, but the company's accelerating operational leverage-demonstrated by revenue growing faster than expenses, and a doubling in strategic growth hires-signals scalability that could see net margins and earnings expand at an even faster rate than consensus projects.

- Analyst consensus acknowledges technology innovation as a positive, but Netwealth's rapid adoption of AI and proprietary systems is likely understated, as these advancements are not only reducing third-party dependencies but can sharply boost internal productivity, client retention, and premium pricing power, supporting improved net margins and revenue growth ahead of expectations.

- The massive intergenerational wealth transfer underway in Australia is set to accelerate net flows and assets under administration, with Netwealth's highly diversified, technology-forward product suite positioning it to capture outsized share of these shifting assets, driving robust, recurring revenue increases over the long term.

- Netwealth's expanding adviser and client networks-fueled by platform stickiness, best-in-class user experience, and seamless integrations-are creating strong network effects, which support higher organic growth rates and customer lifetime value, boosting both top-line revenue and profitability.

- Structural dislocation in the wealth management industry-driven by digitization, regulatory shifts, and the retreat of banks from platforms-creates a rare, long-duration market share opportunity; Netwealth's high Rule of 40 score and strong cash generation reinforce its ability to capitalize on this trend for sustained compound growth in earnings and market share.

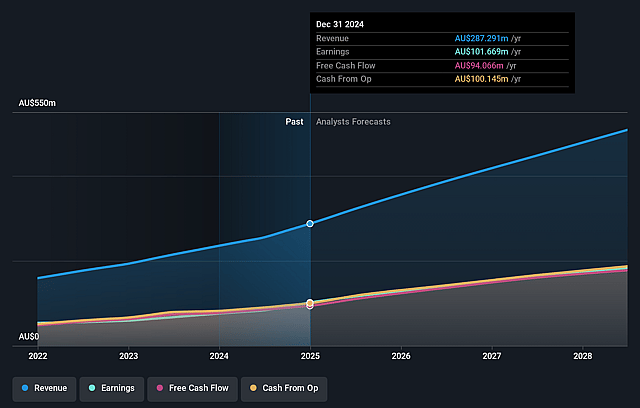

Netwealth Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Netwealth Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Netwealth Group's revenue will grow by 19.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 35.9% today to 37.8% in 3 years time.

- The bullish analysts expect earnings to reach A$210.5 million (and earnings per share of A$0.86) by about September 2028, up from A$116.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 60.1x on those 2028 earnings, down from 64.2x today. This future PE is greater than the current PE for the AU Capital Markets industry at 21.6x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.56%, as per the Simply Wall St company report.

Netwealth Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened regulatory scrutiny and increasing fiduciary standards, discussed in relation to ASIC investigations and industry-wide issues like the First Guardian situation, could drive up compliance and legal costs for Netwealth and negatively impact net margins and earnings over time.

- The increasing shift toward passive investing and direct indexing, combined with ongoing fee compression in the platform space, was reflected in commentary about admin fee earn rate contraction and expectations for continued pressure on admin fees, which may slow Netwealth's revenue growth and erode net margins.

- Rising competition from both large incumbents and technologically advanced disruptors-highlighted by frequent references to the dynamic, consolidating market and "forced migration" by a major peer-may force Netwealth to lower its fees and invest more heavily in technology, placing downward pressure on both revenue and profitability.

- Netwealth's reliance on adviser-led client growth presents a long-term risk given demographic headwinds and potential advisor shortages, as mentioned in the discussion around limited adviser availability and the challenge to scale efficiently, which could ultimately slow net inflows and future revenue growth.

- The sustainability of recent strong transaction-based revenue increases is questionable, with management openly noting that one-off trading and FX tailwinds are not expected to repeat, implying that ancillary and transaction fee growth may slow, putting at risk the maintenance of current revenue levels and EBITDA margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Netwealth Group is A$41.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Netwealth Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$41.5, and the most bearish reporting a price target of just A$15.2.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$556.6 million, earnings will come to A$210.5 million, and it would be trading on a PE ratio of 60.1x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$30.53, the bullish analyst price target of A$41.5 is 26.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.