- Australia

- /

- Capital Markets

- /

- ASX:MFF

Undervalued Small Caps With Insider Action In Global April 2025

Reviewed by Simply Wall St

In the wake of a tumultuous week for global markets, fueled by unexpected tariff announcements and escalating trade tensions, small-cap stocks have faced significant pressure. The Russell 2000 Index's sharp decline highlights the challenges these companies face in an uncertain economic environment, where inflation concerns and potential recession loom large. In such volatile conditions, identifying small-cap stocks with solid fundamentals and insider activity can provide valuable insights into potential opportunities amidst broader market turbulence.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Tristel | 22.7x | 3.2x | 40.20% | ★★★★★★ |

| Nexus Industrial REIT | 5.2x | 2.7x | 23.21% | ★★★★★★ |

| Propel Holdings | 14.5x | 1.5x | 47.83% | ★★★★★☆ |

| Bytes Technology Group | 20.6x | 5.2x | 17.26% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 28.24% | ★★★★★☆ |

| Savills | 22.3x | 0.5x | 45.27% | ★★★★☆☆ |

| Sing Investments & Finance | 7.1x | 3.6x | 43.66% | ★★★★☆☆ |

| Arendals Fossekompani | 20.9x | 1.6x | 48.51% | ★★★☆☆☆ |

| Westshore Terminals Investment | 12.8x | 3.6x | 41.71% | ★★★☆☆☆ |

| Saturn Oil & Gas | 5.5x | 0.4x | -5.83% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

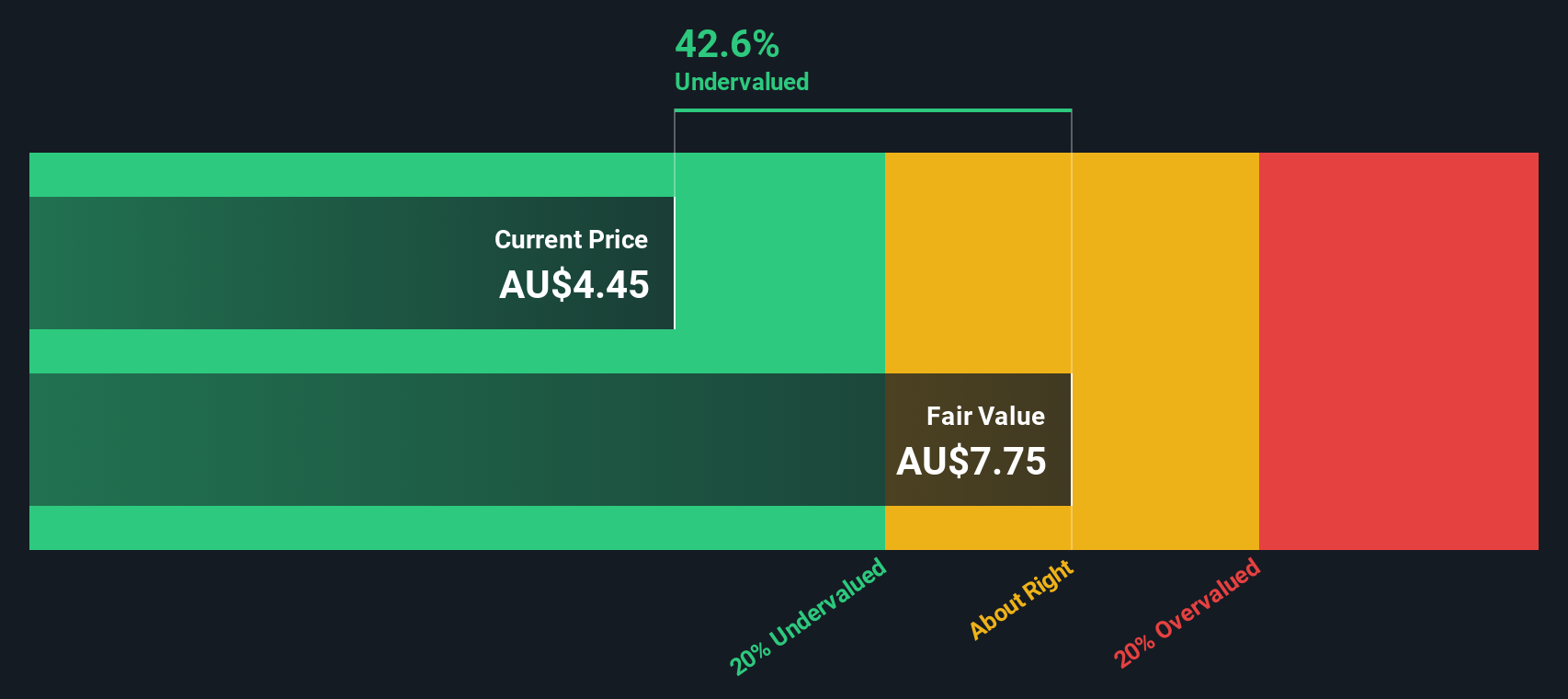

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MFF Capital Investments is a company focused on equity investments, with operations centered around managing a portfolio of international and domestic assets, and has a market cap of A$1.82 billion.

Operations: The company generates revenue primarily through equity investments, with recent figures reaching A$1.01 billion. Operating expenses have shown a decreasing trend, with the latest figure at A$4.05 million, while non-operating expenses are significantly higher at A$325.57 million. The net income margin has fluctuated over time but was recently recorded at 67.44%.

PE: 3.6x

MFF Capital Investments, a smaller player in the investment field, has shown potential through insider confidence with Christopher MacKay purchasing 1.3 million shares for A$5.03 million between January and April 2025. Despite relying on higher-risk external borrowing, the company reported impressive half-year earnings of A$381 million, significantly up from last year's A$146 million. The dividend increased to 8 cents per share from December's 6 cents, reflecting strong financial health and future growth prospects despite funding risks.

- Navigate through the intricacies of MFF Capital Investments with our comprehensive valuation report here.

Evaluate MFF Capital Investments' historical performance by accessing our past performance report.

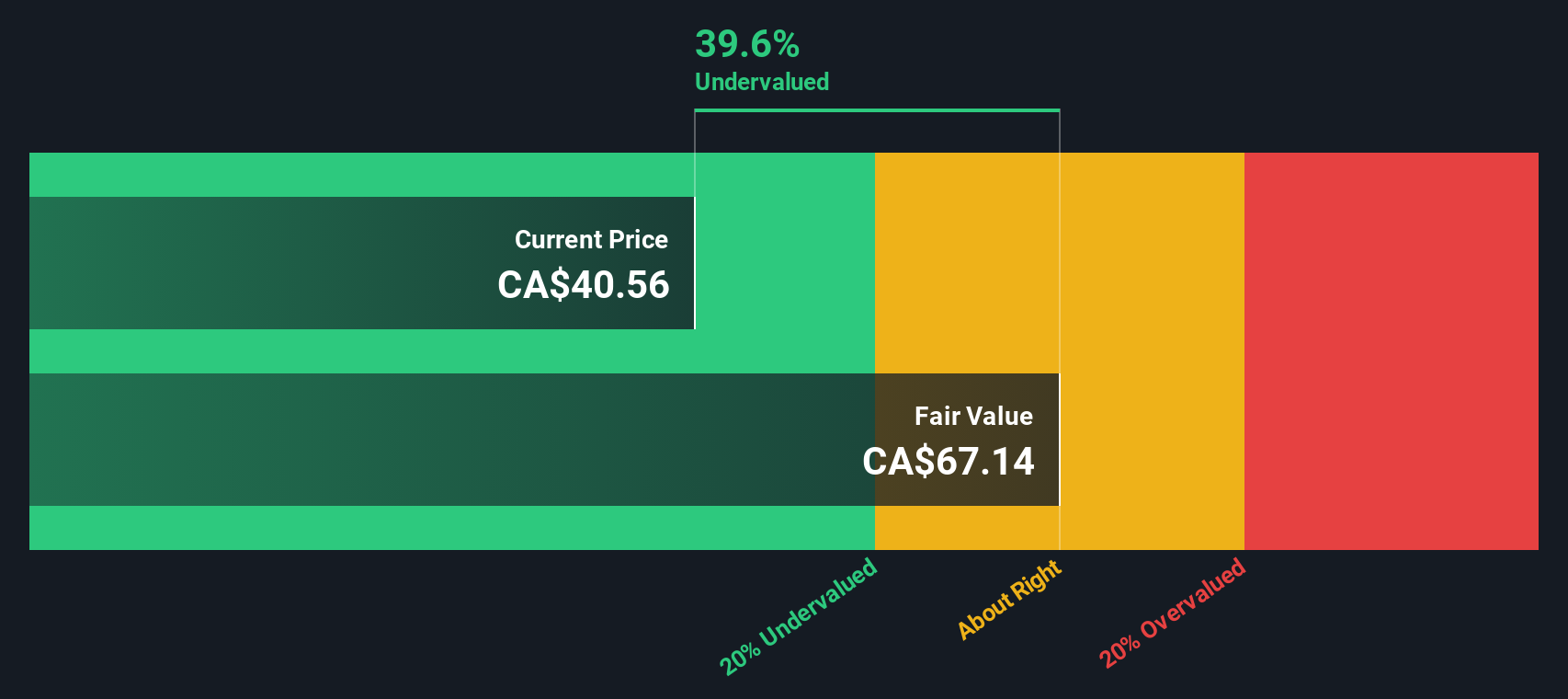

First National Financial (TSX:FN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: First National Financial is a Canadian company specializing in commercial and residential mortgage lending, with a market capitalization of approximately CA$2.76 billion.

Operations: First National Financial generates revenue primarily from its commercial and residential segments, with recent figures showing CA$215.28 million from commercial and CA$467.84 million from residential operations. The company has experienced fluctuations in its gross profit margin, which reached 86.04% by the end of 2024, indicating efficient management of cost of goods sold relative to revenue generation. Operating expenses are a significant part of the cost structure, with general and administrative expenses consistently being a major component over time.

PE: 11.5x

First National Financial, a smaller player in the financial sector, showcases potential as an undervalued investment. Despite a decrease in net income to C$203 million for 2024 from C$253 million the previous year, insider confidence is evident with Stephen J. Smith purchasing 463,300 shares valued at C$20.44 million between January and March 2025. The company's earnings are projected to grow by over 13% annually, though its reliance on external borrowing raises some risk concerns. Regular dividends bolster investor appeal amidst these dynamics.

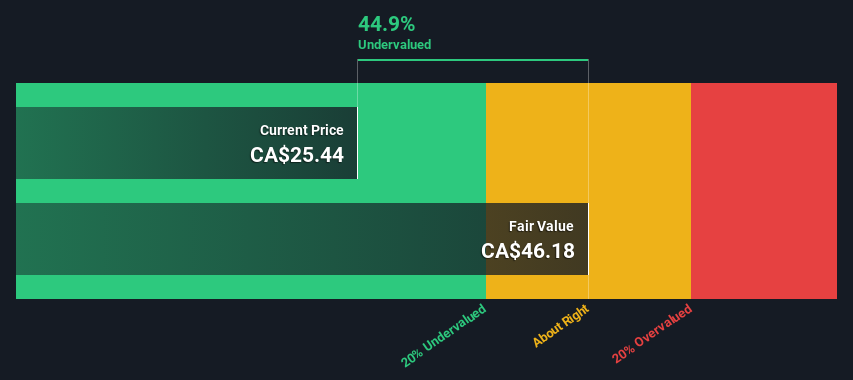

Propel Holdings (TSX:PRL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Propel Holdings operates by providing lending-related services to borrowers, banks, and other institutions, with a market cap of approximately C$0.32 billion.

Operations: Propel Holdings generates revenue primarily through lending-related services, with a gross profit margin consistently at 100% over recent periods. Operating expenses are a significant component of their cost structure, with general and administrative expenses being the largest category.

PE: 14.5x

Propel Holdings, a small yet promising player, recently reported impressive growth with Q4 2024 sales jumping to US$129.31 million from US$96.01 million the previous year. Their net income also rose to US$11.61 million, indicating strong operational performance despite reliance on external borrowing for funding. Insider confidence is evident as Co-Founder & Chief Risk Officer Jonathan Goler purchased 6,000 shares worth approximately US$141K in March 2025. The company increased its dividend by 10%, marking its seventh hike since early 2023, signaling commitment to shareholder returns amidst projected earnings growth of over 35% annually.

- Click to explore a detailed breakdown of our findings in Propel Holdings' valuation report.

Gain insights into Propel Holdings' historical performance by reviewing our past performance report.

Key Takeaways

- Unlock our comprehensive list of 140 Undervalued Global Small Caps With Insider Buying by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade MFF Capital Investments, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MFF

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives