Undervalued Small Caps In Australia With Insider Activity October 2024

Reviewed by Simply Wall St

As the Australian market faces a downturn with a 0.17% drop in the ASX, driven by disappointment over unlikely rate cuts and cautious global sentiment, small-cap stocks are navigating a challenging landscape. In this environment, identifying promising small-cap companies often involves looking for those with strong fundamentals and potential insider activity that may signal confidence from within the company itself.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| GWA Group | 16.4x | 1.5x | 41.77% | ★★★★★★ |

| Magellan Financial Group | 7.9x | 5.0x | 33.83% | ★★★★★☆ |

| Collins Foods | 17.6x | 0.7x | 8.31% | ★★★★☆☆ |

| Dicker Data | 19.5x | 0.7x | -62.21% | ★★★★☆☆ |

| Centuria Capital Group | 21.3x | 4.8x | 46.25% | ★★★★☆☆ |

| Eagers Automotive | 11.2x | 0.3x | 36.83% | ★★★★☆☆ |

| Coventry Group | 249.8x | 0.4x | -25.50% | ★★★☆☆☆ |

| Corporate Travel Management | 20.0x | 2.4x | 2.91% | ★★★☆☆☆ |

| BSP Financial Group | 7.8x | 2.8x | 1.57% | ★★★☆☆☆ |

| Credit Corp Group | 23.2x | 3.1x | 34.46% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

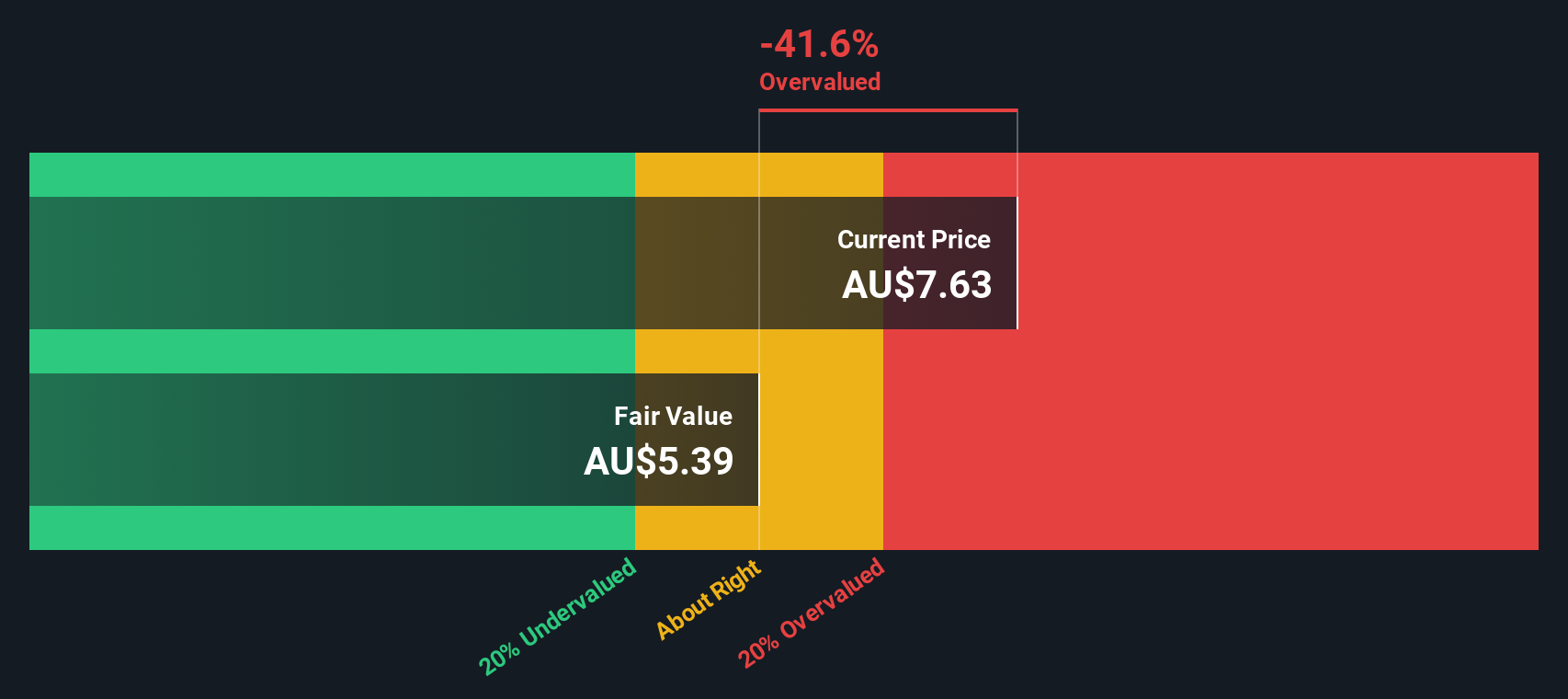

Data#3 (ASX:DTL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Data#3 is a value-added IT reseller and IT solutions provider with a market cap of A$1.01 billion.

Operations: The company generates revenue primarily from its role as a Value-Added IT Reseller and IT Solutions Provider, with recent figures showing A$805.75 million in revenue. The gross profit margin has shown an upward trend, reaching 9.87% in the most recent period. Operating expenses have been increasing alongside depreciation and amortization costs, impacting overall profitability.

PE: 27.6x

Data#3, an Australian IT services company, has shown insider confidence with recent share purchases. Despite a slight dip in sales to A$805.75 million for the year ending June 2024, net income rose to A$43.31 million from A$37.03 million last year, reflecting improved profitability. The company's transition to PwC as its auditor suggests a strategic shift towards enhanced governance. With earnings forecasted to grow annually by 10.94%, Data#3's potential for future growth remains appealing within its sector.

- Dive into the specifics of Data#3 here with our thorough valuation report.

Understand Data#3's track record by examining our Past report.

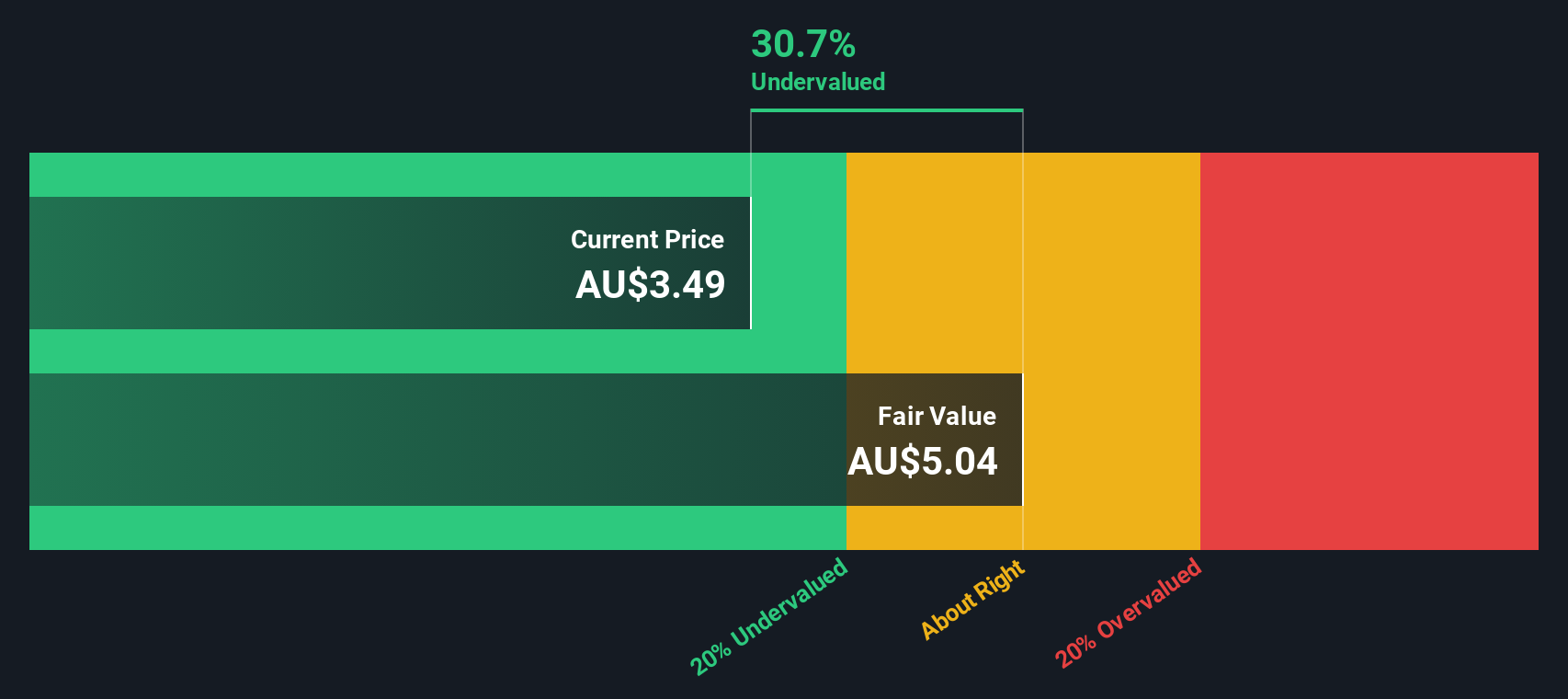

Insignia Financial (ASX:IFL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Insignia Financial is a financial services company that provides advice, platforms, and asset management solutions with a market capitalization of A$3.5 billion.

Operations: Insignia Financial's revenue streams are primarily derived from its Platforms, Advice, and Asset Management segments, with the Platforms segment contributing the largest portion. The company has experienced fluctuations in its gross profit margin, which was 36.72% as of October 2024. Operating expenses are significant and include general & administrative costs and non-operating expenses.

PE: -11.7x

Insignia Financial, a small player in Australia, has seen insider confidence with recent share purchases. Despite reporting a net loss of A$185.3 million for the year ending June 30, 2024, compared to a profit previously, the company is projected to grow earnings by 56.85% annually. Changes in executive roles might impact operations as William Linehan resigned as Company Secretary in September 2024 while Joseph Volpe joined the team earlier in August.

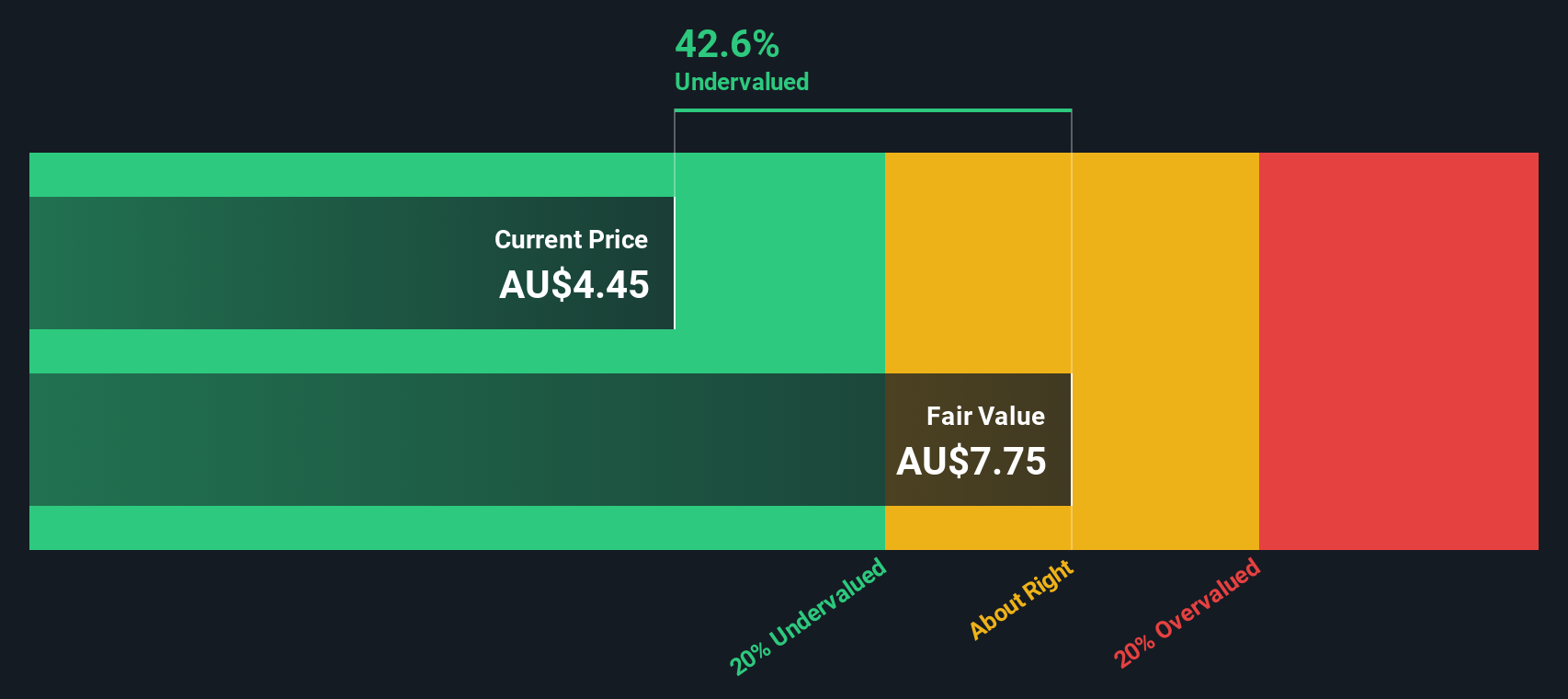

MFF Capital Investments (ASX:MFF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MFF Capital Investments is an investment company primarily focused on managing a portfolio of high-quality international equities, with a market capitalization of approximately A$1.84 billion.

Operations: The revenue model primarily revolves around equity investments, with recent revenue reaching A$659.96 million. Operating expenses have shown a decreasing trend, dropping to A$3.89 million in the latest period. The net income margin has been observed at 67.78%.

PE: 5.1x

MFF Capital Investments, a small cap stock in Australia, shows potential value through insider confidence as Christopher MacKay increased their stake by 1.1% with A$5 million in purchases. Despite relying solely on external borrowing, which adds risk, the company maintains a strategic focus on low-risk funding avenues. The recent AGM highlighted management's commitment to shareholder engagement and transparency. These factors suggest that MFF may offer growth opportunities within its segment despite inherent financial risks.

Key Takeaways

- Click through to start exploring the rest of the 23 Undervalued ASX Small Caps With Insider Buying now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DTL

Data#3

Engages in the provision of information technology (IT) solutions and services in Australia, Fiji, and the Pacific Islands.

Very undervalued with outstanding track record.