- Australia

- /

- Construction

- /

- ASX:SYL

Global Undervalued Small Caps With Insider Action In October 2025

Reviewed by Simply Wall St

As global markets navigate a volatile landscape marked by easing monetary policies from the U.S. Federal Reserve and fluctuating trade tensions, small-cap stocks have shown resilience, with indices like the Russell 2000 reflecting a notable year-to-date increase. In this environment, identifying promising small-cap opportunities involves looking for companies that demonstrate strong fundamentals and potential for growth amidst broader economic uncertainties.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 16.6x | 4.0x | 20.67% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 34.86% | ★★★★★☆ |

| Chinasoft International | 24.3x | 0.8x | -1344.80% | ★★★★☆☆ |

| GDI Integrated Facility Services | 18.8x | 0.3x | 0.14% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.30% | ★★★★☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.6x | 1.7x | 21.19% | ★★★★☆☆ |

| Senior | 24.8x | 0.8x | 25.87% | ★★★★☆☆ |

| Sagicor Financial | 7.1x | 0.4x | -70.78% | ★★★★☆☆ |

| Bumitama Agri | 11.3x | 1.6x | 44.94% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.7x | 0.4x | -437.88% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

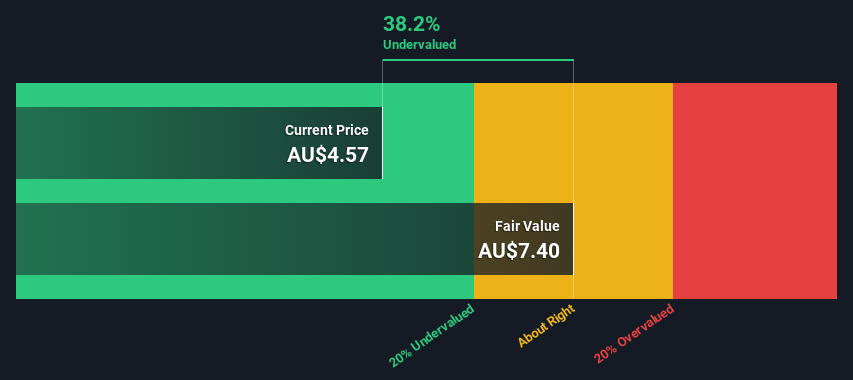

HMC Capital (ASX:HMC)

Simply Wall St Value Rating: ★★★★★☆

Overview: HMC Capital is an investment management firm with a focus on digital, real estate, private credit, and private equity sectors, holding a market cap of A$1.5 billion.

Operations: HMC Capital generates revenue primarily through its Digital, Real Estate, Private Credit, and Private Equity segments. The company has seen a significant trend in its gross profit margin reaching 100% in recent periods. Operating expenses have been substantial, with general and administrative costs being a notable component. Non-operating expenses have also impacted net income figures across various quarters.

PE: 9.0x

HMC Capital, a smaller company in the investment landscape, has seen insider confidence with Mario Verrocchi acquiring nearly 5.9 million shares valued at A$20.3 million, marking a 263% increase in their holdings. The company reported significant earnings growth for the year ending June 2025, with sales jumping to A$234.2 million from A$93.2 million previously and net income doubling to A$147.3 million. Despite challenges like higher-risk external borrowing and strategic shifts in its renewable energy assets, HMC continues exploring options for portfolio optimization and potential partnerships or mergers to enhance value further.

- Dive into the specifics of HMC Capital here with our thorough valuation report.

Examine HMC Capital's past performance report to understand how it has performed in the past.

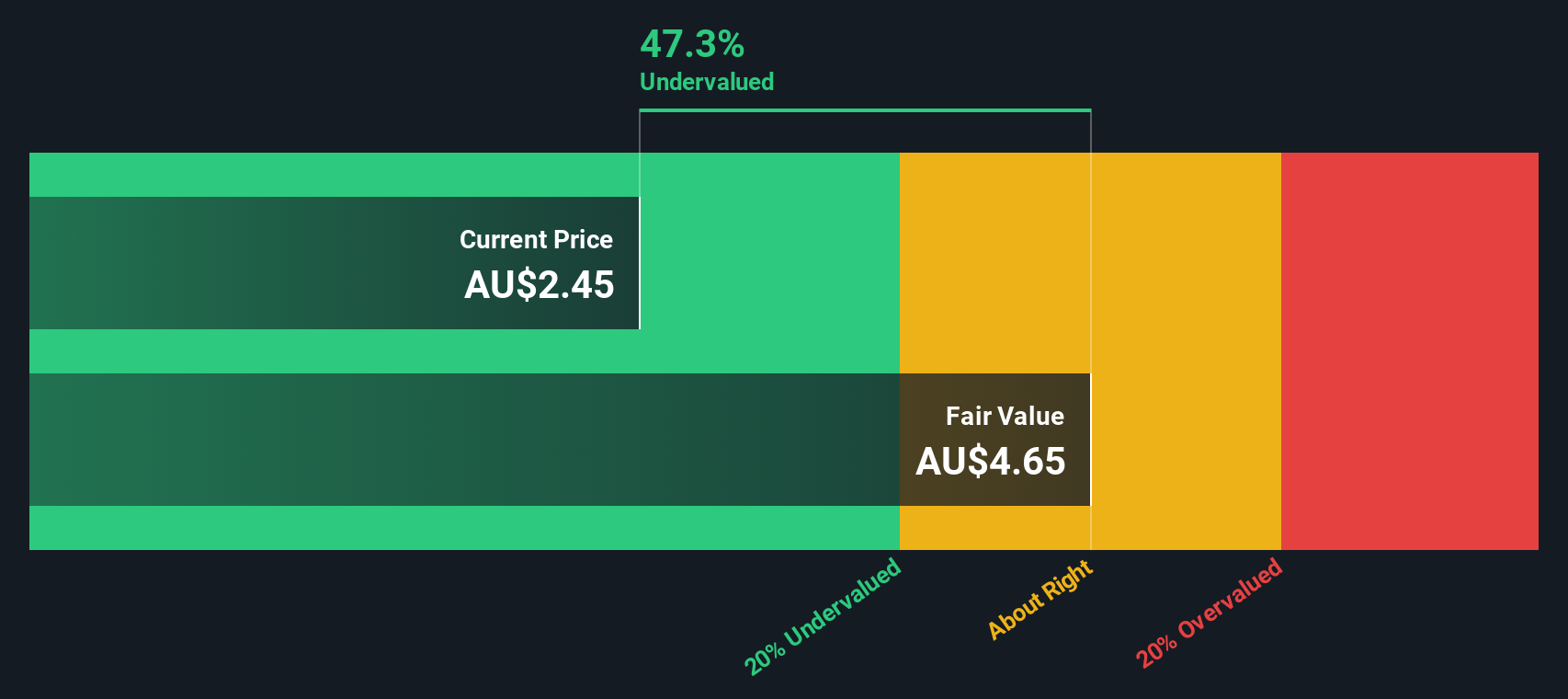

Symal Group (ASX:SYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Symal Group operates primarily in the contracting services and plant & equipment sectors, with a market capitalization of A$1.45 billion.

Operations: Symal Group generates revenue primarily from Contracting Services and Plant & Equipment, with Contracting Services contributing the majority. The company's gross profit margin has shown an upward trend, reaching 21.55% by June 2025. Operating expenses are significant, with General & Administrative Expenses being a notable component.

PE: 15.8x

Symal Group, a smaller player in its field, recently demonstrated insider confidence with an individual acquiring 50,000 shares valued at approximately A$100,135. This move reflects a positive outlook amidst the company's earnings forecast of 13.2% annual growth. Despite relying entirely on external borrowing for funding—considered riskier than customer deposits—Symal's sales rose to A$879.6 million from A$742.5 million year-over-year, though net income slightly dipped to A$34.6 million from A$36.2 million previously reported.

- Click here to discover the nuances of Symal Group with our detailed analytical valuation report.

Gain insights into Symal Group's historical performance by reviewing our past performance report.

Canfor (TSX:CFP)

Simply Wall St Value Rating: ★★★★★★

Overview: Canfor is a Canadian company engaged in the production of lumber and pulp & paper, with a market capitalization of approximately CA$2.56 billion.

Operations: The company generates revenue primarily from its Lumber segment, contributing CA$4.66 billion, and Pulp & Paper segment, adding CA$730.40 million. Over recent periods, the gross profit margin has shown variability, reaching a high of 47.75% in mid-2021 before declining to 16.64% by late 2023 and early 2024. This fluctuation reflects changes in cost structures and market conditions impacting profitability across its segments.

PE: -2.2x

Canfor's recent financials reveal a challenging phase, with Q2 2025 sales at C$1.38 billion and a net loss of C$202.8 million, slightly up from last year’s C$191.1 million loss. Despite these figures, insider confidence is evident as they increased their holdings over the past year, signaling potential value recognition in this small company. Earnings are projected to grow by 73% annually, suggesting optimism for future performance despite current reliance on external borrowing for funding.

- Click to explore a detailed breakdown of our findings in Canfor's valuation report.

Evaluate Canfor's historical performance by accessing our past performance report.

Next Steps

- Delve into our full catalog of 112 Undervalued Global Small Caps With Insider Buying here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SYL

Symal Group

Provides construction contracting, equipment hires, material sales, recycling, and remediation services to the civil construction industry in Australia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)