- Australia

- /

- Capital Markets

- /

- ASX:FNX

If EPS Growth Is Important To You, Finexia Financial Group (ASX:FNX) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Finexia Financial Group (ASX:FNX), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Finexia Financial Group

Finexia Financial Group's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for Finexia Financial Group to have grown EPS from AU$0.0099 to AU$0.053 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future.

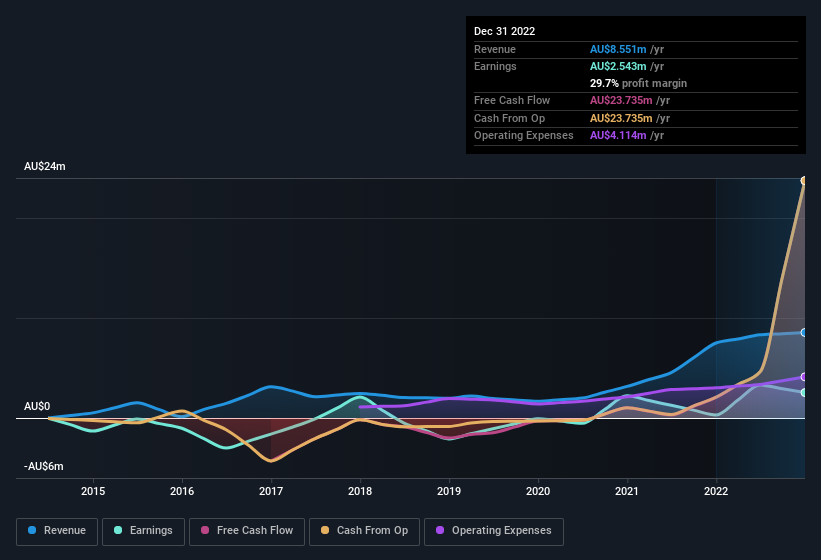

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Finexia Financial Group's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. While we note Finexia Financial Group achieved similar EBIT margins to last year, revenue grew by a solid 14% to AU$8.6m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Finexia Financial Group is no giant, with a market capitalisation of AU$12m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Finexia Financial Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Finexia Financial Group shares, in the last year. With that in mind, it's heartening that Neil Sheather, the Executive Chairman of the company, paid AU$67k for shares at around AU$0.29 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

It's commendable to see that insiders have been buying shares in Finexia Financial Group, but there is more evidence of shareholder friendly management. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to Finexia Financial Group, with market caps under AU$291m is around AU$421k.

Finexia Financial Group's CEO took home a total compensation package worth AU$274k in the year leading up to June 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Finexia Financial Group To Your Watchlist?

Finexia Financial Group's earnings have taken off in quite an impressive fashion. Better yet, we can observe insider buying and the chief executive pay looks reasonable. It could be that Finexia Financial Group is at an inflection point, given the EPS growth. For those attracted to fast growth, we'd suggest this stock merits monitoring. Before you take the next step you should know about the 4 warning signs for Finexia Financial Group (2 don't sit too well with us!) that we have uncovered.

The good news is that Finexia Financial Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FNX

Finexia Financial Group

Operates as a specialist private credit provider focusing on delivering income returns in Australia.

Good value with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026