- Australia

- /

- Construction

- /

- ASX:LYL

Undiscovered Gems in Australia To Explore This April 2025

Reviewed by Simply Wall St

As the Australian market navigates a period of cautious optimism, with the ASX inching back towards 8,000 points amid geopolitical shifts and sector-specific rallies, investors are keenly observing how these dynamics might influence small-cap stocks. In this environment, identifying promising opportunities often involves looking beyond immediate headlines to discover companies with solid fundamentals and growth potential that align with broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Djerriwarrh Investments (ASX:DJW)

Simply Wall St Value Rating: ★★★★★★

Overview: Djerriwarrh Investments Limited is a publicly owned investment manager with a market capitalization of A$783.89 million.

Operations: Djerriwarrh Investments generates revenue primarily from its portfolio of investments, amounting to A$50.84 million.

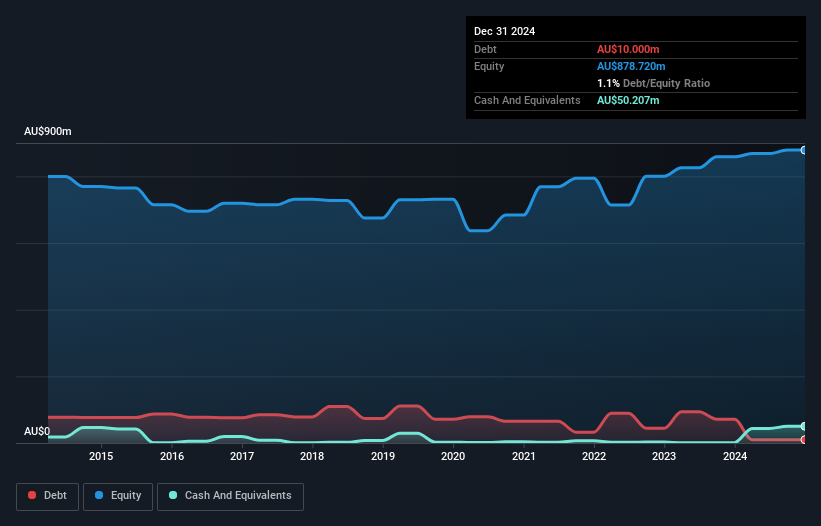

Djerriwarrh Investments, a smaller player in the Australian market, has demonstrated strong financial health with its earnings surging by 57% over the past year, outpacing the Capital Markets industry's 24% growth. The debt-to-equity ratio has impressively dropped from 9.7 to 1.1 over five years, indicating prudent financial management. With a price-to-earnings ratio of 16.5x, it offers better value compared to the broader market's 16.8x average. Recent moves include an expanded equity buyback plan as of February 2025, reflecting confidence in future prospects and commitment to shareholder returns through strategic repurchases.

- Get an in-depth perspective on Djerriwarrh Investments' performance by reading our health report here.

Explore historical data to track Djerriwarrh Investments' performance over time in our Past section.

Diversified United Investment (ASX:DUI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Diversified United Investment Limited is a publicly owned investment manager with a market capitalization of A$1.08 billion.

Operations: DUI generates revenue primarily from its investment company segment, amounting to A$46.41 million.

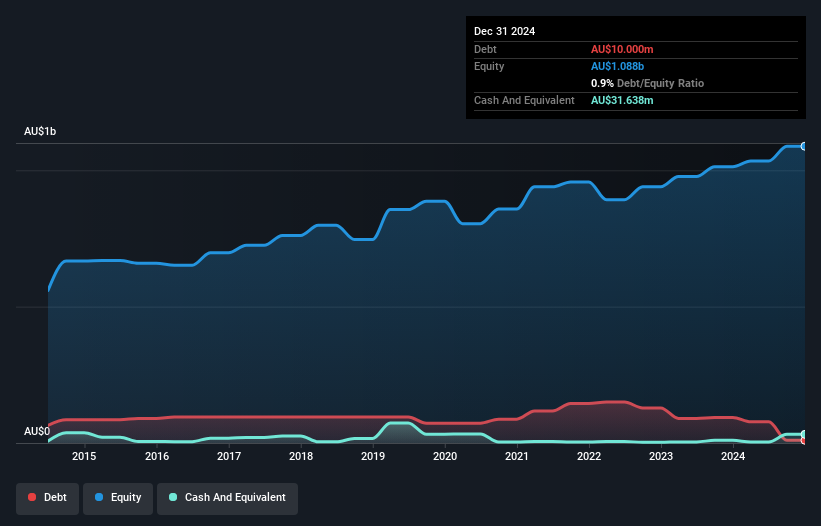

Diversified United Investment, a smaller player in the Australian market, shows a mixed bag of financials. Despite negative earnings growth of 7% over the past year, its debt-to-equity ratio impressively decreased from 8.2% to 0.9% in five years. The company's interest payments are well covered by EBIT at 12.2 times coverage, indicating strong financial health. With more cash than total debt and positive free cash flow, it seems financially stable despite recent challenges in earnings growth compared to industry averages. Recent dividends of A$0.07 per share reflect consistent shareholder returns amidst these dynamics.

Lycopodium (ASX:LYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lycopodium Limited offers engineering and project delivery services across the resources, rail infrastructure, and industrial processes sectors in Australia, with a market capitalization of A$418.14 million.

Operations: Lycopodium Limited generates revenue primarily from the resources sector, contributing A$347.83 million, with additional income from process industries and rail infrastructure at A$10.84 million and A$10.14 million respectively.

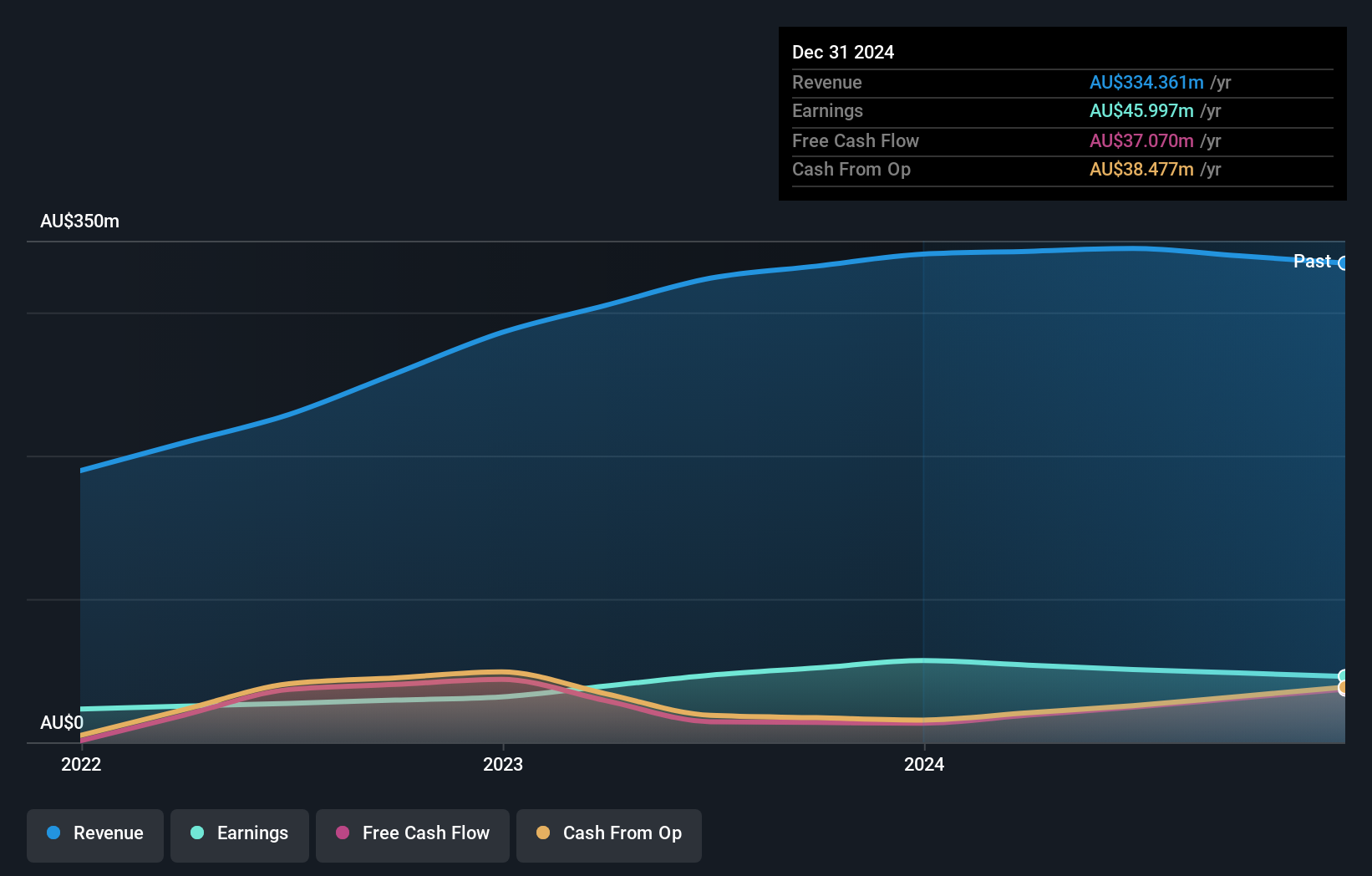

Lycopodium, a notable player in the construction sector, has been trading at 21.8% below its estimated fair value, offering potential appeal for investors seeking undervalued opportunities. Despite facing a negative earnings growth of 19.3% over the past year compared to the industry's average of 28.7%, LYC maintains high-quality earnings and is free cash flow positive with A$13.31 million as of December 2023. The company's debt to equity ratio rose from 0% to 6.9% over five years but remains manageable due to having more cash than total debt, ensuring interest payments are well-covered by profits. Recent updates include being added to the S&P/ASX Emerging Companies Index and issuing guidance for fiscal year revenue between A$320 million and A$340 million with NPAT projected at A$37 million to A$43 million, reflecting cautious optimism amidst market challenges.

- Take a closer look at Lycopodium's potential here in our health report.

Evaluate Lycopodium's historical performance by accessing our past performance report.

Summing It All Up

- Take a closer look at our ASX Undiscovered Gems With Strong Fundamentals list of 51 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LYL

Lycopodium

Provides engineering and project delivery services in the resources, rail infrastructure, and industrial processes sectors in Australia.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives