- Australia

- /

- Diversified Financial

- /

- ASX:CGF

What Challenger (ASX:CGF)'s Appointment of Group CIO Signals for Its Investment Integration Strategy

Reviewed by Sasha Jovanovic

- Challenger Limited recently announced the appointment of Damian Graham to the newly created role of Group Chief Investment Officer, effective January 2026, consolidating investment teams from Challenger Life and Funds Management under unified leadership.

- Graham’s extensive track record at major investment institutions, including leading Aware Super’s A$205 billion portfolio, signals a strengthened focus on integrated investment management and operational alignment at Challenger.

- We’ll examine how Graham’s leadership and the integration of Challenger’s investment teams could influence the company’s future investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Challenger Investment Narrative Recap

Challenger's long-term appeal often hinges on confidence in robust demand for retirement income products, capital standard reforms, and sustained annuity growth. Damian Graham’s appointment as Group Chief Investment Officer does not materially affect the most immediate catalyst, APRA capital reforms or the primary short-term risk: persistent tight credit spreads and margin pressure on legacy assets, though his leadership could influence future performance over time.

Among recent events, Challenger's 2026 earnings guidance reaffirmation is most relevant here, as it underpins market expectations for steady earnings growth amid structural leadership transitions. The company forecasts normalized basic EPS of 66 to 72 cents per share, signaling confidence in near-term operational and investment stability even as changes unfold.

Yet, with credit spreads still historically narrow, investors should watch for how sustained margin pressure may challenge future earnings...

Read the full narrative on Challenger (it's free!)

Challenger's narrative projects A$1.1 billion revenue and A$541.1 million earnings by 2028. This requires a 26.8% annual revenue decline and a A$348.8 million increase in earnings from A$192.3 million today.

Uncover how Challenger's forecasts yield a A$9.38 fair value, a 5% upside to its current price.

Exploring Other Perspectives

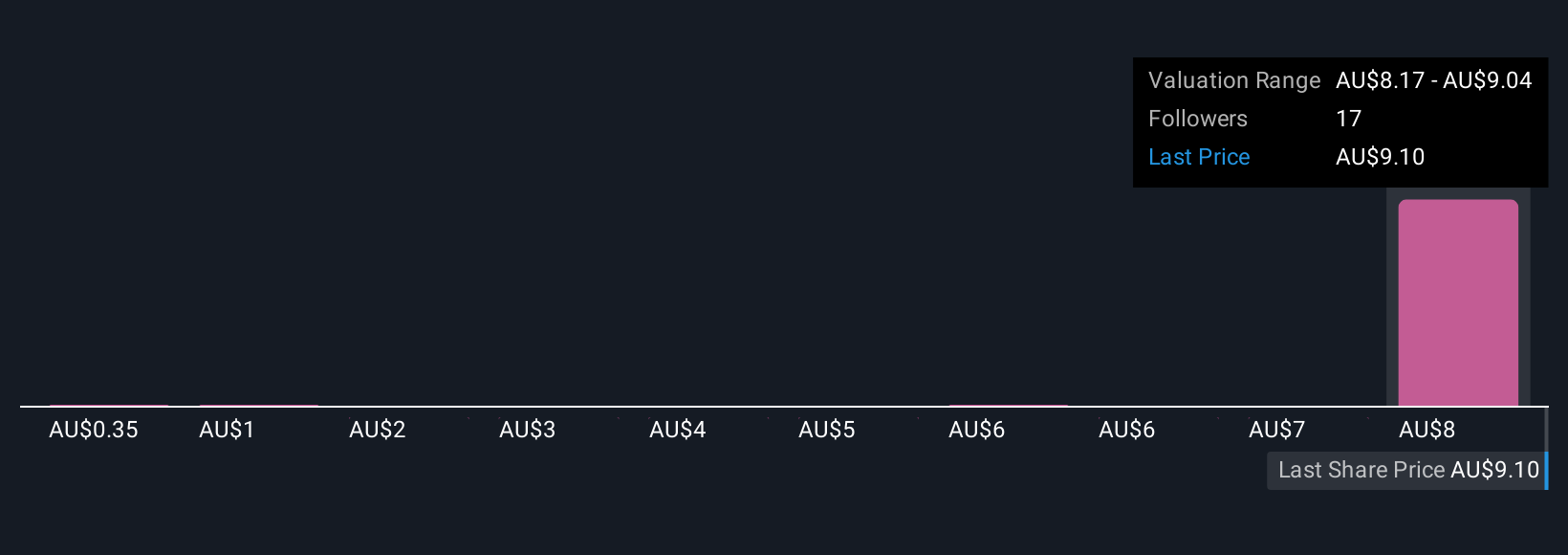

Five Simply Wall St Community members value Challenger between A$0.35 and A$9.51 per share, reflecting a wide divergence in future outlooks. While consensus expects APRA capital reforms to reduce capital intensity and support growth, it’s clear that market participants approach Challenger’s outlook from many different angles, explore more perspectives to form your own view.

Explore 5 other fair value estimates on Challenger - why the stock might be worth as much as 7% more than the current price!

Build Your Own Challenger Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Challenger research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Challenger research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Challenger's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CGF

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives