- Australia

- /

- Diversified Financial

- /

- ASX:CGF

How Investors Are Reacting To Challenger (ASX:CGF) Strong Annual Profit Growth and Higher Earnings Per Share

Reviewed by Simply Wall St

- Challenger Limited has reported its full-year earnings for the period ended June 30, 2025, revealing net income of A$192.3 million, up from A$129.9 million the previous year, with basic earnings per share from continuing operations rising to A$0.28.

- This substantial increase in both net income and earnings per share highlights a period of improved operational profitability for the company.

- We'll assess how Challenger's strong annual profit growth shapes its investment outlook, especially given its focus on annuities and technology upgrades.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Challenger Investment Narrative Recap

To be a shareholder in Challenger, you need to believe in the company's ability to capture long-term growth from its leading position in annuities and benefit from operational upgrades in technology. The latest annual results, highlighting a sharp rise in net income and earnings per share, reinforce improving profitability, but do not materially alter the most important short-term catalyst: Challenger’s efforts to shift its annuity sales toward longer-term products. The biggest risk remains the company’s sensitivity to market-driven valuation movements, with profit volatility still a key concern.

The most relevant recent announcement alongside these results is TAL Dai-ichi Life Australia’s completed acquisition of a 15.1% stake for A$880 million, following regulatory approval earlier this month. While this major shareholding underpins Challenger’s profile within the insurance and annuities sector, it does not directly impact catalysts such as technology-driven efficiency gains or underlying earnings quality, both of which are central to the outlook following this profit update.

By contrast, the risk of large market or property valuation swings influencing Challenger’s reported profits is something investors should watch for…

Read the full narrative on Challenger (it's free!)

Challenger's narrative projects A$1.1 billion revenue and A$507.4 million earnings by 2028. This implies a 32.6% annual revenue decrease and an earnings increase of A$360.2 million from current earnings of A$147.2 million.

Uncover how Challenger's forecasts yield a A$8.42 fair value, in line with its current price.

Exploring Other Perspectives

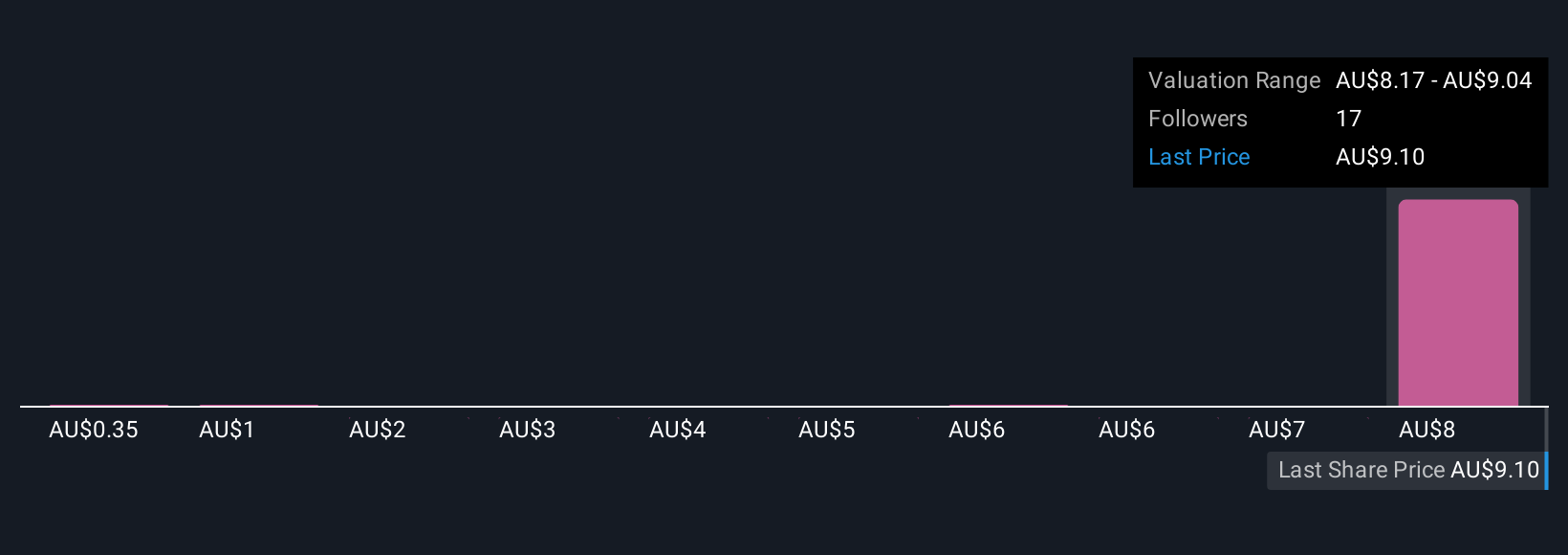

Four Simply Wall St Community fair value estimates for Challenger range from A$0.35 to A$8.42, underscoring how much opinions can differ. While many expect earnings growth, swings in property or market values remain a high-impact risk for the company’s outcomes.

Explore 4 other fair value estimates on Challenger - why the stock might be worth as much as A$8.42!

Build Your Own Challenger Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Challenger research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Challenger research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Challenger's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CGF

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives