- Australia

- /

- Diversified Financial

- /

- ASX:CCL

Undiscovered Gems In Australia And 2 Other Promising Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

In recent sessions, the Australian market has experienced a cautious atmosphere with a slight downturn in the S&P/ASX 200 Index, as risk-off sentiment prevails amid mixed performances across sectors. While some industries like Energy and Financials have shown resilience, others such as Materials and Real Estate have faced challenges, highlighting the importance of identifying small-cap stocks with solid fundamentals and growth potential in this fluctuating environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Tribune Resources | NA | -21.42% | -41.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| K&S | 16.07% | 0.09% | 33.40% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$584.11 million.

Operations: Australian Ethical Investment Ltd generates revenue primarily through its funds management segment, totaling A$100.49 million.

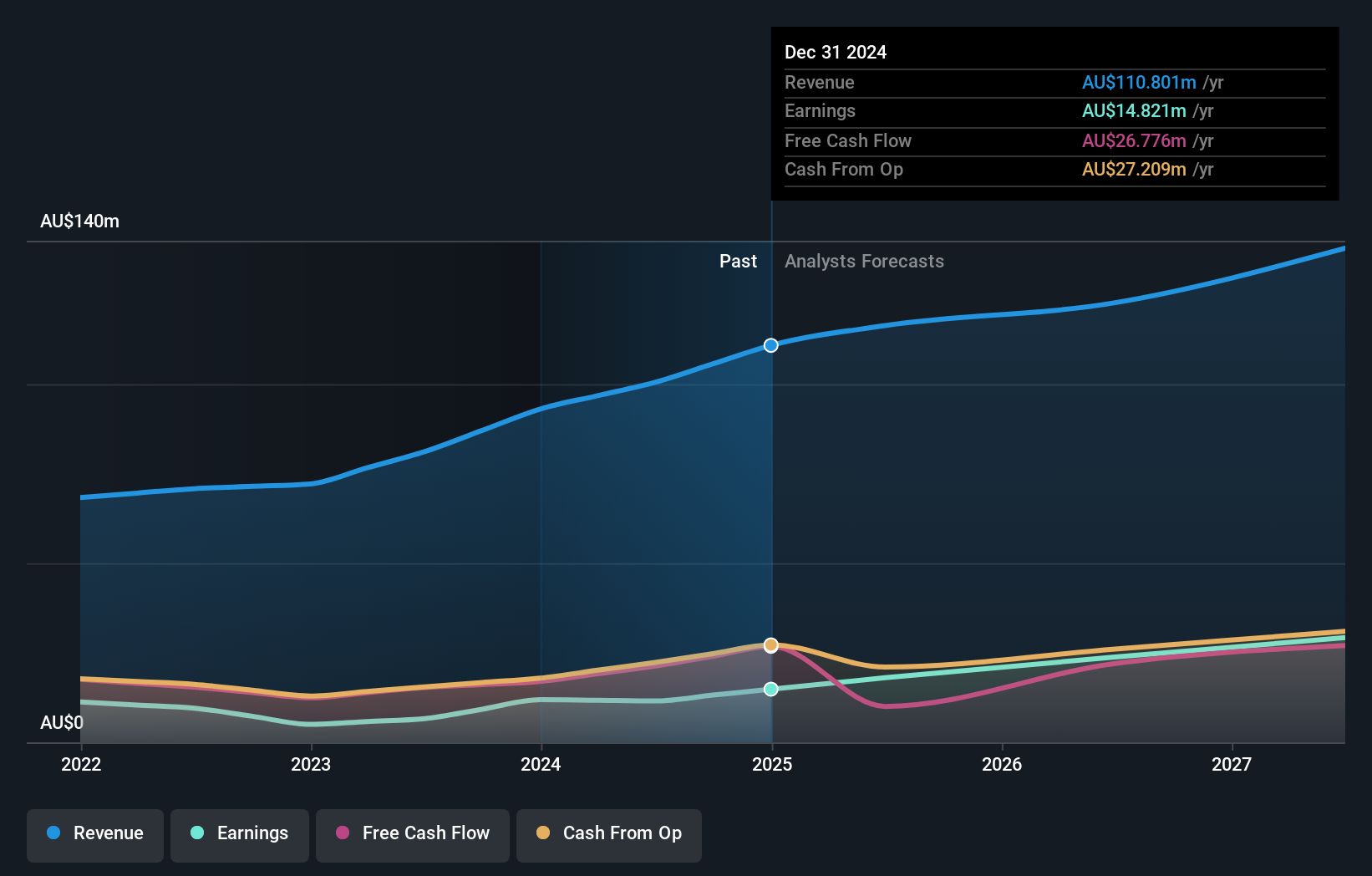

Australian Ethical Investment, a nimble player in the capital markets, has demonstrated impressive earnings growth of 75.3% over the past year, outpacing the industry's 19.9%. Despite a significant A$8.6M one-off loss impacting recent financials, the firm remains debt-free and boasts positive free cash flow. The acquisition of Altius Asset Management is poised to diversify income streams and expand its customer base, though challenges like fee margin pressures could affect net profit margins. Analysts forecast a promising annual revenue growth of 12.7%, with potential upside from its current share price of A$4.97 to A$6.7 based on strategic projections.

Cuscal (ASX:CCL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cuscal Limited, with a market cap of A$490.40 million, offers payment and regulated data-related products and services to financial and consumer-centric institutions in Australia.

Operations: Cuscal Limited generates revenue through its payment and data services for financial institutions in Australia.

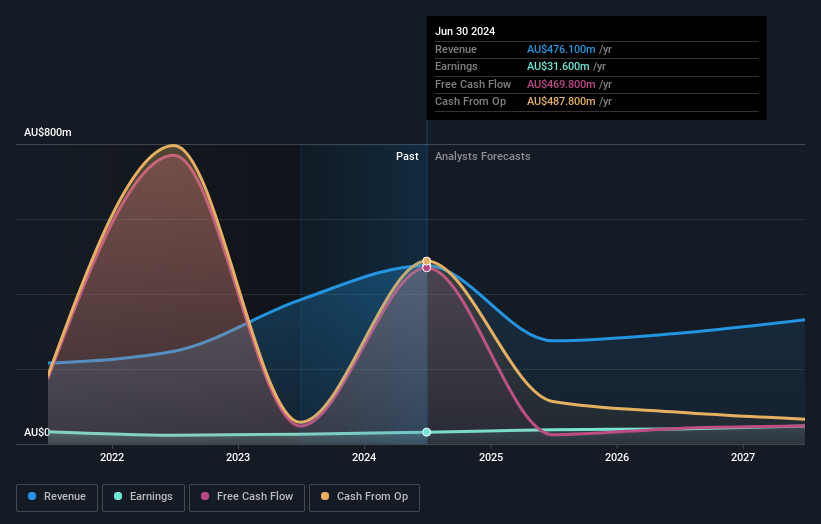

Cuscal, an intriguing player in Australia's financial landscape, offers a compelling profile with its price-to-earnings ratio of 15.5x, undercutting the broader market's 18.8x. Over the past year, earnings surged by 21.1%, outpacing the Diversified Financial industry, which saw a -12.7% change. The company has successfully reduced its debt to equity from 172.5% to 103.5% over five years and maintains more cash than total debt, indicating strong financial health despite interest payments being only covered at 1.4x EBIT—a point of concern for potential investors evaluating risk versus reward prospects in this sector.

- Dive into the specifics of Cuscal here with our thorough health report.

Evaluate Cuscal's historical performance by accessing our past performance report.

GR Engineering Services (ASX:GNG)

Simply Wall St Value Rating: ★★★★★☆

Overview: GR Engineering Services Limited offers engineering, procurement, and construction services to the mining and mineral processing sectors both in Australia and globally, with a market capitalization of A$484.85 million.

Operations: GR Engineering Services derives its revenue primarily from engineering, procurement, and construction services targeted at the mining and mineral processing industries in Australia and internationally. The company's financial performance is influenced by project-based revenue streams, with costs largely associated with labor, materials, and subcontractor expenses.

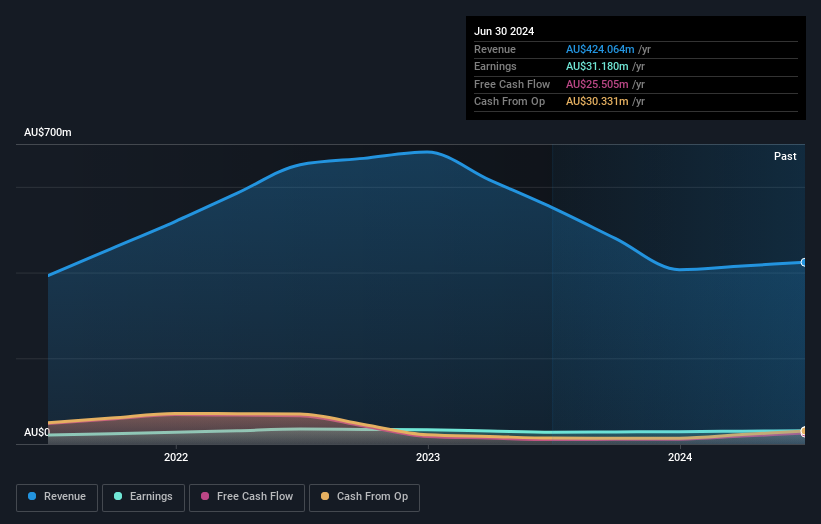

GR Engineering Services, a nimble player in the engineering sector, showcases impressive financial metrics. Its earnings growth of 34% over the past year outpaced the broader Metals and Mining industry, which saw a -3% performance. The company reported A$272.11 million in sales for the half-year ending December 2024, up from A$187.27 million previously, while net income rose to A$21.82 million from A$14.3 million a year earlier. Additionally, GR Engineering declared a fully franked interim dividend of 10 cents per share for this period compared to 9 cents last year, reflecting robust shareholder returns amidst solid operational performance.

- Take a closer look at GR Engineering Services' potential here in our health report.

Gain insights into GR Engineering Services' past trends and performance with our Past report.

Make It Happen

- Click through to start exploring the rest of the 44 ASX Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CCL

Cuscal

Provides payment and regulated data related products and services for financial and consumer centric institutions in Australia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives