- Australia

- /

- Professional Services

- /

- ASX:IPH

Top ASX Dividend Stocks To Watch In May 2025

Reviewed by Simply Wall St

The Australian market recently experienced a boost, with the ASX200 closing up 0.58% following a rate cut by the Reserve Bank of Australia, highlighting positive momentum in sectors like IT and Real Estate. In this environment, dividend stocks can offer stability and income potential for investors seeking to navigate these dynamic conditions effectively.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Bisalloy Steel Group (ASX:BIS) | 9.39% | ★★★★★☆ |

| IPH (ASX:IPH) | 7.07% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.90% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.74% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.45% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 8.41% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.72% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.15% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.41% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.10% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

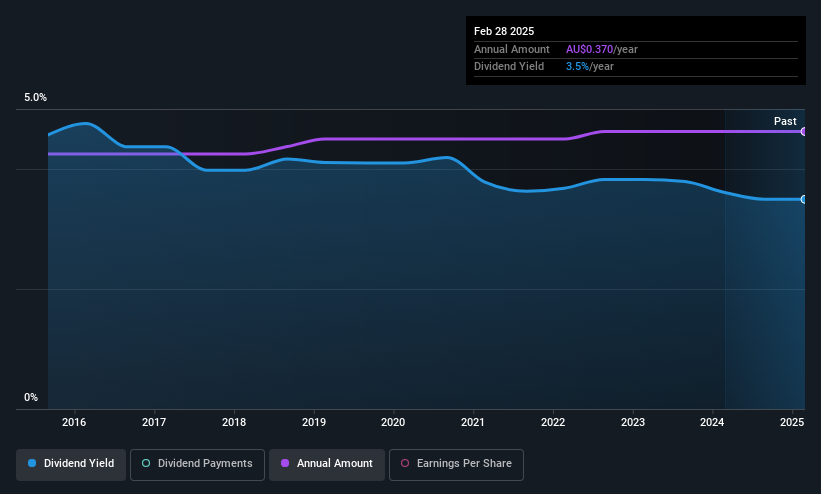

Australian United Investment (ASX:AUI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Australian United Investment Company Limited is a publicly owned investment manager with a market cap of A$1.34 billion.

Operations: Australian United Investment Company Limited generates revenue primarily from its investment segment, totaling A$58.38 million.

Dividend Yield: 3.4%

Australian United Investment offers a stable dividend history with consistent growth over the past decade. However, its current dividend yield of 3.43% falls short compared to top-tier Australian payers. The dividends are reliable but not well-covered by earnings, with a high payout ratio of 91.9%. While cash flows cover the dividends at an 89.7% cash payout ratio, sustainability concerns persist due to insufficient earnings coverage.

- Click to explore a detailed breakdown of our findings in Australian United Investment's dividend report.

- Our expertly prepared valuation report Australian United Investment implies its share price may be too high.

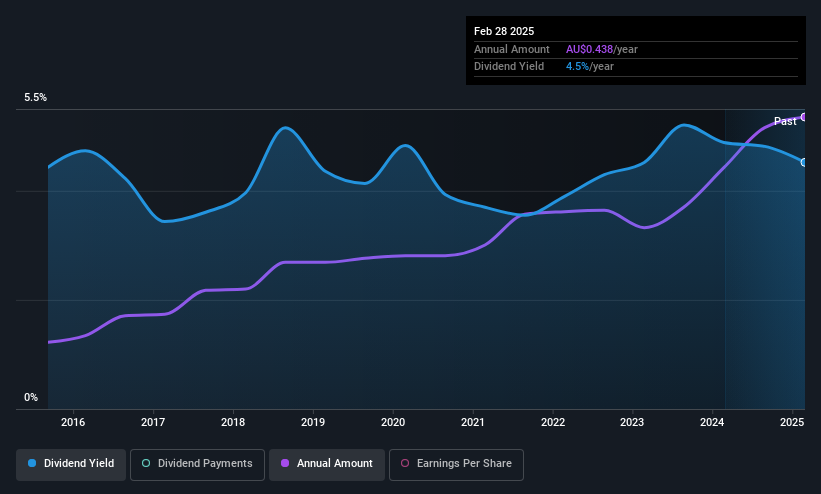

Fiducian Group (ASX:FID)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fiducian Group Ltd, with a market cap of A$313.78 million, operates through its subsidiaries to provide financial services in Australia.

Operations: Fiducian Group Ltd generates revenue through its segments of Funds Management (A$24.34 million), Corporate Services (A$16.38 million), Financial Planning (A$28.93 million), and Platform Administration (A$16.49 million).

Dividend Yield: 4.4%

Fiducian Group's dividends are well-supported by both earnings and cash flows, with payout ratios of 80.4% and 67.8%, respectively. Over the past decade, its dividend payments have shown consistent growth and stability, offering a yield of 4.41%. However, this yield is lower than the top quartile in Australia at 6.11%. Recent earnings growth of 23.6% may bolster future dividend sustainability despite the relatively modest yield compared to market leaders.

- Dive into the specifics of Fiducian Group here with our thorough dividend report.

- The analysis detailed in our Fiducian Group valuation report hints at an inflated share price compared to its estimated value.

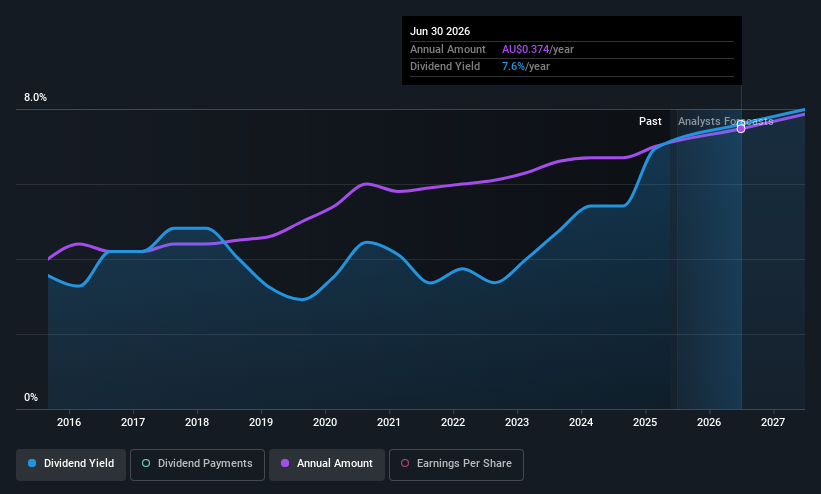

IPH (ASX:IPH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IPH Limited, along with its subsidiaries, offers intellectual property services and products and has a market capitalization of approximately A$1.30 billion.

Operations: IPH Limited's revenue is derived from its intellectual property services across different regions, including A$121 million from Asia, A$259.20 million from Canada, and A$300.30 million from Australia and New Zealand.

Dividend Yield: 7.1%

IPH's dividend yield of 7.07% ranks in the top quartile of Australian dividend payers but is not well covered by earnings, with a high payout ratio of 119.5%. Despite this, dividends have been stable and growing over the past decade. Earnings grew by 35.3% last year, indicating potential for future support of dividends. The recent appointment of Brendan York as CFO may influence financial strategy and investor confidence moving forward.

- Click here to discover the nuances of IPH with our detailed analytical dividend report.

- Our expertly prepared valuation report IPH implies its share price may be lower than expected.

Next Steps

- Get an in-depth perspective on all 29 Top ASX Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IPH

Very undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives