- Australia

- /

- Capital Markets

- /

- ASX:ASX

ASX (ASX:ASX) Valuation in Focus as Cboe Wins Approval to Challenge Exchange Monopoly

Reviewed by Kshitija Bhandaru

The Australian Securities Exchange (ASX:ASX) has entered a new era after the Australian Securities and Investments Commission approved Cboe Global Markets as a rival listing exchange. This move officially ends ASX's exclusive grip on IPOs and primary market listings.

See our latest analysis for ASX.

ASX shares dropped 1.4% following the news of incoming competition from Cboe Australia, highlighting investor concerns about the implications for the exchange’s long-term revenue model. While the 1-year total shareholder return sits at -8%, short-term momentum has faded. An 18% slide in the past three months suggests the market is reassessing growth prospects amid regulatory change and an evolving landscape for capital markets.

If this shift in Australia's listings scene has you thinking bigger, now's an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With the ASX share price down and trading around a 13% discount to analyst price targets, the key question is whether today's weakness unlocks value or if the market is already pricing in slower growth ahead.

Most Popular Narrative: 12.7% Undervalued

With ASX shares closing at A$58.06 and the most-followed narrative suggesting fair value lands much higher, the gap points to intriguing assumptions powering analyst targets and future outlook. Get a glimpse of what could send the share price higher in this direct quote.

Expansion and demand in high-margin technology and data offerings, driven by appetite for analytics, connectivity, and market information from both domestic and global market participants, provides opportunity for recurring, diversified non-transactional income, supporting overall margin expansion and earnings stability.

How does a traditional market operator command a premium valuation, even with regulatory and competitive headwinds? There is a bold operating transformation at the heart of this narrative, one you’ll want to unpack. The most closely-watched numbers behind this valuation might surprise even ASX veterans. Find out which foundational shifts underpin the optimism around future growth, margins, and strategic pricing power.

Result: Fair Value of $66.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising technology costs and tighter regulatory scrutiny could quickly emerge as catalysts that challenge these bullish assumptions and threaten future margin stability.

Find out about the key risks to this ASX narrative.

Another Perspective: Mind the DCF Gap

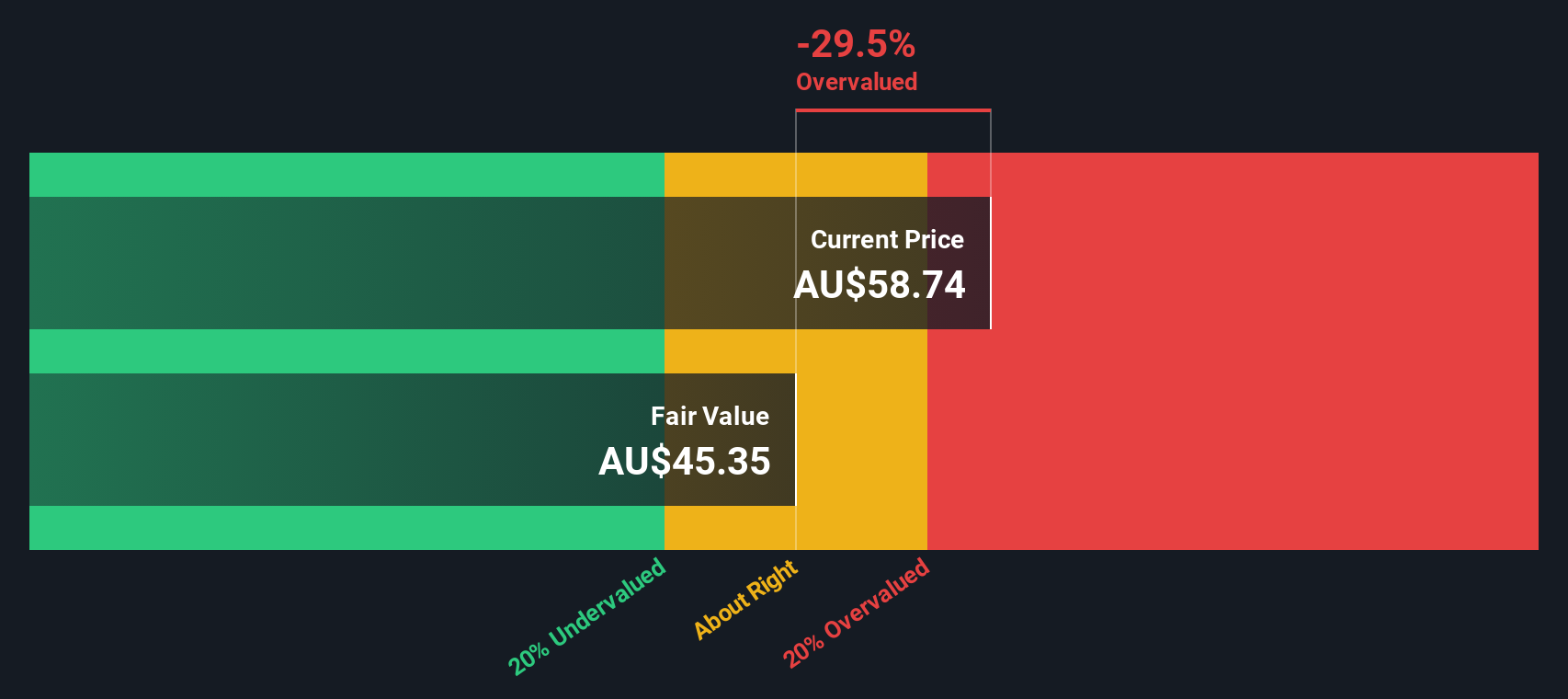

Taking a different approach, the SWS DCF model suggests ASX shares are trading above their estimated fair value of A$45.45. This method paints a less optimistic picture compared to analyst price targets and raises the real question: are growth assumptions too high, or could the market be discounting hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASX Narrative

If these scenarios do not align with your outlook, or you want to back your own convictions, it's easy to build your own take in just a few minutes, so why not Do it your way

A great starting point for your ASX research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act on today's momentum and open up your portfolio to advantage. Don't miss out on the most talked-about stocks and fast-moving markets Simply Wall St surfaces every day.

- Tap into the growth potential of bleeding-edge technology with these 25 AI penny stocks. Spot companies making waves in artificial intelligence breakthroughs.

- Capture attractive yields and enhance your passive income by assessing these 19 dividend stocks with yields > 3%, which features reliable payouts above market averages.

- Capitalize on major valuations and hunt for bargains hidden among these 897 undervalued stocks based on cash flows. These stocks show strong fundamentals yet remain overlooked by many investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ASX

ASX

Operates as a multi-asset class and integrated exchange company in Australia and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives