- Australia

- /

- Diversified Financial

- /

- ASX:AMP

Why AMP (ASX:AMP) Is Up 5.1% After New Head of Sales Appointment and What's Next

Reviewed by Simply Wall St

- Earlier this week, AMP Limited announced the appointment of Harry Georges as Head of National Sales for its North platform, reporting to the General Manager of Wealth Distribution, Lisa Sorgini.

- This move brings an executive with over two decades of experience in advice and platform distribution, highlighting AMP’s emphasis on data-driven adviser support for the expanding superannuation and retirement sector.

- To assess how this leadership appointment could enhance AMP’s platform and adviser engagement, we’ll review its impact on the company’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

AMP Investment Narrative Recap

For shareholders of AMP, the investment case often centers on AMP’s ability to leverage its leading platforms and adviser networks to grow in the Australian superannuation and retirement sectors, while maintaining efficient cost control. The appointment of Harry Georges as Head of National Sales for North aligns with this focus on platform growth and adviser support, but does not represent a significant short-term catalyst or remove the main risk of ongoing margin compression in banking earnings.

Among recent announcements, the appointment of Estelle Liu as Head of Retirement Solutions stands out, given her role in enhancing AMP’s platform capabilities for retirement products. This is closely linked to AMP’s efforts to expand in fast-growing segments and could build on the adviser engagement themes highlighted by Georges’s arrival, supporting the broader growth catalyst around increased wealth management flows.

Yet, despite these executive moves, the pressure of declining net interest margins on AMP’s bank earnings remains a risk that investors should...

Read the full narrative on AMP (it's free!)

AMP's outlook anticipates A$1.3 billion in revenue and A$297.8 million in earnings by 2028. This forecast assumes a 22.7% annual decline in revenue but a rise in earnings from A$180.0 million today, a value increase of A$117.8 million.

Uncover how AMP's forecasts yield a A$1.35 fair value, a 12% downside to its current price.

Exploring Other Perspectives

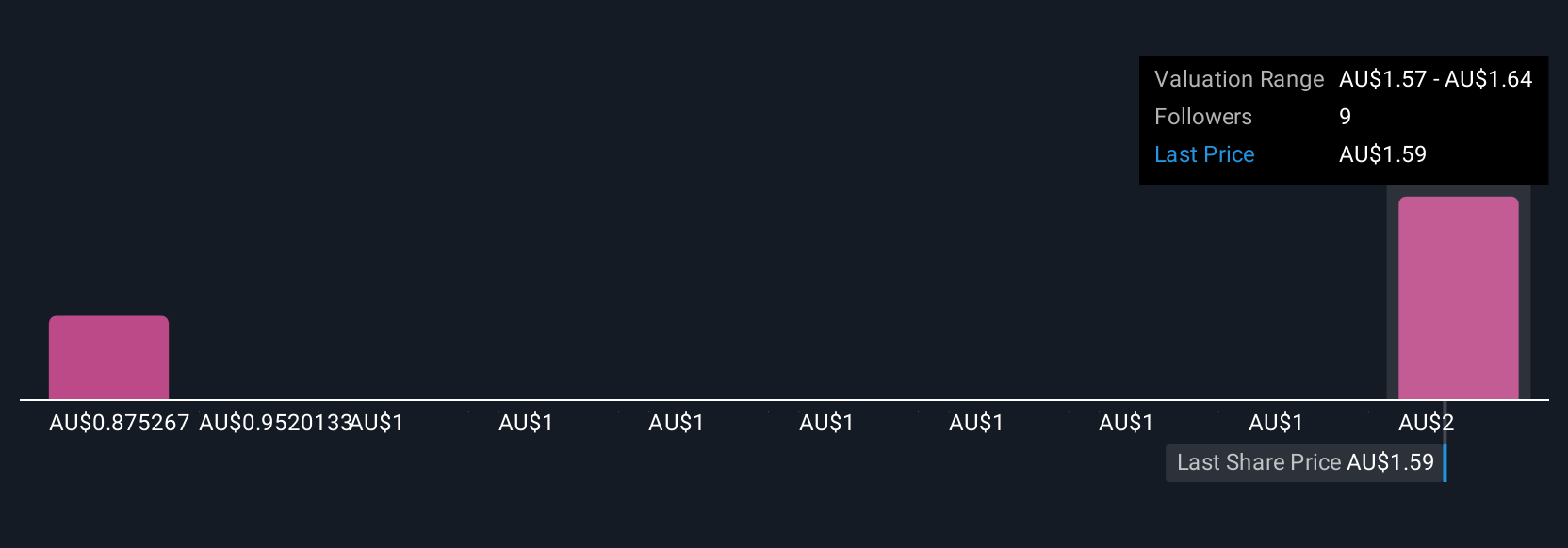

Community members at Simply Wall St peg AMP’s fair value between A$0.85 and A$1.35, with two perspectives considered. Some highlight risks from competitive banking pressures impacting net interest margins, suggesting that outcomes could diverge widely as more viewpoints emerge.

Build Your Own AMP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AMP research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AMP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AMP's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AMP

AMP

Provides banking, super, and retirement services in Australia and New Zealand.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives