Asian Insider Action Highlights These 3 Top Undervalued Small Caps

Reviewed by Simply Wall St

Amid escalating trade tensions and fluctuating consumer sentiment, Asian markets have experienced notable volatility, with indices reflecting broader global uncertainties. Despite these challenges, small-cap stocks in Asia present intriguing opportunities for investors seeking potential value plays within the current market landscape. Identifying promising small-cap stocks often involves evaluating their resilience to economic shifts and their ability to capitalize on regional growth dynamics.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.6x | 1.1x | 40.53% | ★★★★★★ |

| New Hope | 5.4x | 1.5x | 49.95% | ★★★★★☆ |

| Viva Energy Group | NA | 0.1x | 41.03% | ★★★★★☆ |

| Dicker Data | 18.4x | 0.6x | -31.14% | ★★★★☆☆ |

| Hansen Technologies | 296.2x | 2.9x | 22.90% | ★★★★☆☆ |

| Sing Investments & Finance | 7.2x | 3.6x | 43.04% | ★★★★☆☆ |

| PWR Holdings | 33.5x | 4.6x | 27.76% | ★★★☆☆☆ |

| Integral Diagnostics | 148.4x | 1.7x | 44.05% | ★★★☆☆☆ |

| Zip Co | NA | 2.0x | -44.91% | ★★★☆☆☆ |

| Manawa Energy | NA | 2.6x | 42.78% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

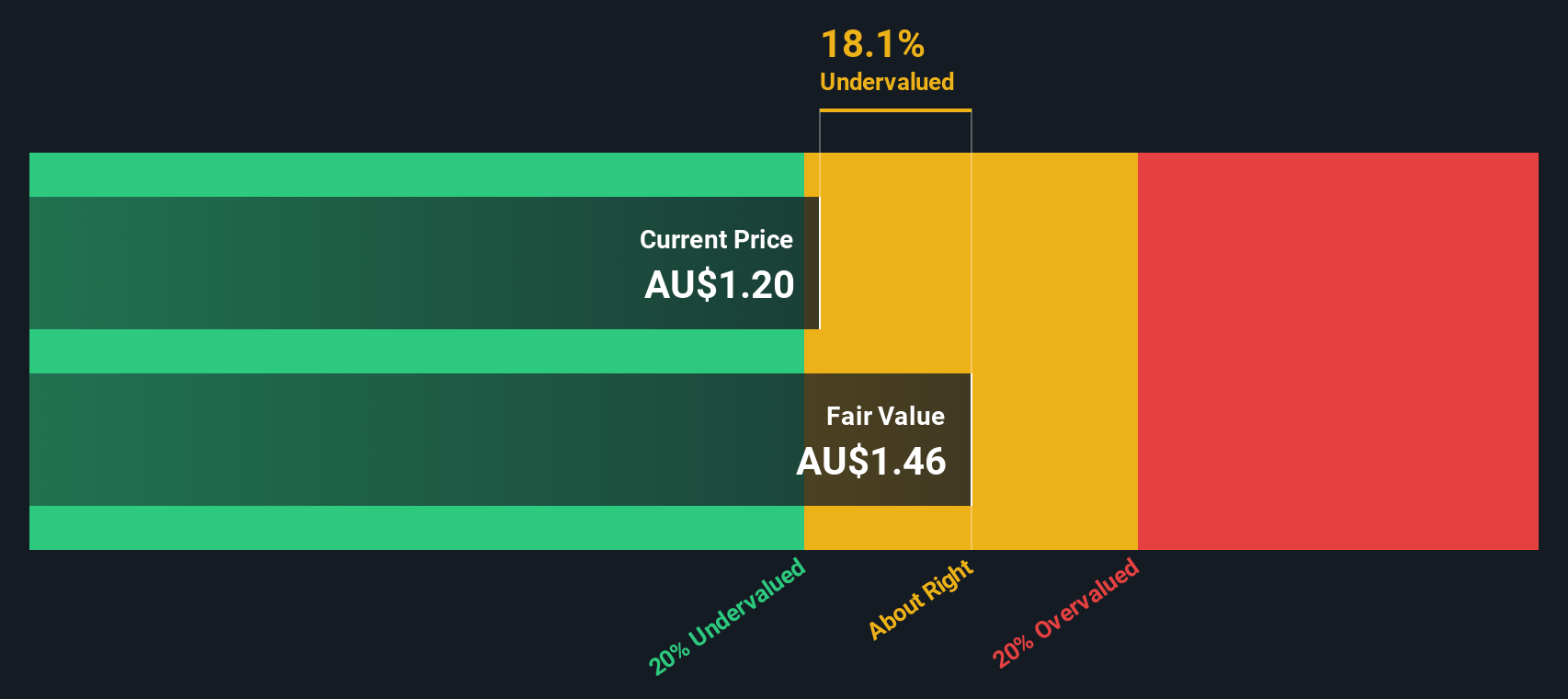

AMP (ASX:AMP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: AMP is a financial services company operating in sectors such as banking, platforms, superannuation and investments, and wealth management in New Zealand with a market capitalization of A$4.94 billion.

Operations: AMP generates revenue primarily from its Platforms, AMP Bank, and Superannuation & Investments segments, with additional contributions from New Zealand Wealth Management. The company experienced varied net income margins over time, with a notable shift to consistently achieving a gross profit margin of 100% starting in 2019.

PE: 15.8x

AMP, a small player in Asia's financial sector, has seen insider confidence with notable share purchases in recent months. Despite facing higher risk due to reliance on external borrowing, AMP's earnings are forecasted to grow by 13% annually. Recent earnings showed revenue of A$2.87 billion for 2024, though net income dropped to A$150 million from A$265 million the previous year. The company is potentially eyeing acquisitions like Insignia Financial amid takeover talks, indicating strategic growth ambitions.

- Click to explore a detailed breakdown of our findings in AMP's valuation report.

Explore historical data to track AMP's performance over time in our Past section.

Bell Financial Group (ASX:BFG)

Simply Wall St Value Rating: ★★★★☆☆

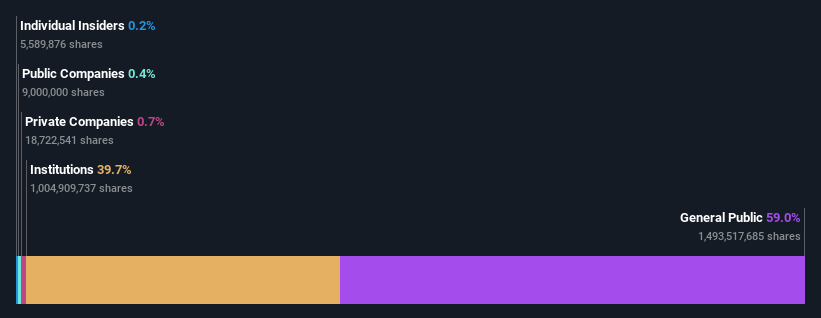

Overview: Bell Financial Group is an Australian-based financial services company specializing in broking, products and services, and technology platforms, with a market capitalization of approximately A$0.88 billion.

Operations: Revenue is primarily driven by Broking, followed by Products & Services and Technology & Platforms. The net income margin has shown an upward trend from 3.08% in June 2014 to 12.18% in December 2024, indicating improved profitability over time. Cost of Goods Sold (COGS) remains relatively stable while operating expenses, particularly general and administrative expenses, constitute a significant portion of total costs.

PE: 13.3x

Bell Financial Group, a smaller player in the financial services sector, has shown promising financial growth. In 2024, they reported A$276.38 million in revenue and a net income of A$30.74 million, marking an increase from the previous year. Despite relying entirely on external borrowing for funding, which carries higher risk compared to customer deposits, the company maintains confidence with insiders purchasing shares over recent months. Future earnings are projected to grow nearly 14% annually, indicating potential value for investors seeking smaller-cap opportunities in Asia's market landscape.

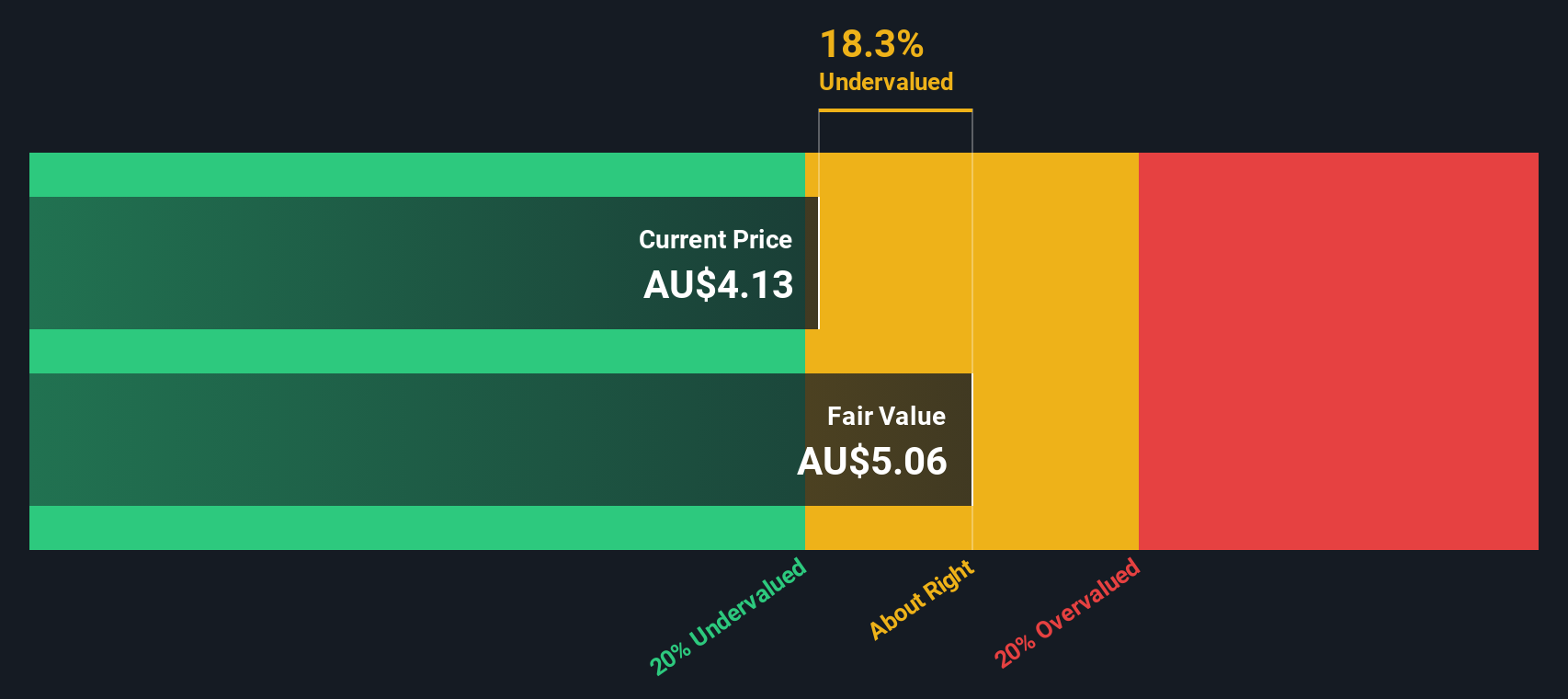

Charter Hall Long WALE REIT (ASX:CLW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Charter Hall Long WALE REIT focuses on investing in high-quality commercial properties with long lease agreements, and it has a market capitalization of approximately A$4.74 billion.

Operations: The company generates revenue primarily from its commercial real estate investments, with recent figures showing A$243.09 million in revenue. Operating expenses have increased significantly over time, impacting net income negatively in recent periods. The gross profit margin has shown variability, reaching a low of -41.96% and a high of 91.71%. Net income margins have also fluctuated widely, recently recording negative values as low as -23.13%.

PE: -13.0x

Charter Hall Long WALE REIT, a smaller player in the Asian market, shows potential with its forecasted 40.68% annual earnings growth despite relying solely on external borrowing for funding. Recent earnings for the half-year ended December 2024 revealed a turnaround, with net income reaching A$51.28 million from a previous loss of A$258.37 million. Insider confidence is evident as insiders have increased their holdings recently, signaling belief in future prospects amid confirmed dividend payouts and steady financial guidance for 2025.

Taking Advantage

- Reveal the 65 hidden gems among our Undervalued Asian Small Caps With Insider Buying screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CLW

Charter Hall Long WALE REIT

An Australian Real Estate Investment Trust (REIT) listed on the ASX.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives