- Australia

- /

- Capital Markets

- /

- ASX:AEF

ASX Growth Companies With High Insider Ownership In December 2025

Reviewed by Simply Wall St

As the Australian market navigates a turbulent landscape marked by mixed GDP data and volatile sector performances, investors are keenly observing growth companies that demonstrate resilience and potential. In such an environment, stocks with high insider ownership often signal confidence from those who know the company best, making them attractive prospects for those seeking stability amid uncertainty.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.4% | 96.4% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Polymetals Resources (ASX:POL) | 37.7% | 108% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 11% | 31.4% |

| IRIS Metals (ASX:IR1) | 26% | 144.4% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| BlinkLab (ASX:BB1) | 35.4% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Underneath we present a selection of stocks filtered out by our screen.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Growth Rating: ★★★★☆☆

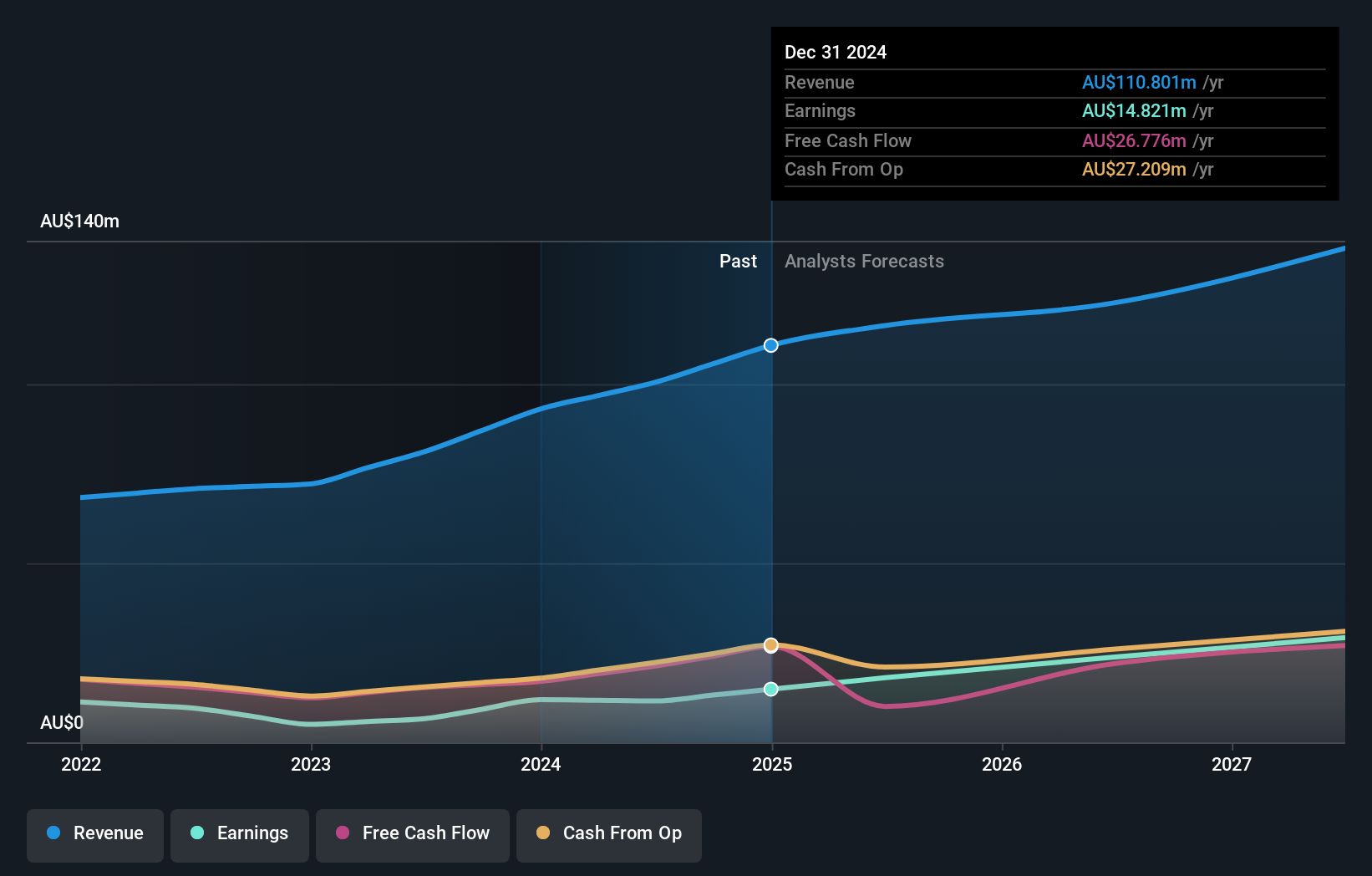

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$622.67 million, focusing on ethical and sustainable investment strategies.

Operations: The company generates revenue primarily through its funds management segment, which accounts for A$119.38 million.

Insider Ownership: 22.5%

Earnings Growth Forecast: 18.3% p.a.

Australian Ethical Investment demonstrates strong growth prospects with earnings forecasted to grow 18.3% annually, outpacing the Australian market's 12.1%. Its revenue is expected to increase by 10.4% per year, surpassing the market average of 6%. The company boasts a very high projected return on equity of 59.2% within three years, although its dividend track record remains unstable. Recent events include an upcoming Annual General Meeting on November 11, 2025, in Sydney.

- Unlock comprehensive insights into our analysis of Australian Ethical Investment stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Australian Ethical Investment shares in the market.

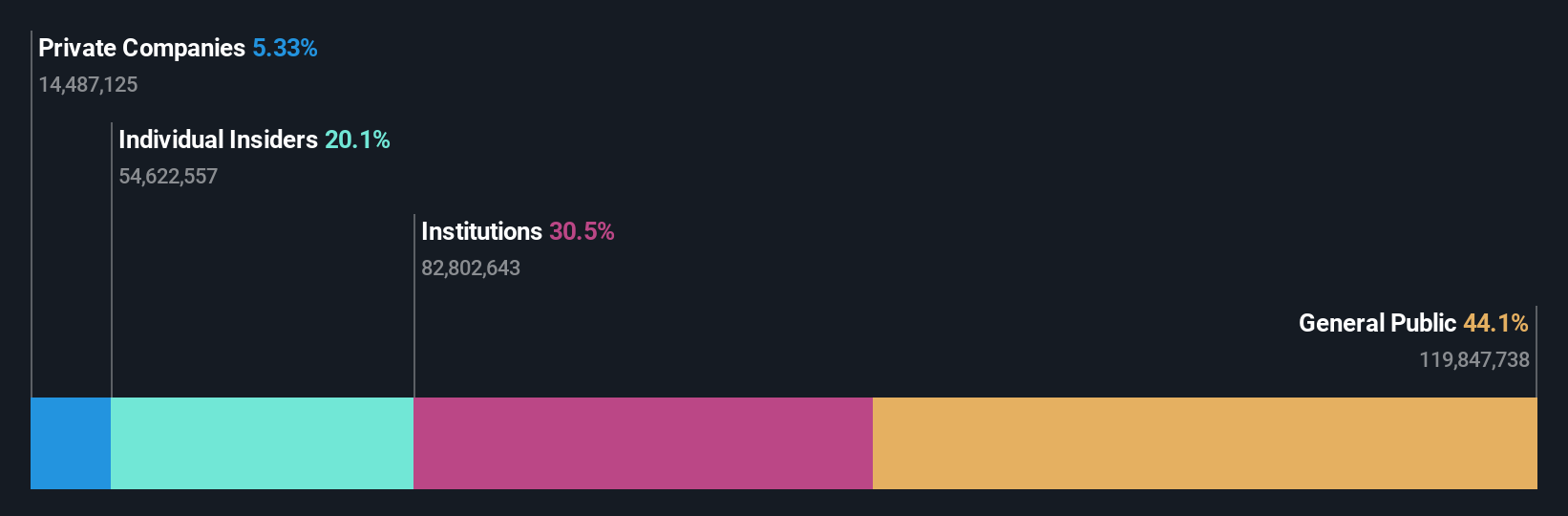

Australian Finance Group (ASX:AFG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Australian Finance Group Limited operates in the mortgage broking industry in Australia and has a market cap of A$627.77 million.

Operations: The company's revenue is primarily derived from its Distribution segment, which accounts for A$934.50 million, followed by the Manufacturing segment at A$330.30 million.

Insider Ownership: 20.1%

Earnings Growth Forecast: 18.1% p.a.

Australian Finance Group shows promising growth potential, with earnings projected to rise by 18.1% annually, outpacing the Australian market's 12.1%. Revenue is expected to grow at 9% per year. The company has a high forecasted return on equity of 22.4% in three years and a competitive price-to-earnings ratio of 17.9x compared to the market's 21.3x, although its dividend history is unstable and debt coverage by operating cash flow is inadequate.

- Navigate through the intricacies of Australian Finance Group with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Australian Finance Group is trading beyond its estimated value.

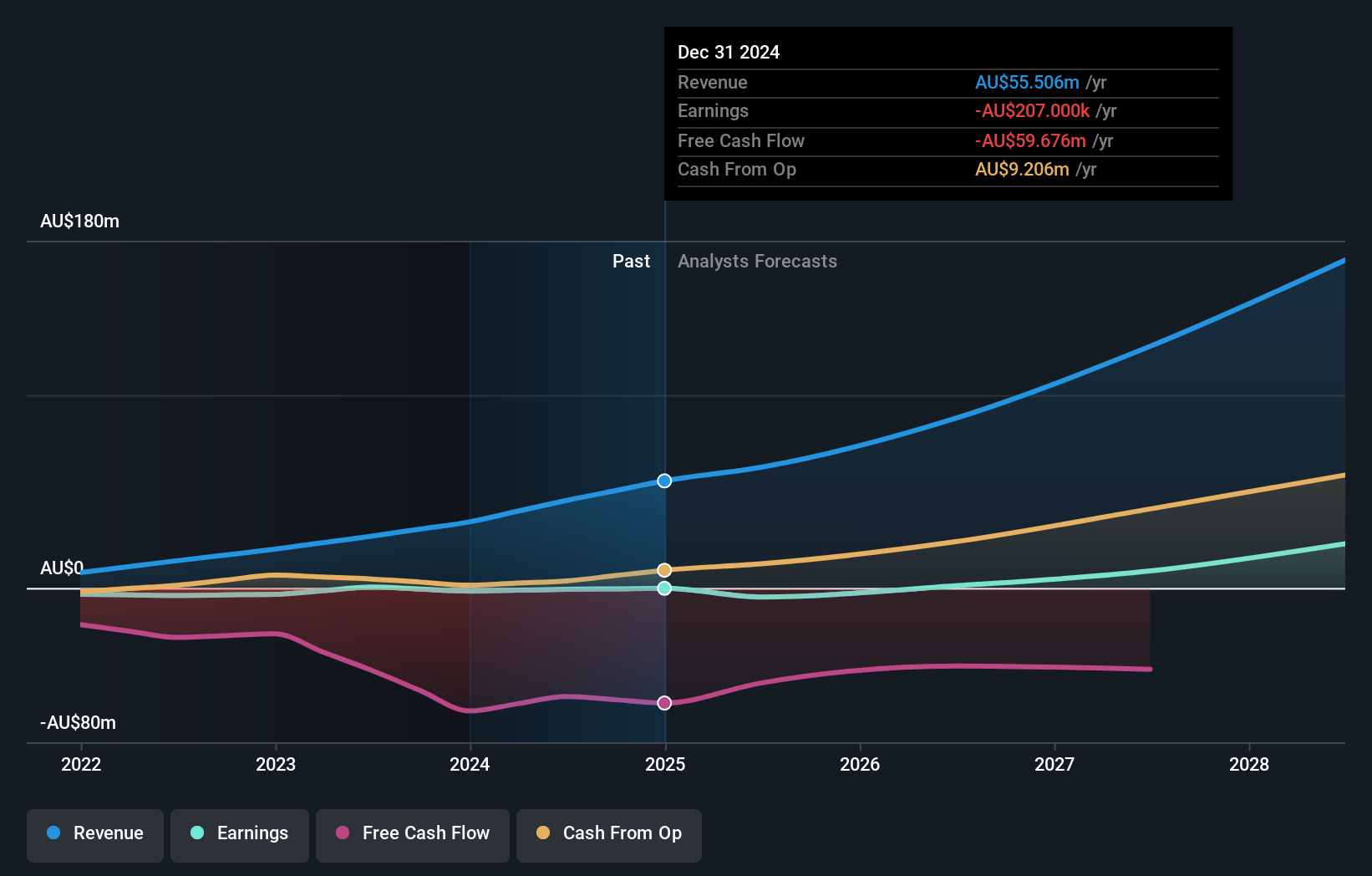

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited develops and supplies mining technologies across Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of A$892.21 million.

Operations: The company generates revenue from its mining services segment, which accounted for A$66.11 million.

Insider Ownership: 15%

Earnings Growth Forecast: 65% p.a.

Chrysos Corporation is positioned for growth, with revenue expected to increase by 22.6% annually, surpassing the market's 6%. Earnings are projected to grow at a robust 65.01% per year, with profitability anticipated within three years. Despite significant insider selling recently, strategic appointments like Ms. Elisha Civil as Non-Executive Director enhance governance and financial oversight as Chrysos expands globally with its PhotonAssay technology. However, the company faces challenges such as low forecasted return on equity of 7.6%.

- Click here to discover the nuances of Chrysos with our detailed analytical future growth report.

- Our valuation report here indicates Chrysos may be overvalued.

Turning Ideas Into Actions

- Click here to access our complete index of 109 Fast Growing ASX Companies With High Insider Ownership.

- Curious About Other Options? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AEF

Australian Ethical Investment

Australian Ethical Investment Ltd is a publicly owned investment manager.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026