- Australia

- /

- Hospitality

- /

- ASX:WEB

Webjet (ASX:WEB) Valuation: Assessing Upside as Incentives and B2B Growth Drive Post-Demerger Momentum

Reviewed by Kshitija Bhandaru

Web Travel Group (ASX:WEB) has moved forward with an employee incentive scheme by issuing over 2.7 million performance rights as part of its ongoing strategy to retain talent and support growth following its recent demerger.

See our latest analysis for Web Travel Group.

Web Travel Group’s recent momentum is catching notice, with a 9.6% boost in 7-day share price return and a resilient 1-month gain. At the same time, the 1-year total shareholder return is still down sharply at -36.6%. The recent employee incentives and B2B focus may be shifting sentiment in its favor, signaling potential for a turnaround ahead.

If you’re watching for companies with strong growth stories taking shape, now’s the time to broaden your view and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets and strong growth in earnings and revenue, investors are left debating whether the market is overlooking future upside or if expectations are already fully reflected in the price.

Most Popular Narrative: 26.2% Undervalued

With Web Travel Group’s fair value estimate standing well above its current share price, the case for a re-rating is gaining traction. The gap between market skepticism and narrative optimism is significant, setting the stage for potential big moves ahead.

The long-term strategy to reach $10 billion in TTV by 2030 through market expansion, improved conversion rates, and geographic and customer mix diversification is expected to deliver sustained revenue and earnings growth over time, supporting operational stability and potentially higher margins.

What fuels this ambitious price target? The secret is not just headline revenue; it centers on bold projections for margin expansion, a shrinking share count, and a profit leap that challenges the market’s current view. Discover what numbers really power this bullish forecast. Are analysts too optimistic, or could the narrative win the day?

Result: Fair Value of $6.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising corporate expenses and efficiency concerns after the demerger could challenge margin expansion. This introduces uncertainty to the bullish turnaround story.

Find out about the key risks to this Web Travel Group narrative.

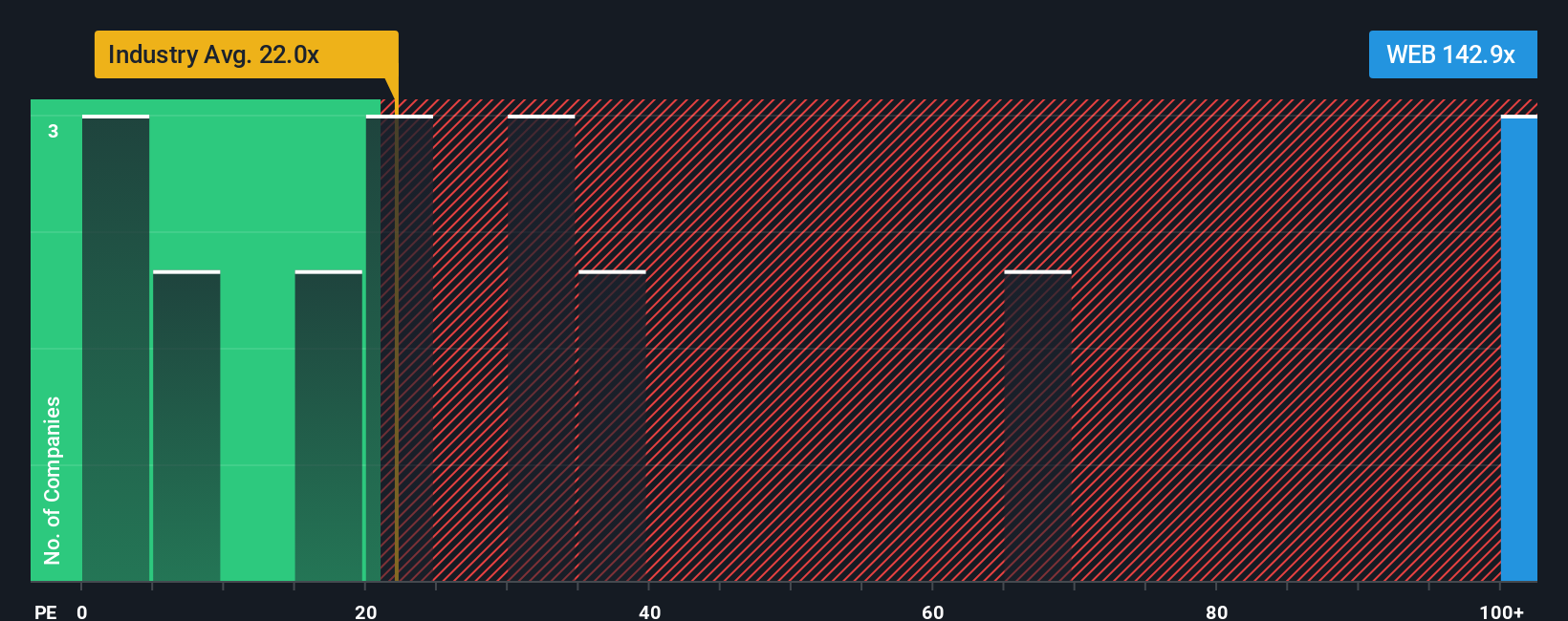

Another View: Gauging Value Through Multiples

Looking from a market multiples perspective, Web Travel Group appears expensive. Its price-to-earnings ratio is much higher than both global industry peers and its fair ratio. This signals that much of its future rebound may already be priced in. Does this set up a valuation risk or a chance for sentiment to shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Web Travel Group Narrative

If you see the numbers differently or want to run your own analysis, you can craft a personalized narrative in just minutes. Do it your way

A great starting point for your Web Travel Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don’t let potential winners pass you by. Use the Simply Wall Street Screener to target standouts you may have overlooked and shape your next big move.

- Tap into the earnings power of companies positioned for robust, cash-based growth by checking out these 898 undervalued stocks based on cash flows. See which stocks are trading well below their future potential.

- Uncover high-yield alternatives that can help boost your portfolio’s income stream with these 19 dividend stocks with yields > 3%, offering stocks yielding over 3% annually.

- Get ahead of market trends by riding the momentum in cutting-edge artificial intelligence sectors. Start with these 24 AI penny stocks to spot early movers in this booming space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Web Travel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WEB

Web Travel Group

Provides online travel booking services in Australia, the United Arab Emirates, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)