It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Lottery (ASX:TLC), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Lottery with the means to add long-term value to shareholders.

Check out our latest analysis for Lottery

Lottery's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. To the delight of shareholders, Lottery's EPS soared from AU$0.12 to AU$0.19, over the last year. That's a fantastic gain of 56%.

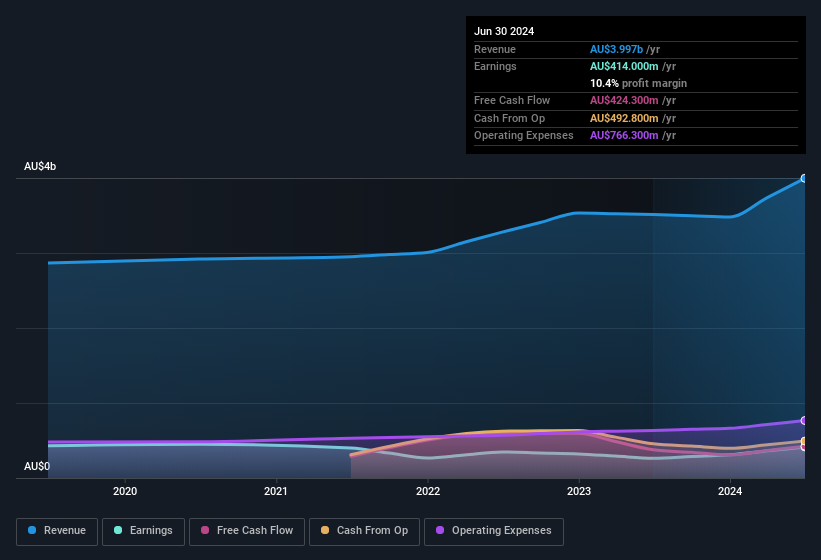

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Lottery achieved similar EBIT margins to last year, revenue grew by a solid 14% to AU$4.0b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Lottery.

Are Lottery Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Lottery insiders spent AU$245k on stock, over the last year; in contrast, we didn't see any selling. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. It is also worth noting that it was Independent Non-Executive Director Anne Brennan who made the biggest single purchase, worth AU$101k, paying AU$4.95 per share.

Along with the insider buying, another encouraging sign for Lottery is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at AU$34m. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.3% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is Lottery Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Lottery's strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. You still need to take note of risks, for example - Lottery has 2 warning signs we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Lottery, you'll probably love this curated collection of companies in AU that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TLC

Lottery

Engages in provision of gaming and entertainment services in Australia.

Proven track record with limited growth.

Market Insights

Community Narratives