- Australia

- /

- Hospitality

- /

- ASX:TAH

3 Undervalued Small Caps On ASX With Insider Buying

Reviewed by Simply Wall St

As the Australian market experiences fluctuations, with the ASX200 closing up 0.66% at 8,402 points amid reactions to potential tariff decisions by Donald Trump, small-cap stocks are navigating a landscape influenced by sector-specific performances such as Financials and Materials leading gains. In this dynamic environment, identifying promising small-cap stocks often involves looking for companies that demonstrate resilience and growth potential amidst broader market sentiment and economic indicators.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Infomedia | 39.6x | 3.6x | 39.48% | ★★★★★★ |

| Collins Foods | 16.9x | 0.6x | 13.28% | ★★★★★☆ |

| Dicker Data | 19.0x | 0.7x | -59.40% | ★★★★☆☆ |

| Centuria Capital Group | 21.5x | 4.8x | 46.91% | ★★★★☆☆ |

| Abacus Group | NA | 5.4x | 25.32% | ★★★★☆☆ |

| Healius | NA | 0.6x | 7.38% | ★★★★☆☆ |

| Corporate Travel Management | 24.6x | 2.9x | 39.23% | ★★★☆☆☆ |

| Abacus Storage King | 10.9x | 6.8x | -20.30% | ★★★☆☆☆ |

| Eureka Group Holdings | 18.9x | 6.1x | 29.08% | ★★★☆☆☆ |

| Tabcorp Holdings | NA | 0.6x | -3.77% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Amotiv (ASX:AOV)

Simply Wall St Value Rating: ★★★★★★

Overview: Amotiv specializes in the production and distribution of automotive components, including powertrain and undercar systems, lighting power and electrical solutions, as well as 4WD accessories and trailering products, with a market capitalization of A$1.45 billion.

Operations: Amotiv generates revenue primarily from its Powertrain & Undercar, Lighting Power & Electrical, and 4WD Accessories & Trailering segments. The company experienced fluctuations in its net income margin, with a notable increase to 10.22% as of June 2023. Operating expenses have varied over time, impacting the company's net income results across different periods.

PE: 14.8x

Amotiv, a smaller player in the Australian market, is drawing attention with its planned share repurchase program targeting up to 7 million shares by October 2025. This move could indicate management's confidence in its stock value. Despite relying entirely on external borrowing for funding, which carries higher risk, Amotiv forecasts an annual earnings growth of 8.26%. Such dynamics suggest potential upside if growth projections materialize while managing financial risks effectively.

- Click here to discover the nuances of Amotiv with our detailed analytical valuation report.

Gain insights into Amotiv's past trends and performance with our Past report.

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dicker Data is a distributor specializing in computer peripherals, with operations focused on wholesale distribution, and it has a market capitalization of A$2.15 billion.

Operations: The company generates revenue primarily from wholesale computer peripherals, with the latest reported revenue at A$2.24 billion. Over recent periods, there has been an upward trend in gross profit margin, reaching 14.54%. Operating expenses and non-operating expenses are significant cost components, with general and administrative expenses consistently contributing to overall costs.

PE: 19.0x

Dicker Data, a notable player in the Australian tech distribution sector, has caught attention due to insider confidence with recent share purchases. Despite its small size, it faces challenges as its debt isn't well covered by operating cash flow and relies solely on external borrowing. However, earnings are projected to grow at 9.75% annually. Additionally, the company affirmed a fully franked dividend of A$0.11 for Q3 2024, indicating steady shareholder returns amidst financial hurdles.

- Delve into the full analysis valuation report here for a deeper understanding of Dicker Data.

Assess Dicker Data's past performance with our detailed historical performance reports.

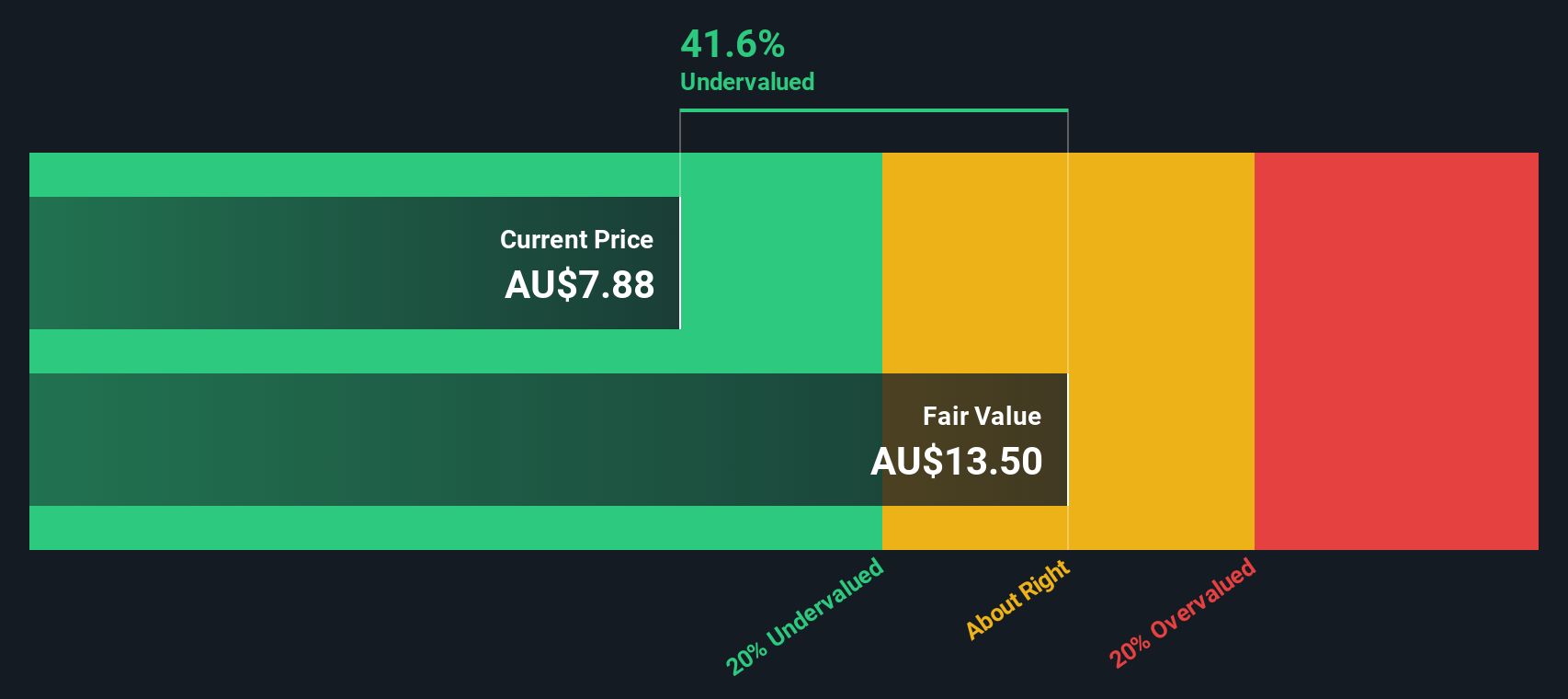

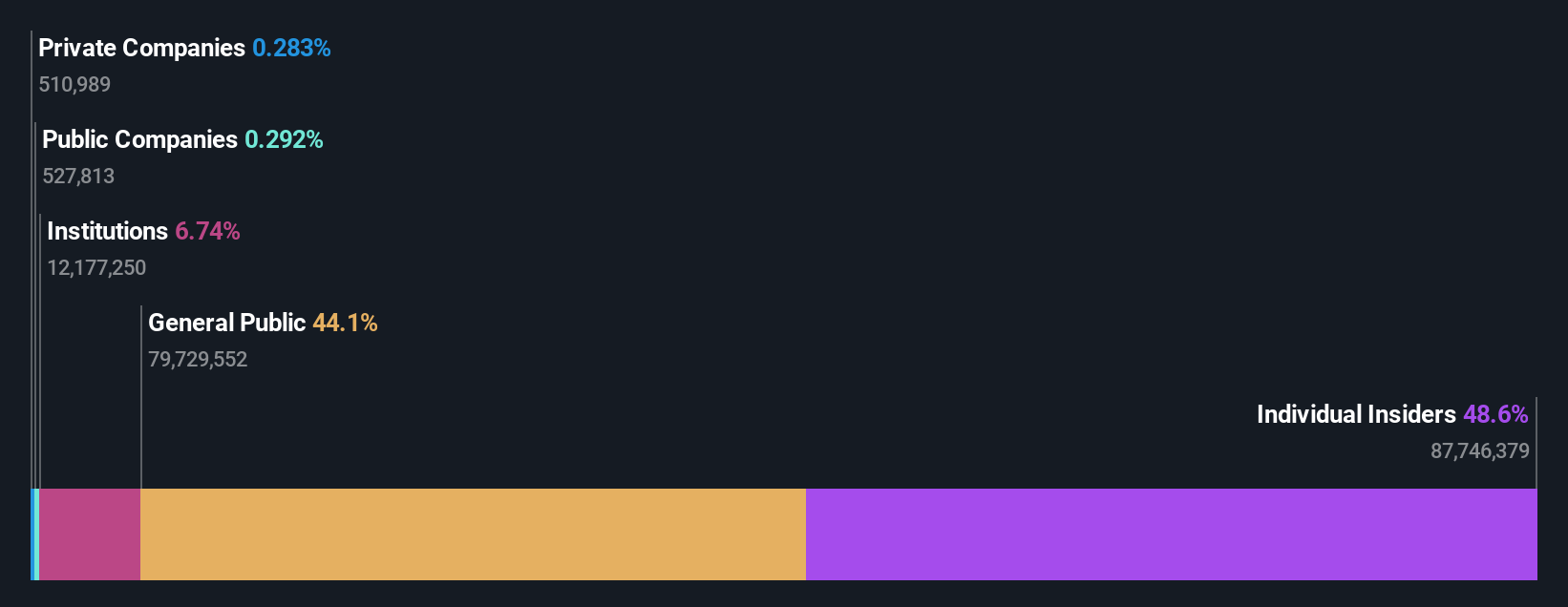

Tabcorp Holdings (ASX:TAH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Tabcorp Holdings is an Australian company primarily engaged in gaming services and wagering and media operations, with a market cap of A$4.90 billion.

Operations: The company's primary revenue stream is from the Wagering and Media segment, contributing A$2.16 billion, with a smaller portion from Gaming Services at A$176.1 million. Operating expenses are significant, including sales and marketing costs of over A$1.15 billion in recent periods. The gross profit margin consistently stands at 100%, indicating that cost of goods sold is negligible or not reported separately for these periods.

PE: -1.1x

Tabcorp Holdings, a smaller Australian company, recently saw insider confidence with their CEO purchasing 200,000 shares for A$136K in early January 2025. This move suggests optimism about the company's future prospects. The appointment of Michael Fitzsimons as Chief Wagering Officer aims to enhance strategic growth through his extensive global experience in sports betting. Despite relying solely on external borrowing for funding and having less than a year of cash runway, earnings are projected to grow significantly by over 100% annually.

- Click here and access our complete valuation analysis report to understand the dynamics of Tabcorp Holdings.

Evaluate Tabcorp Holdings' historical performance by accessing our past performance report.

Key Takeaways

- Get an in-depth perspective on all 22 Undervalued ASX Small Caps With Insider Buying by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tabcorp Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TAH

Tabcorp Holdings

Provides gambling and entertainment services in Australia.

Fair value with moderate growth potential.