- Australia

- /

- Consumer Services

- /

- ASX:NXD

The Price Is Right For NextEd Group Limited (ASX:NXD) Even After Diving 32%

The NextEd Group Limited (ASX:NXD) share price has softened a substantial 32% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 75%, which is great even in a bull market.

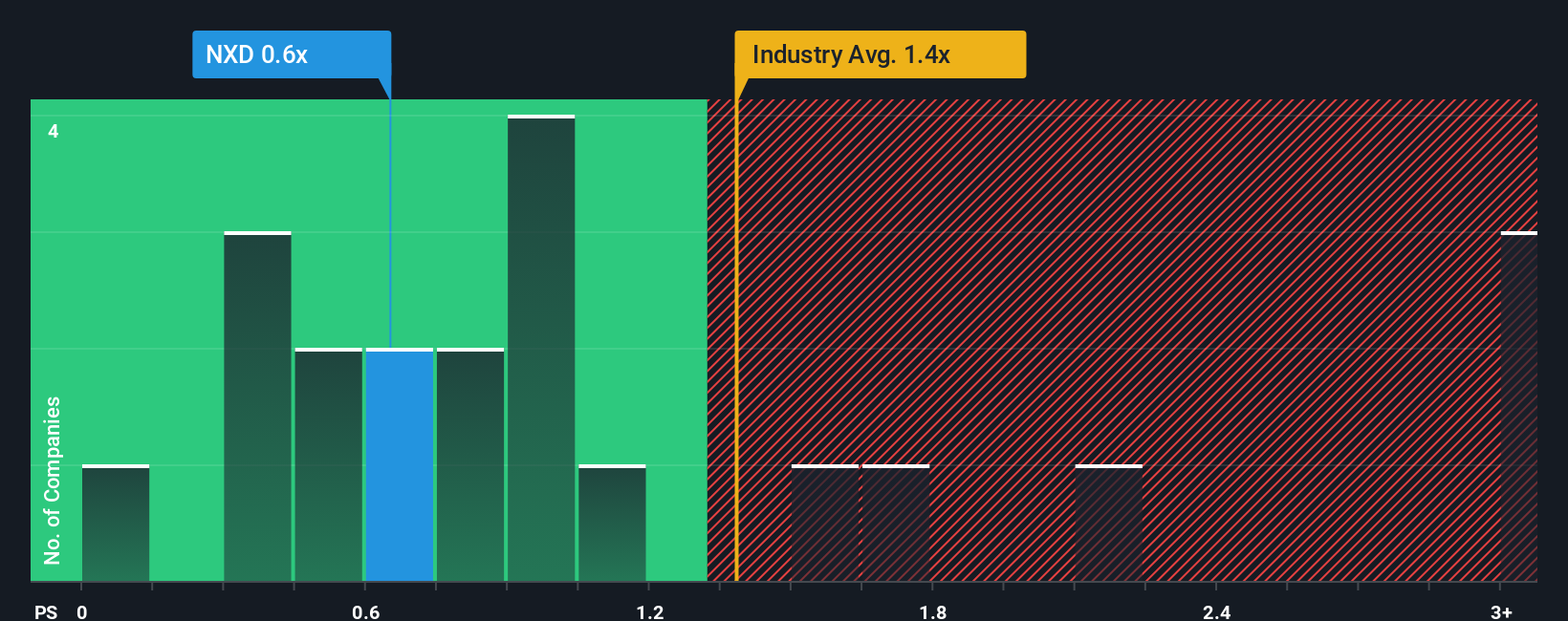

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about NextEd Group's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Consumer Services industry in Australia is also close to 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for NextEd Group

What Does NextEd Group's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, NextEd Group's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think NextEd Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is NextEd Group's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like NextEd Group's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. Even so, admirably revenue has lifted 105% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 6.5% per year during the coming three years according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 6.1% per year, which is not materially different.

With this in mind, it makes sense that NextEd Group's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

With its share price dropping off a cliff, the P/S for NextEd Group looks to be in line with the rest of the Consumer Services industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A NextEd Group's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Consumer Services industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

You should always think about risks. Case in point, we've spotted 2 warning signs for NextEd Group you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NextEd Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NXD

NextEd Group

Provides educational services in Australia, Europe, and South America.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)