- Australia

- /

- Consumer Services

- /

- ASX:NDO

This Insider Has Just Gave Away Shares In Nido Education, But For A Good Reason!

We wouldn't blame Nido Education Limited ( ASX:NDO ) shareholders if they were a little curious about the fact that Mathew Edwards, the Founder, recently transferred about AU$4.1m worth of shares at an average price of AU$0.89 from his holdings. However, it's crucial to note that they remain very much invested in the stock, and that disposition only reduced their holding by 3.8%.

View our latest analysis for Nido Education

The Last 12 Months Of Insider Transactions At Nido Education

In fact, the recent transfer of shares by Mathew Edwards wasn't really a transaction of Nido Education shares at all! Rather, it was a gift to Mamakai Foundation, a charitable organisation that provides support programs to children and young people impacted by domestic and family violence. The equity Mamakai received in Nido is expected to support their support services by generating a steady revenue stream through annual dividends.

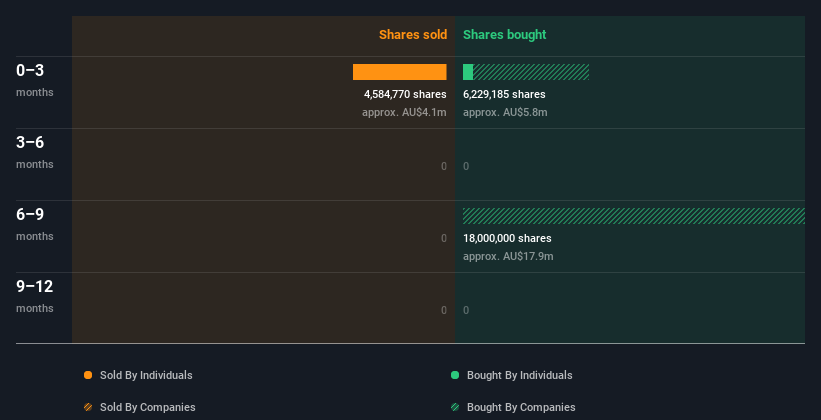

You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Nido Education insiders own about AU$109m worth of shares (which is 54% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At Nido Education Tell Us?

With the understanding that the only recent disposition of shares by insiders was actually a charitable gift, shareholders will be pleased to know there has been many more share acquisitions by insiders at Nido Education and institutional investors. It is also good to see high insider ownership, as it helps ensure the management have a high degree of alignment with shareholders. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. To assist with this, we've discovered 1 warning sign that you should run your eye over to get a better picture of Nido Education.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Nido Education might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NDO

Nido Education

Owns, operates, and manages long day early childhood education and care centers under the Nido Early School brand name in Australia.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives