- Australia

- /

- Consumer Services

- /

- ASX:MFD

We Think Mayfield Childcare (ASX:MFD) Can Stay On Top Of Its Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Mayfield Childcare Limited (ASX:MFD) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Mayfield Childcare

How Much Debt Does Mayfield Childcare Carry?

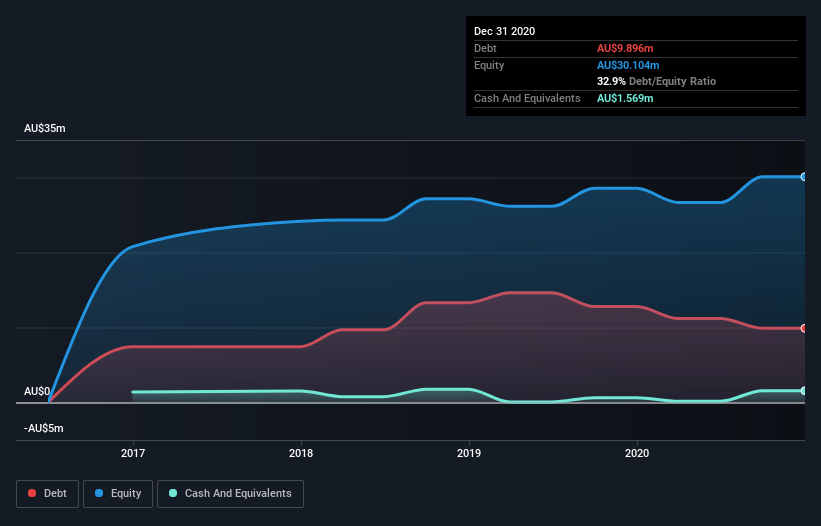

As you can see below, Mayfield Childcare had AU$9.90m of debt at December 2020, down from AU$12.8m a year prior. However, because it has a cash reserve of AU$1.57m, its net debt is less, at about AU$8.33m.

A Look At Mayfield Childcare's Liabilities

The latest balance sheet data shows that Mayfield Childcare had liabilities of AU$9.74m due within a year, and liabilities of AU$31.6m falling due after that. Offsetting this, it had AU$1.57m in cash and AU$1.03m in receivables that were due within 12 months. So it has liabilities totalling AU$38.7m more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's AU$33.9m market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Mayfield Childcare's low debt to EBITDA ratio of 1.2 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 5.1 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Mayfield Childcare grew its EBIT by 9.7% in the last year. Whilst that hardly knocks our socks off it is a positive when it comes to debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Mayfield Childcare can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Mayfield Childcare recorded free cash flow worth a fulsome 96% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

On our analysis Mayfield Childcare's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. In particular, level of total liabilities gives us cold feet. When we consider all the factors mentioned above, we do feel a bit cautious about Mayfield Childcare's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 1 warning sign with Mayfield Childcare , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Mayfield Childcare, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MFD

Mayfield Childcare

Owns and operates long day care centers in Victoria, Queensland, and South Australia.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives