- Australia

- /

- Consumer Services

- /

- ASX:IEL

If EPS Growth Is Important To You, IDP Education (ASX:IEL) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like IDP Education (ASX:IEL), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for IDP Education

How Quickly Is IDP Education Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. IDP Education managed to grow EPS by 13% per year, over three years. That's a good rate of growth, if it can be sustained.

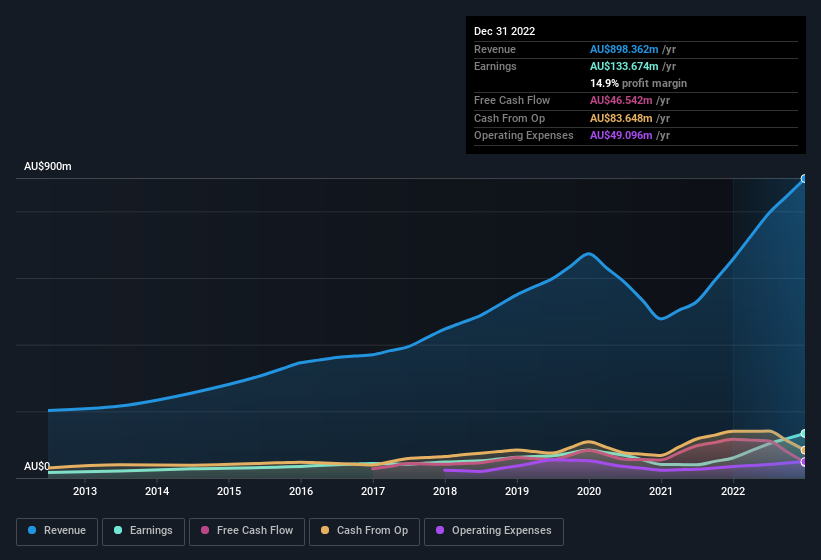

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. IDP Education shareholders can take confidence from the fact that EBIT margins are up from 14% to 23%, and revenue is growing. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for IDP Education's future EPS 100% free.

Are IDP Education Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's nice to see that there have been no reports of any insiders selling shares in IDP Education in the previous 12 months. So it's definitely nice that Non-Executive Director Michelle Tredenick bought AU$66k worth of shares at an average price of around AU$26.46. It seems that at least one insider is prepared to show the market there is potential within IDP Education.

Should You Add IDP Education To Your Watchlist?

As previously touched on, IDP Education is a growing business, which is encouraging. While some companies are struggling to grow EPS, IDP Education seems free from that morose affliction. The cherry on top is that we have an insider buying shares. A further encouragement to keep an eye on this stock. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of IDP Education.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of IDP Education, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:IEL

IDP Education

Engages in the placement of students into education institutions in Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives