- Australia

- /

- Consumer Services

- /

- ASX:IEL

Can IDP Education’s (ASX:IEL) Index Shift Reveal a Turning Point for Its Growth Strategy?

Reviewed by Sasha Jovanovic

- In recent weeks, IDP Education Limited (ASX:IEL) was dropped from the FTSE All-World Index but added to the S&P/ASX Small Ordinaries Index, coinciding with a broker upgrade and the company's announcement of a multi-year operational transformation focused on cost reductions and technology adoption.

- This combination of index changes and operational overhaul highlights industry headwinds and the company's response to shifting market dynamics and investor expectations.

- We'll explore how IDP Education's operational transformation plan may influence its growth outlook and investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

IDP Education Investment Narrative Recap

To be a shareholder of IDP Education today, you need to believe in its ability to adapt to persistent sector headwinds and capture future growth as student mobility recovers. The recent removal from the FTSE All-World Index and addition to the S&P/ASX Small Ordinaries Index reflect shifts in market sentiment but do not materially change the biggest short-term catalyst, execution of the operational transformation plan, or the ongoing risk of declining international student volumes and regulatory disruption.

The most relevant recent announcement is IDP’s multi-year operational transformation, aiming for A$25 million in cost reductions by FY26, with a particular focus on technology adoption and digital platforms. This initiative is designed to reset the cost base and improve productivity, which directly addresses investor concerns about pressured margins and muted enrolments as industry conditions remain uncertain.

On the other hand, investors should be aware of the potential for sudden changes to migration and policy settings in key destination markets, as even...

Read the full narrative on IDP Education (it's free!)

IDP Education's narrative projects A$1.0 billion revenue and A$112.5 million earnings by 2028. This requires 4.7% yearly revenue growth and a A$68 million increase in earnings from A$44.5 million currently.

Uncover how IDP Education's forecasts yield a A$7.22 fair value, a 11% upside to its current price.

Exploring Other Perspectives

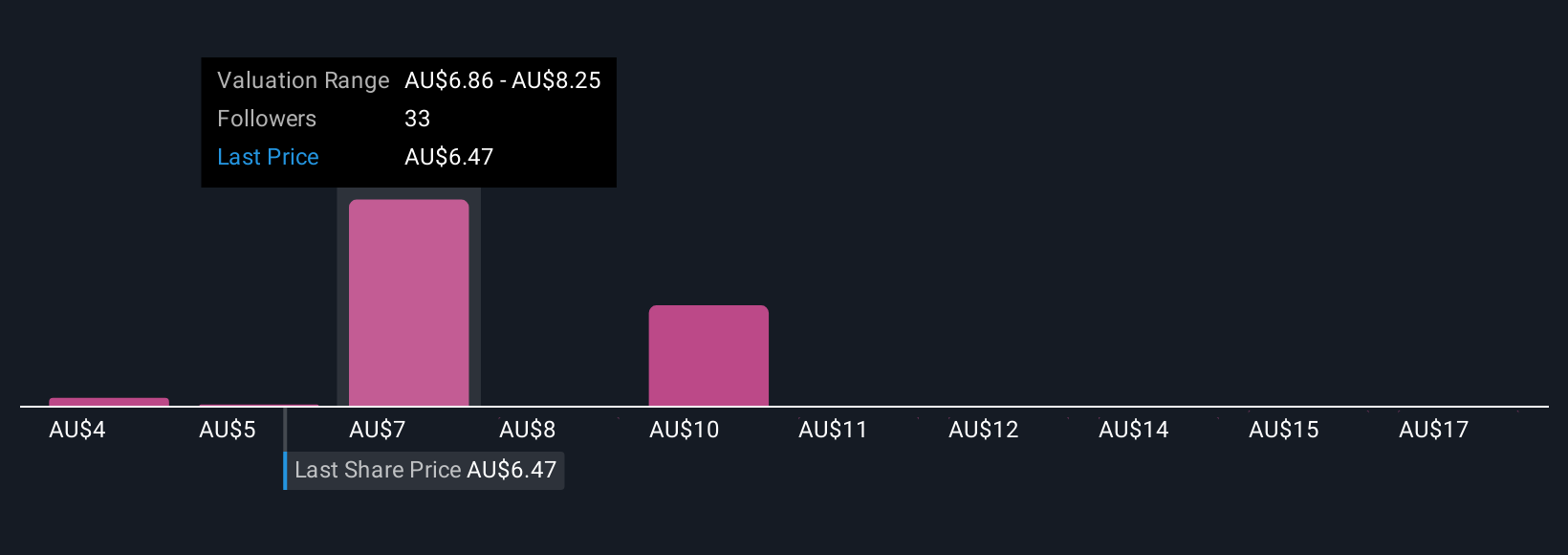

Private investor fair value estimates for IDP Education from the Simply Wall St Community range from A$4.07 to A$18 per share across 12 perspectives. With student volumes under pressure, it’s clear market participants hold very different views on how regulatory risks may influence future performance.

Explore 12 other fair value estimates on IDP Education - why the stock might be worth 38% less than the current price!

Build Your Own IDP Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IDP Education research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free IDP Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IDP Education's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IEL

IDP Education

Engages in the placement of students into education institutions in Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026