Last Update 01 Dec 25

Fair value Increased 0.0013%IEL: Index Changes and Outlook Will Drive Renewed Market Confidence

Analysts have slightly raised their price target for IDP Education to $7.64 from $7.64, citing minor improvements in projected revenue growth and a modest decrease in the discount rate.

What's in the News

- IDP Education Limited (ASX:IEL) was removed from the FTSE All-World Index (USD) (Key Developments)

- IDP Education Limited (ASX:IEL) was included in the S&P/ASX Small Ordinaries Index (Key Developments)

- IDP Education Limited (ASX:IEL) was removed from the S&P/ASX 100 Index (Key Developments)

Valuation Changes

- Consensus Analyst Price Target: increased marginally from A$7.64 to A$7.64

- Discount Rate: declined slightly from 7.20% to 7.18%

- Revenue Growth: edged up slightly from 4.95% to 4.95%

- Net Profit Margin: remained nearly unchanged, moving from 11.11% to 11.11%

- Future P/E: decreased just slightly from 23.10x to 23.09x

Key Takeaways

- Strategic expansion in emerging markets and focus on product innovation offer potential for long-term revenue and earnings growth.

- Investments in technology and operational efficiencies may enhance net margins, while disciplined cost management supports strong financial performance despite challenges.

- IDP's revenue and growth are threatened by regulatory changes, international student volume declines, and increased competition in English language testing markets.

Catalysts

About IDP Education- Engages in the placement of students into education institutions in Australia, the United Kingdom, the United States, Canada, New Zealand, and Ireland.

- IDP Education's strategic expansion into high-growth markets like India, Pakistan, and China positions the company to capture increased student placement revenues in emerging regions, bolstering future revenue streams.

- Investments in product innovation, such as the development of FastLane and enhanced IELTS offerings, are geared towards improving customer experience and driving higher conversion rates, which should positively impact revenue and earnings growth.

- IDP's focus on market share expansion in the student placement business, especially in key markets like the U.S. and Canada, creates potential for revenue growth despite industry cyclicality.

- The company's strategic investments in digital and technological enhancements, particularly for IELTS and Student Essentials, aim to improve operational efficiencies and could result in higher net margins over time.

- Despite near-term challenges, IDP’s disciplined cost management and focus on long-term strategic investment could lead to enhanced earnings growth, supported by a strong balance sheet and flexible capital for future opportunities.

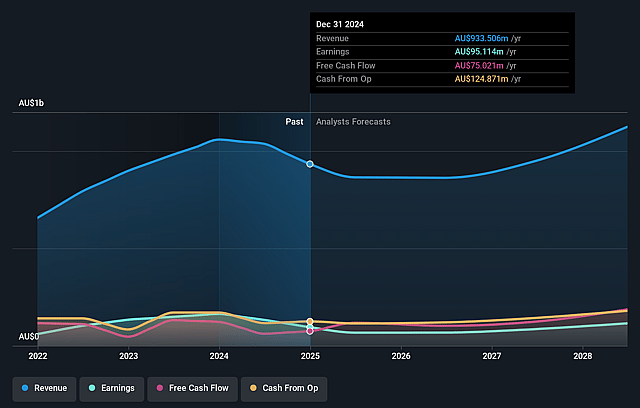

IDP Education Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming IDP Education's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.0% today to 11.1% in 3 years time.

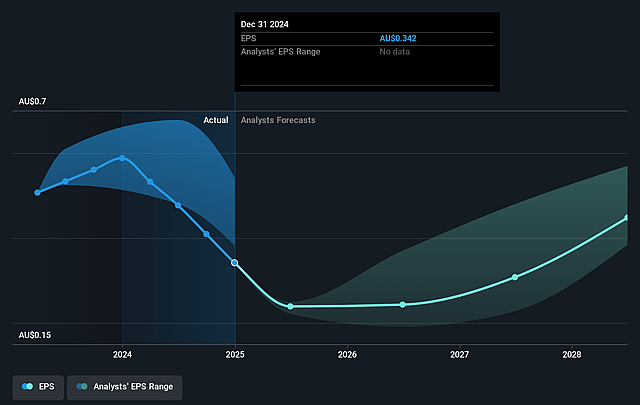

- Analysts expect earnings to reach A$112.5 million (and earnings per share of A$0.4) by about September 2028, up from A$44.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$136.7 million in earnings, and the most bearish expecting A$86.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.9x on those 2028 earnings, down from 35.8x today. This future PE is greater than the current PE for the AU Consumer Services industry at 15.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.13%, as per the Simply Wall St company report.

IDP Education Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- IDP faces a decline in IELTS volumes, particularly due to weak market conditions in India and regulatory uncertainties in destination markets, which could impact overall revenue from English language testing.

- Regulatory and immigration policy changes in key markets such as Australia and Canada introduce cyclical uncertainty, potentially leading to decreased international student volumes, impacting student placement revenues.

- The assumption of a 20%-25% decline in international student volumes for FY '25 suggests significant pressure on IDP’s revenues and earnings as the market adjusts to policy settings.

- The high dependency on international migration policies and educational ecosystems in large destination countries like Australia, the U.K., and Canada creates vulnerability to sudden policy changes, affecting revenue consistency and growth projections.

- Increased competition in the IELTS testing market, especially with the opening of the Canadian market to additional tests, could erode market share and pressure profit margins in this segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$7.215 for IDP Education based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$16.0, and the most bearish reporting a price target of just A$4.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$1.0 billion, earnings will come to A$112.5 million, and it would be trading on a PE ratio of 21.9x, assuming you use a discount rate of 7.1%.

- Given the current share price of A$5.73, the analyst price target of A$7.22 is 20.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.