- Australia

- /

- Hospitality

- /

- ASX:FLT

High Insider Ownership ASX Growth Companies To Watch In June 2024

Reviewed by Simply Wall St

As the Australian market navigates through a diverse range of sector performances and economic signals, with the ASX200 showing resilience in its upward movement, investors continue to seek solid opportunities amidst these fluctuations. High insider ownership can be a reassuring signal for potential stability and growth in companies, particularly valuable in current market conditions where strategic insights from insiders could steer companies effectively through uncertain economic waters.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Change Financial (ASX:CCA) | 26.6% | 76.4% |

| Biome Australia (ASX:BIO) | 34.9% | 114.4% |

| Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

| Liontown Resources (ASX:LTR) | 16.4% | 62.3% |

| Argosy Minerals (ASX:AGY) | 14.5% | 129.6% |

We'll examine a selection from our screener results.

Botanix Pharmaceuticals (ASX:BOT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Botanix Pharmaceuticals Limited, based in Australia, focuses on the research and development of dermatology and antimicrobial products with a market capitalization of A$574.93 million.

Operations: The company generates revenue primarily through its research and development activities in dermatology and antimicrobial products, totaling A$0.44 million.

Insider Ownership: 11.4%

Botanix Pharmaceuticals, with its expected annual revenue growth of 120.4%, is poised to outpace the Australian market significantly. Despite making less than A$1 million in revenue, the company's earnings are projected to grow by 120.89% annually. Recently, Botanix filed for a follow-on equity offering of A$70 million to support its commercial launch plans for SofdraÔ as it nears approval. However, shareholders have experienced dilution over the past year, and the firm has less than one year of cash runway remaining.

- Click here to discover the nuances of Botanix Pharmaceuticals with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Botanix Pharmaceuticals shares in the market.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across various regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia, with a market capitalization of approximately A$4.41 billion.

Operations: The company generates revenue primarily through its leisure and corporate travel services, with the leisure segment bringing in A$1.28 billion and the corporate segment contributing A$1.06 billion.

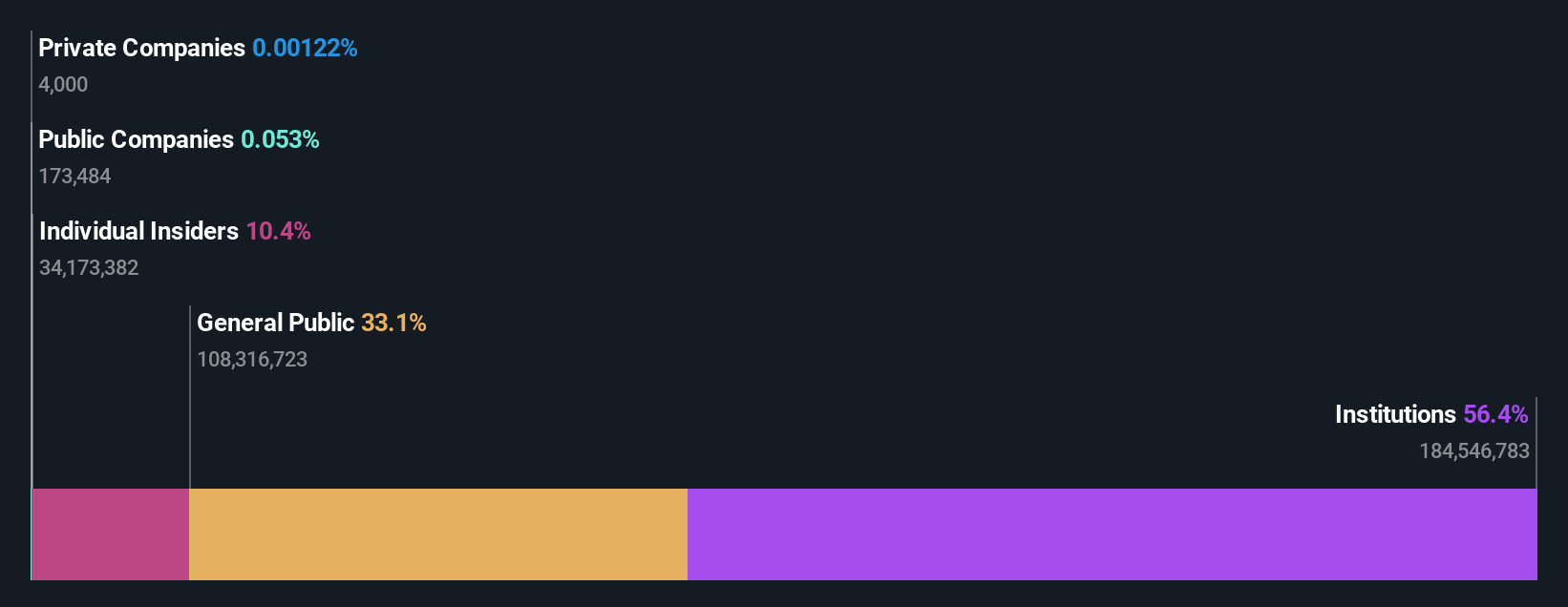

Insider Ownership: 13.3%

Flight Centre Travel Group, trading 19% below its estimated fair value, shows promise with insider ownership aligning interests with shareholders. While its revenue growth at 9.7% per year is modest compared to high-growth benchmarks, it outpaces the Australian market's 5.4%. Impressively, FLT's profit forecasts are robust, expecting an 18.81% annual increase and a strong projected Return on Equity of 21.8%. However, these figures do not reach the high-growth threshold of over 20% annually in earnings typically seen in top growth companies.

- Delve into the full analysis future growth report here for a deeper understanding of Flight Centre Travel Group.

- The analysis detailed in our Flight Centre Travel Group valuation report hints at an deflated share price compared to its estimated value.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is a company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both in Australia and internationally, with a market capitalization of approximately A$6.01 billion.

Operations: The company generates revenue through three primary segments: Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

Insider Ownership: 12.3%

Technology One has demonstrated solid growth with a 13.1% increase in earnings over the past year, and its revenue is expected to grow at 11.1% annually, surpassing the Australian market's average of 5.4%. Although its forecasted earnings growth of 14.3% annually slightly exceeds the market's 13.6%, it doesn't meet the high-growth benchmark of over 20%. The company maintains a strong projected Return on Equity at 32.6%, and its Price-To-Earnings ratio stands favorable at 54.8x compared to the industry average of 60.2x, indicating potential value relative to peers.

- Navigate through the intricacies of Technology One with our comprehensive analyst estimates report here.

- The analysis detailed in our Technology One valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Embark on your investment journey to our 90 Fast Growing ASX Companies With High Insider Ownership selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FLT

Flight Centre Travel Group

Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

Solid track record with excellent balance sheet.