ASX Growth Companies With High Insider Ownership And A Minimum 22% Return On Equity

Reviewed by Simply Wall St

Despite reaching a record high earlier in the week, the ASX200 experienced a downturn, closing down 0.81% to 7971.60 points amid broad sector losses and volatile commodity prices. This backdrop underscores the importance of focusing on growth companies with strong insider ownership and robust return on equity, which can offer resilience and potential for long-term value creation in fluctuating market environments.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Cettire (ASX:CTT) | 28.7% | 26.7% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 13.6% | 26.8% |

| Catalyst Metals (ASX:CYL) | 17.1% | 77.1% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 109.4% |

| Biome Australia (ASX:BIO) | 34.5% | 114.4% |

| Ora Banda Mining (ASX:OBM) | 10.2% | 96.2% |

| Liontown Resources (ASX:LTR) | 16.4% | 49.5% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Change Financial (ASX:CCA) | 26.6% | 76.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across various regions globally, with a market capitalization of A$4.98 billion.

Operations: The company's revenue is primarily generated through its leisure and corporate travel services, contributing A$1.28 billion and A$1.06 billion respectively.

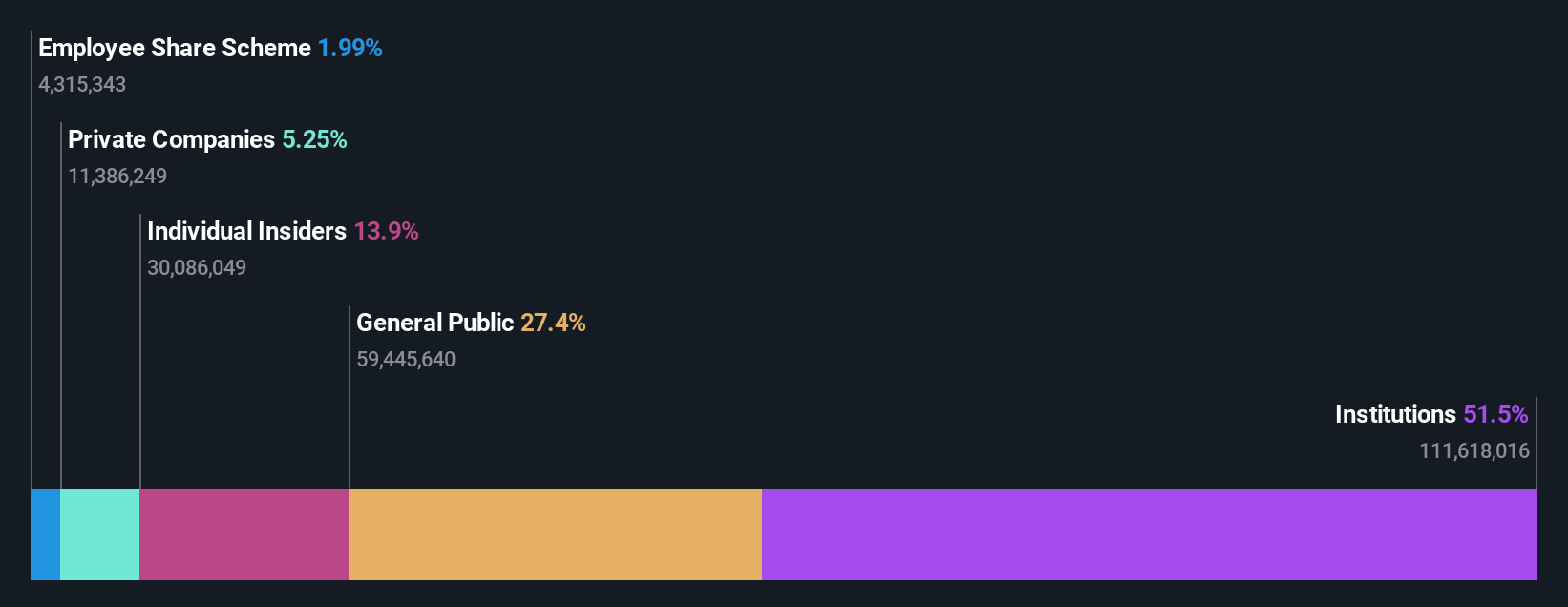

Insider Ownership: 13.3%

Return On Equity Forecast: 22% (2026 estimate)

Flight Centre Travel Group, a growth-oriented company with significant insider ownership, is trading at A$26.6% below its estimated fair value. Recently turning profitable, FLT's revenue and earnings are expected to outpace the Australian market, with revenue growing at 9.7% annually and earnings at 19.07%. Despite this performance, there's no recent insider buying or selling activity. The company’s Return on Equity is also projected to be robust in three years at 22.1%.

- Dive into the specifics of Flight Centre Travel Group here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Flight Centre Travel Group's share price might be too pessimistic.

PWR Holdings (ASX:PWH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PWR Holdings Limited specializes in designing, prototyping, producing, testing, validating, and selling cooling products and solutions across Australia, the US, the UK, Italy, Germany and other international markets with a market capitalization of approximately A$1.23 billion.

Operations: The company's revenue is primarily generated from two segments: PWR C&R, which contributed A$37.35 million, and PWR Performance Products, accounting for A$104.44 million.

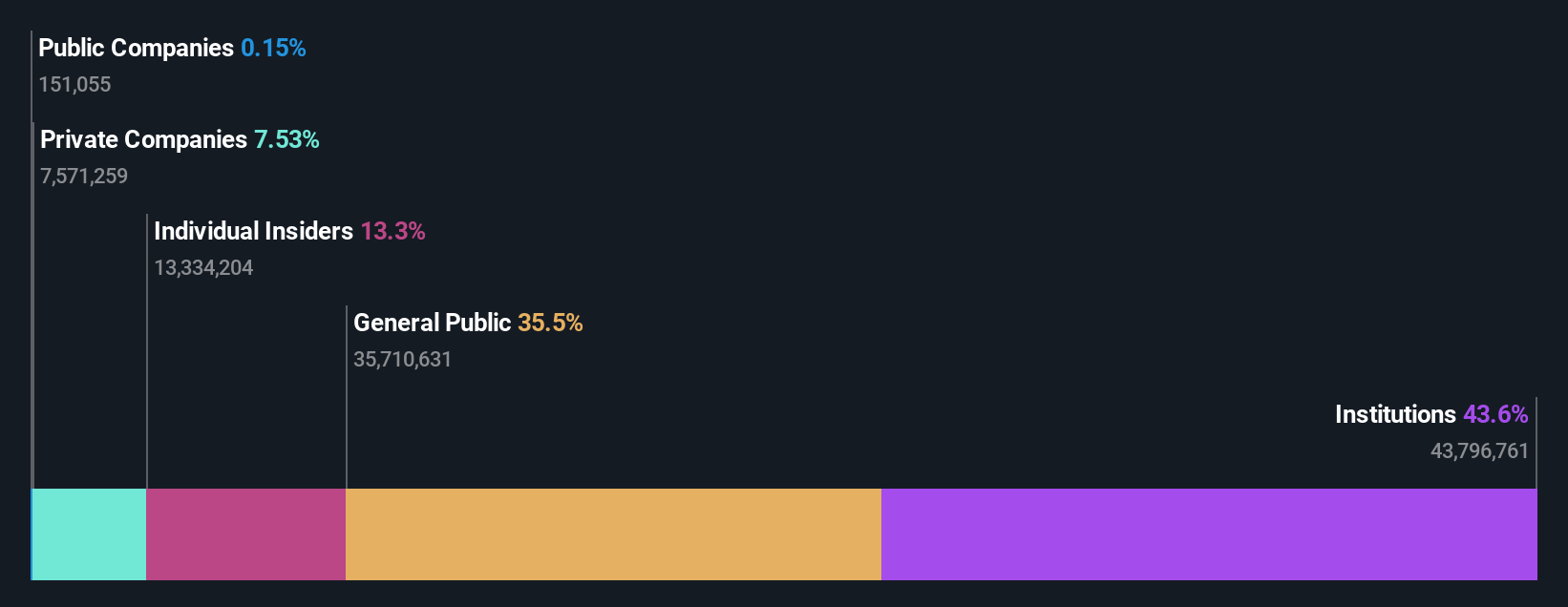

Insider Ownership: 13.4%

Return On Equity Forecast: 31% (2026 estimate)

PWR Holdings, recognized for its growth potential and high insider ownership, is trading at A$12.6% below its estimated fair value. The company's revenue is expected to increase by 12.9% annually, surpassing the Australian market average of 5.6%. Additionally, PWR's earnings are projected to grow by 15.37% per year, outperforming the market's forecast of 13.5%. Insider activity has been balanced with more purchases than sales in recent months, though not in large volumes.

- Click here and access our complete growth analysis report to understand the dynamics of PWR Holdings.

- According our valuation report, there's an indication that PWR Holdings' share price might be on the expensive side.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an enterprise software company that develops, markets, sells, implements, and supports integrated business solutions in Australia and internationally, with a market capitalization of approximately A$6.19 billion.

Operations: The company generates revenue through three primary segments: software (A$317.24 million), corporate (A$83.83 million), and consulting (A$68.13 million).

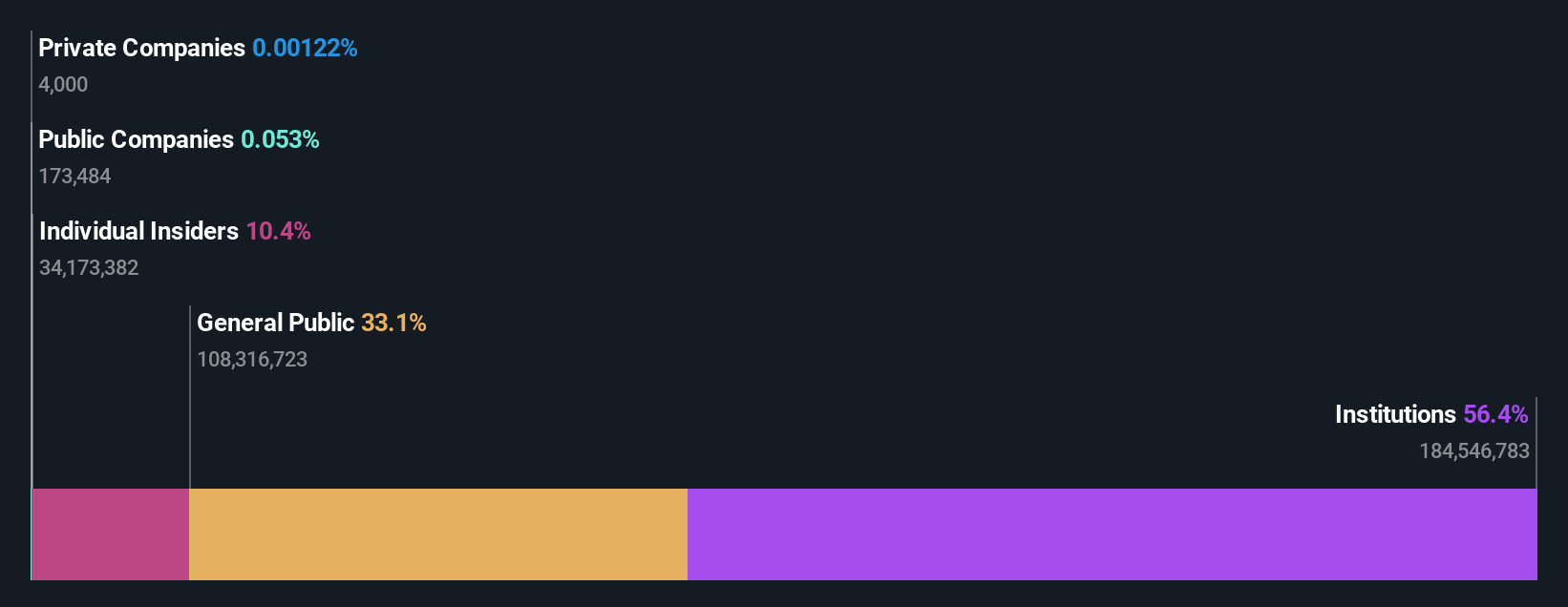

Insider Ownership: 12.3%

Return On Equity Forecast: 33% (2027 estimate)

Technology One, a key player in the software industry, maintains a robust growth trajectory with earnings rising by 13.1% over the past year and revenue forecasted to increase at 11.1% annually, outpacing the Australian market's average of 5.6%. Despite its high Price-To-Earnings ratio of A$56.5x—just below the industry average—the company is expected to see earnings grow by 14.4% per year, again exceeding market norms. The recent appointment of Paul Robson as Non-Executive Director could further enhance strategic initiatives and operational efficiencies.

- Click to explore a detailed breakdown of our findings in Technology One's earnings growth report.

- Our valuation report here indicates Technology One may be overvalued.

Taking Advantage

- Discover the full array of 88 Fast Growing ASX Companies With High Insider Ownership right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Engages in the development, marketing, sale, implementation, and support of integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with reasonable growth potential.