- Australia

- /

- Basic Materials

- /

- ASX:BKW

Brickworks Limited's (ASX:BKW) Popularity With Investors Is Under Threat From Overpricing

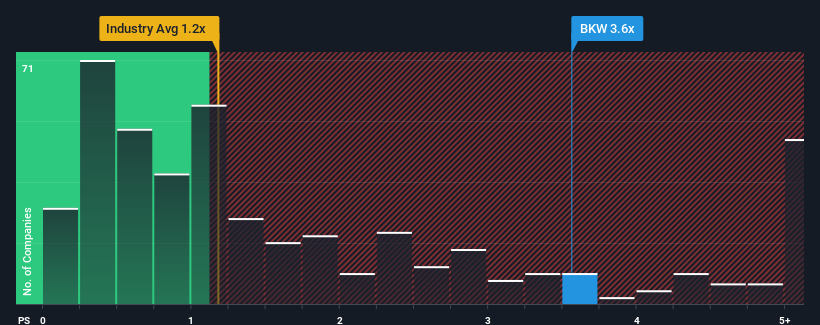

When you see that almost half of the companies in the Basic Materials industry in Australia have price-to-sales ratios (or "P/S") below 1.2x, Brickworks Limited (ASX:BKW) looks to be giving off strong sell signals with its 3.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Brickworks

What Does Brickworks' Recent Performance Look Like?

Brickworks hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Brickworks will help you uncover what's on the horizon.How Is Brickworks' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Brickworks' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.8%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 28% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 3.4% each year during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 3.5% per year, which is not materially different.

With this in consideration, we find it intriguing that Brickworks' P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Brickworks' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Brickworks currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Brickworks with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Brickworks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BKW

Brickworks

Engages in the manufacture, sale, and distribution of building products for the residential and commercial markets in Australia and North America.

Moderate growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives