- Australia

- /

- Hospitality

- /

- ASX:FLT

3 ASX Stocks Estimated To Be Trading Up To 40.9% Below Intrinsic Value

Reviewed by Simply Wall St

The Australian market has shown mixed performance with the ASX 200 closing up slightly at 8,361 points, driven by gains in the IT and Materials sectors, while Utilities lagged significantly. In such a fluctuating environment, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Smart Parking (ASX:SPZ) | A$0.895 | A$1.74 | 48.5% |

| Elders (ASX:ELD) | A$6.16 | A$11.39 | 45.9% |

| Austal (ASX:ASB) | A$5.22 | A$9.12 | 42.8% |

| Charter Hall Group (ASX:CHC) | A$17.81 | A$33.88 | 47.4% |

| Polymetals Resources (ASX:POL) | A$0.825 | A$1.54 | 46.4% |

| SciDev (ASX:SDV) | A$0.365 | A$0.68 | 46% |

| Integral Diagnostics (ASX:IDX) | A$2.41 | A$4.24 | 43.1% |

| Nuix (ASX:NXL) | A$2.41 | A$4.08 | 40.9% |

| PointsBet Holdings (ASX:PBH) | A$1.10 | A$2.07 | 46.7% |

| Superloop (ASX:SLC) | A$2.61 | A$4.48 | 41.7% |

Let's explore several standout options from the results in the screener.

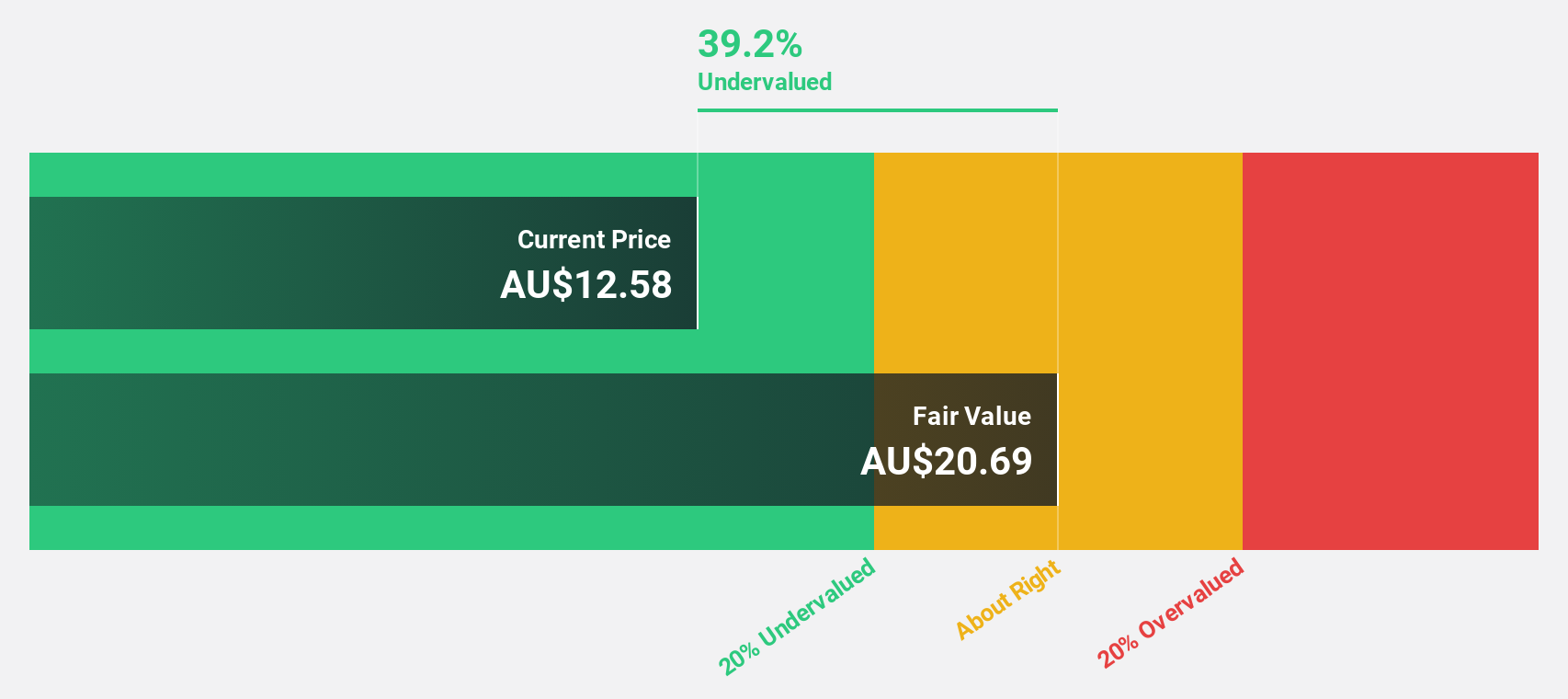

ALS (ASX:ALQ)

Overview: ALS Limited offers professional technical services focused on testing, measurement, and inspection across various regions including Africa, Asia/Pacific, Europe, the Middle East, and the Americas with a market cap of A$8.55 billion.

Operations: The company's revenue is derived from its Commodities segment, generating A$1.08 billion, and its Life Sciences Excluding Nuvisan segment, contributing A$1.63 billion.

Estimated Discount To Fair Value: 28.9%

ALS Limited is trading at A$17.64, significantly below its estimated fair value of A$24.8, making it undervalued based on discounted cash flow analysis. Despite a high level of debt and reduced profit margins (0.2% from 11.1%), ALS's earnings are projected to grow substantially at 24.9% annually, outpacing the Australian market's growth rate of 11.8%. The recent appointment of Catharine Farrow as a Non-Executive Director may enhance strategic governance and innovation efforts.

- Our comprehensive growth report raises the possibility that ALS is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in ALS' balance sheet health report.

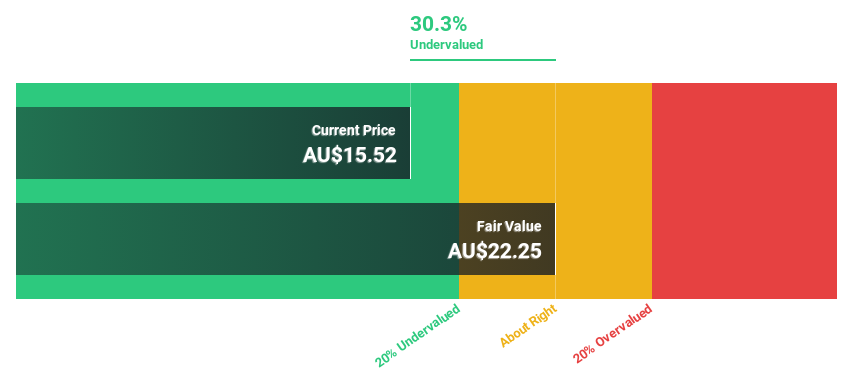

Flight Centre Travel Group (ASX:FLT)

Overview: Flight Centre Travel Group Limited offers travel retailing services for both leisure and corporate sectors across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and other international markets with a market cap of A$2.90 billion.

Operations: The company's revenue is derived from two main segments: Leisure, which accounts for A$1.38 billion, and Corporate, contributing A$1.13 billion.

Estimated Discount To Fair Value: 37.2%

Flight Centre Travel Group is trading at A$13.18, well below its estimated fair value of A$21, highlighting its undervaluation based on discounted cash flow analysis. Despite profit margins declining from 6% to 4.1%, earnings are expected to grow significantly at 23.65% annually, surpassing the Australian market's growth rate of 11.8%. The company has initiated a share buyback program worth A$200 million, funded by cash reserves, which could enhance shareholder value further.

- Our expertly prepared growth report on Flight Centre Travel Group implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Flight Centre Travel Group.

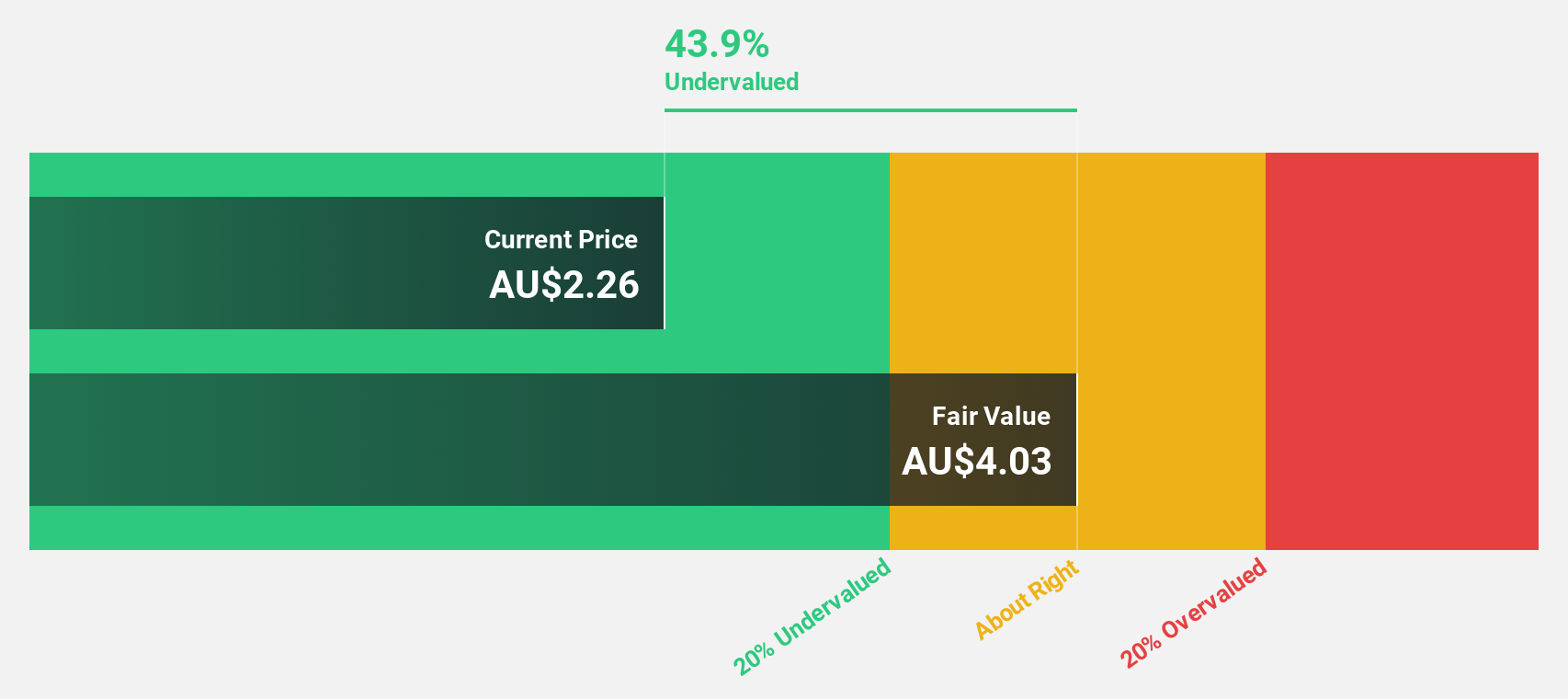

Nuix (ASX:NXL)

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions, including the Asia Pacific, the Americas, Europe, the Middle East, and Africa, with a market cap of A$797.07 million.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated A$227.37 million.

Estimated Discount To Fair Value: 40.9%

Nuix is trading at A$2.41, significantly below its estimated fair value of A$4.08, indicating a strong undervaluation based on discounted cash flow analysis. Its earnings are forecast to grow substantially at 53.98% annually, and the company is expected to become profitable within three years, outperforming average market growth expectations. Recently added to the S&P/ASX 200 Index, Nuix's revenue growth rate of 15.3% per year surpasses the Australian market average of 5.6%.

- Insights from our recent growth report point to a promising forecast for Nuix's business outlook.

- Navigate through the intricacies of Nuix with our comprehensive financial health report here.

Key Takeaways

- Unlock our comprehensive list of 38 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FLT

Flight Centre Travel Group

Provides travel retailing services for the leisure and corporate sectors in Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives