- Australia

- /

- Specialty Stores

- /

- ASX:UNI

3 ASX Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

As the Australian market braces for a potential downturn, with ASX 200 futures indicating a significant decline following Wall Street's recent struggles, investors are keenly watching how local companies navigate these turbulent times. In such an environment, growth stocks with high insider ownership can be particularly appealing, as they often signal confidence from those closest to the company's operations and strategy.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medallion Metals (ASX:MM8) | 13.8% | 67.5% |

| Acrux (ASX:ACR) | 15.5% | 91.8% |

| Emerald Resources (ASX:EMR) | 18.1% | 34.7% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| AVA Risk Group (ASX:AVA) | 15.8% | 77.3% |

| Pointerra (ASX:3DP) | 23.8% | 126.4% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 133.7% |

We're going to check out a few of the best picks from our screener tool.

Flight Centre Travel Group (ASX:FLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited offers travel retailing services for both leisure and corporate sectors across various regions worldwide, with a market cap of A$3.91 billion.

Operations: The company generates revenue through its leisure segment, contributing A$1.35 billion, and its corporate segment, which accounts for A$1.11 billion.

Insider Ownership: 13.5%

Flight Centre Travel Group is positioned for growth with earnings forecasted to increase at 19% annually, outpacing the Australian market. However, revenue growth is expected to be moderate at 7.2% per year. Trading below fair value by 27.4%, it offers potential investment appeal despite an unstable dividend track record. Recent issuance of A$140 million in convertible notes suggests strategic financial maneuvers to support future expansion without significant insider trading activity reported recently.

- Take a closer look at Flight Centre Travel Group's potential here in our earnings growth report.

- Our valuation report unveils the possibility Flight Centre Travel Group's shares may be trading at a discount.

MA Financial Group (ASX:MAF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MA Financial Group Limited, with a market cap of A$1.33 billion, operates in Australia offering a range of financial services through its subsidiaries.

Operations: MA Financial Group Limited generates revenue through its subsidiaries by providing a variety of financial services within Australia.

Insider Ownership: 28.5%

MA Financial Group is poised for significant earnings growth, with forecasts indicating a 28.33% annual increase, surpassing the Australian market's average. Despite expected revenue declines of 27.8% annually over three years, recent net income rose to A$41.79 million from A$28.52 million year-on-year, reflecting robust financial performance. The launch of MA Credit Income Trust and MA Specialty Credit Income Fund highlights strategic expansion into private credit markets, though insider trading activity remains minimal in recent months.

- Click here and access our complete growth analysis report to understand the dynamics of MA Financial Group.

- The valuation report we've compiled suggests that MA Financial Group's current price could be inflated.

Universal Store Holdings (ASX:UNI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Universal Store Holdings Limited is an Australian company that designs, wholesales, and retails fashion products for men and women, with a market cap of A$703.53 million.

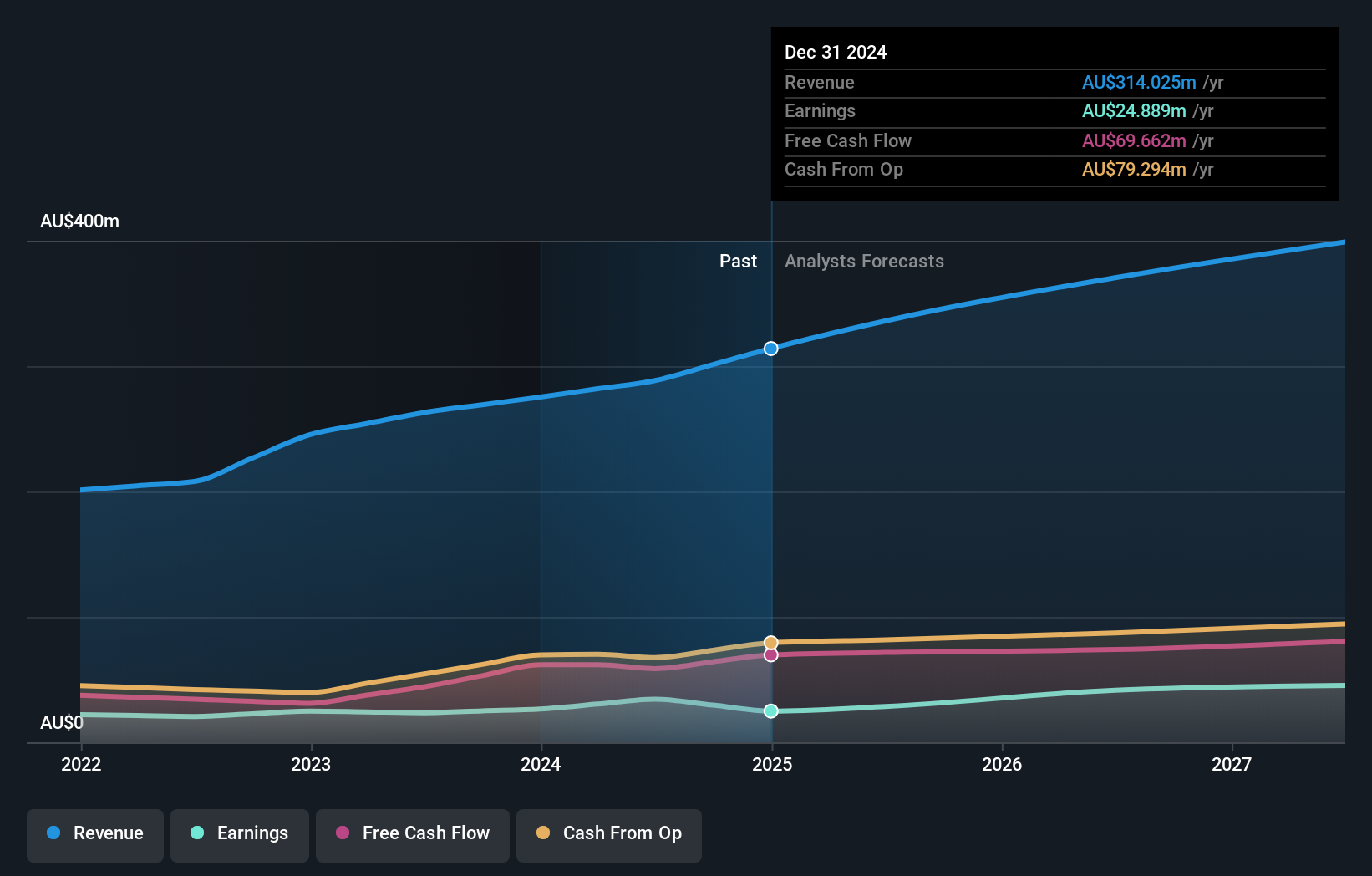

Operations: The company generates revenue through its segments, with Universal Store contributing A$287.13 million and CTC adding A$41.29 million.

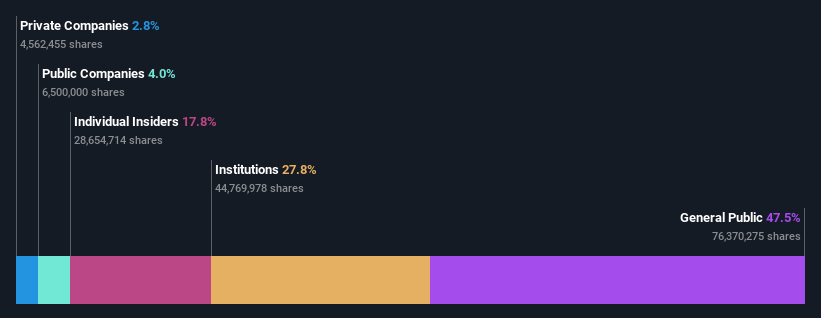

Insider Ownership: 14.7%

Universal Store Holdings demonstrates potential for growth, with forecasted annual earnings growth of 19%, outpacing the Australian market. Recent earnings results showed a decline in net income to A$11.29 million from A$20.74 million year-on-year, impacting basic EPS from continuing operations to A$0.148. Despite trading significantly below its estimated fair value, the company's dividend is not well covered by earnings, and there is no substantial insider trading activity reported recently.

- Click to explore a detailed breakdown of our findings in Universal Store Holdings' earnings growth report.

- In light of our recent valuation report, it seems possible that Universal Store Holdings is trading beyond its estimated value.

Seize The Opportunity

- Discover the full array of 99 Fast Growing ASX Companies With High Insider Ownership right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:UNI

Universal Store Holdings

Designs, wholesales, and retails fashion products for men and women in Australia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives