- Australia

- /

- Hospitality

- /

- ASX:PBH

ASX Penny Stocks To Watch In November 2024

Reviewed by Simply Wall St

The Australian market is showing resilience with the ASX 200 expected to open higher, despite cautious moves from Wall Street investors ahead of the Thanksgiving break. For those interested in exploring beyond well-known stocks, penny stocks can offer intriguing opportunities. Although often associated with speculative trading, these smaller or newer companies can still present surprising value and potential for growth when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$325.58M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.50 | A$111.06M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.77 | A$229.66M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.64 | A$803.73M | ★★★★★☆ |

| Atlas Pearls (ASX:ATP) | A$0.15 | A$65.35M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.075 | A$116.81M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$490.37M | ★★★★☆☆ |

Click here to see the full list of 1,045 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Experience Co (ASX:EXP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Experience Co Limited operates in the adventure tourism and leisure sector across Australia and New Zealand, with a market cap of A$102.26 million.

Operations: The company's revenue is derived from its Skydiving segment, which generated A$62.05 million, and Adventure Experiences segment, contributing A$64.97 million.

Market Cap: A$102.26M

Experience Co Limited, with a market cap of A$102.26 million, operates in the adventure tourism sector and is currently unprofitable but has shown improvement by reducing losses at 27.3% annually over five years. Despite its negative return on equity and liabilities exceeding short-term assets, the company benefits from a stable cash runway exceeding three years and a satisfactory net debt to equity ratio of 6.9%. Trading at 68.6% below estimated fair value offers potential appeal for investors seeking undervalued opportunities in penny stocks. Recent developments include an amendment to its constitution approved at the Annual General Meeting on November 26, 2024.

- Navigate through the intricacies of Experience Co with our comprehensive balance sheet health report here.

- Assess Experience Co's future earnings estimates with our detailed growth reports.

PointsBet Holdings (ASX:PBH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PointsBet Holdings Limited operates a cloud-based technology platform offering sports, racing, and iGaming betting products and services in Australia, with a market cap of A$337.97 million.

Operations: The company's revenue is primarily derived from its Australian Trading segment, which accounts for A$211.54 million, complemented by contributions from Canada Trading at A$33.95 million and Technology at A$21.37 million.

Market Cap: A$337.97M

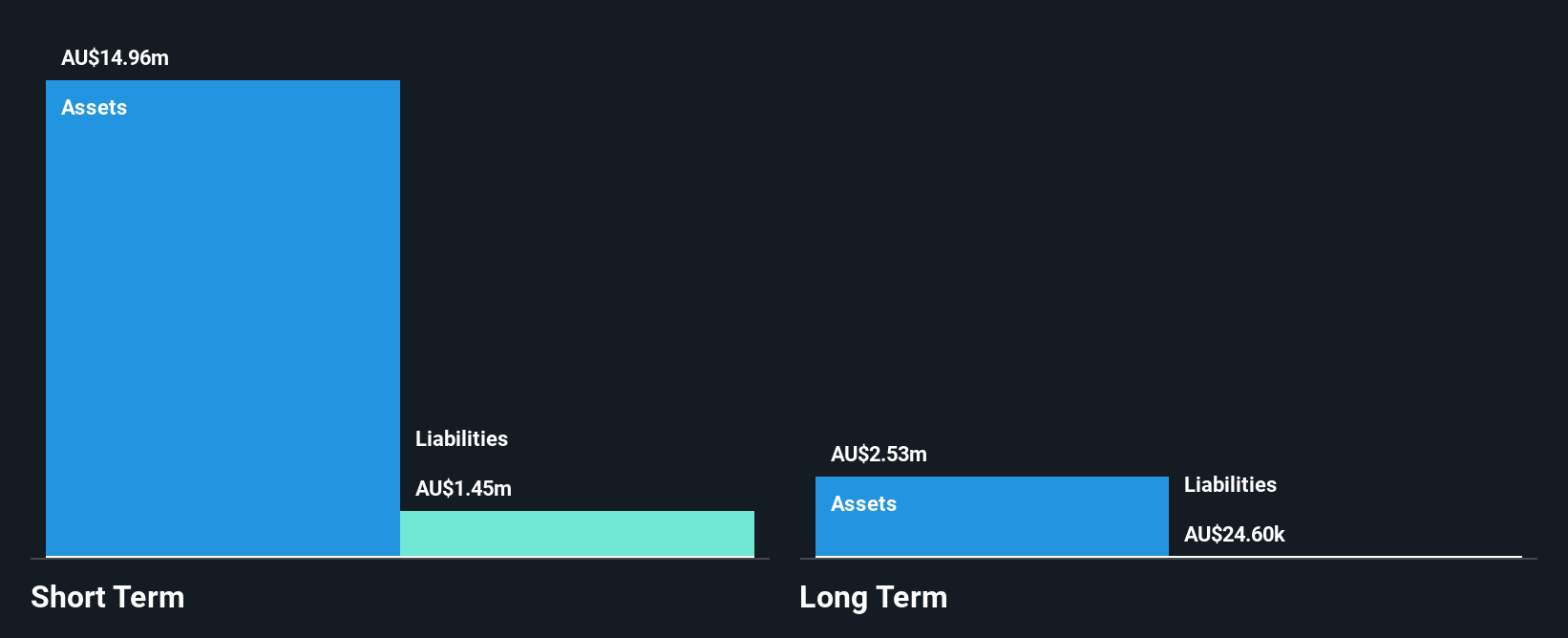

PointsBet Holdings Limited, with a market cap of A$337.97 million, is currently unprofitable but has reduced losses by 7.9% annually over five years. Despite negative return on equity and short-term liabilities exceeding assets, it remains debt-free and maintains a cash runway exceeding three years. Recent takeover discussions suggest potential acquisition interest from overseas suitors, possibly valuing the company above A$300 million. PointsBet's stock has surged over 80% since September amid these rumors, highlighting speculative interest in its future prospects despite current financial challenges and shareholder dilution in the past year.

- Unlock comprehensive insights into our analysis of PointsBet Holdings stock in this financial health report.

- Understand PointsBet Holdings' earnings outlook by examining our growth report.

Race Oncology (ASX:RAC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Race Oncology Limited is a clinical stage biopharmaceutical company dedicated to developing treatments for cancer patients, with a market cap of A$241.22 million.

Operations: The company's revenue segment includes A$4.00 million from Australia.

Market Cap: A$241.22M

Race Oncology Limited, with a market cap of A$241.22 million, is pre-revenue and currently unprofitable, with losses increasing over the past five years. Despite this, the company maintains a strong financial position with no debt and short-term assets significantly exceeding liabilities. The management team and board are relatively new, suggesting recent strategic shifts. Race Oncology's cash runway extends beyond one year even if historical cash flow reduction rates persist. Recent executive changes include appointing Dr Serge Scrofani as an Independent Non-Executive Director, potentially bringing valuable strategic insights from his extensive healthcare sector experience.

- Take a closer look at Race Oncology's potential here in our financial health report.

- Gain insights into Race Oncology's future direction by reviewing our growth report.

Taking Advantage

- Unlock our comprehensive list of 1,045 ASX Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PBH

PointsBet Holdings

Provides sports, racing, and iGaming betting products and services through its cloud-based technology platform in Australia.

High growth potential and good value.