- Australia

- /

- Hospitality

- /

- ASX:CTD

Corporate Travel Management (ASX:CTD investor three-year losses grow to 47% as the stock sheds AU$200m this past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Corporate Travel Management Limited (ASX:CTD) shareholders have had that experience, with the share price dropping 49% in three years, versus a market decline of about 6.6%. And over the last year the share price fell 24%, so we doubt many shareholders are delighted. Even worse, it's down 16% in about a month, which isn't fun at all. However, we note the price may have been impacted by the broader market, which is down 7.6% in the same time period.

If the past week is anything to go by, investor sentiment for Corporate Travel Management isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Corporate Travel Management moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

Revenue is actually up 25% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Corporate Travel Management further; while we may be missing something on this analysis, there might also be an opportunity.

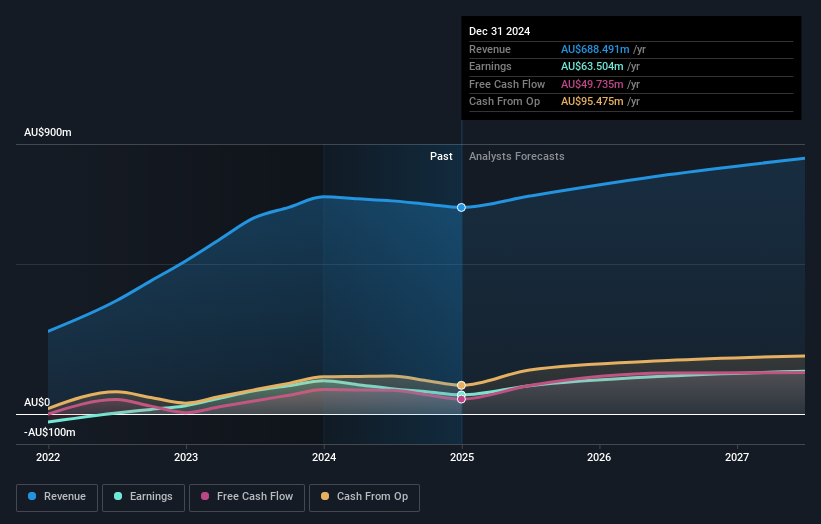

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Corporate Travel Management will earn in the future (free profit forecasts) .

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Corporate Travel Management the TSR over the last 3 years was -47%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We regret to report that Corporate Travel Management shareholders are down 23% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 4.0%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 8% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Corporate Travel Management you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CTD

Corporate Travel Management

A travel management solutions company, manages the procurement and delivery of travel services in Australia and New Zealand, North America, Asia, and Europe.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives