Collins Foods And 2 Other ASX Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

Recent movements in the Australian market have seen the ASX200 rise by 0.83%, with all sectors gaining ground, notably led by IT and Financials. As markets closely monitor ongoing developments such as the US election, investors are increasingly focused on identifying opportunities within small-cap stocks that may offer potential value amidst broader economic shifts. In this context, understanding what constitutes a promising stock—such as solid fundamentals and strategic insider activities—can be crucial for navigating current market conditions effectively.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Magellan Financial Group | 7.6x | 4.8x | 36.04% | ★★★★★☆ |

| GWA Group | 16.4x | 1.5x | 41.37% | ★★★★★☆ |

| SHAPE Australia | 14.3x | 0.3x | 32.66% | ★★★★☆☆ |

| Collins Foods | 18.0x | 0.7x | 5.69% | ★★★★☆☆ |

| Dicker Data | 19.7x | 0.7x | -64.56% | ★★★★☆☆ |

| Centuria Capital Group | 20.6x | 4.6x | 47.36% | ★★★★☆☆ |

| Fiducian Group | 19.0x | 3.5x | 1.27% | ★★★☆☆☆ |

| Coventry Group | 234.4x | 0.4x | -19.88% | ★★★☆☆☆ |

| BSP Financial Group | 7.8x | 2.8x | 1.10% | ★★★☆☆☆ |

| Cromwell Property Group | NA | 4.8x | -20.95% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

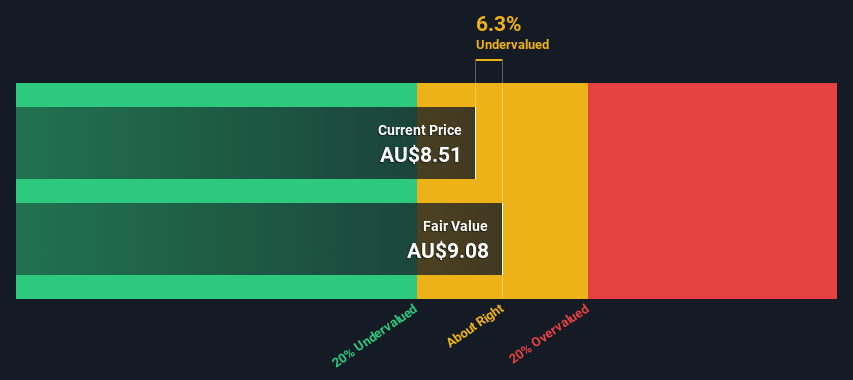

Collins Foods (ASX:CKF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Collins Foods is a company that operates Taco Bell and KFC restaurants in Australia and Europe, with a market capitalization of A$1.63 billion.

Operations: Revenue is primarily generated from KFC Restaurants in Australia, followed by KFC Restaurants in Europe and Taco Bell. The gross profit margin has shown a slight downward trend, reaching 50.44% recently. Operating expenses are significant, with sales and marketing being a major component.

PE: 18.0x

Collins Foods, a smaller player in the Australian market, is drawing attention due to its growth potential and strategic leadership changes. With earnings projected to grow 15% annually, the company is positioned for expansion despite relying solely on external borrowing. Recent insider confidence was shown through share purchases in September 2024. The appointment of Xavier Simonet as CEO and Managing Director from November 2024 brings a wealth of experience in global retail operations and strategic transformations, potentially enhancing Collins Foods' competitive edge.

- Unlock comprehensive insights into our analysis of Collins Foods stock in this valuation report.

Explore historical data to track Collins Foods' performance over time in our Past section.

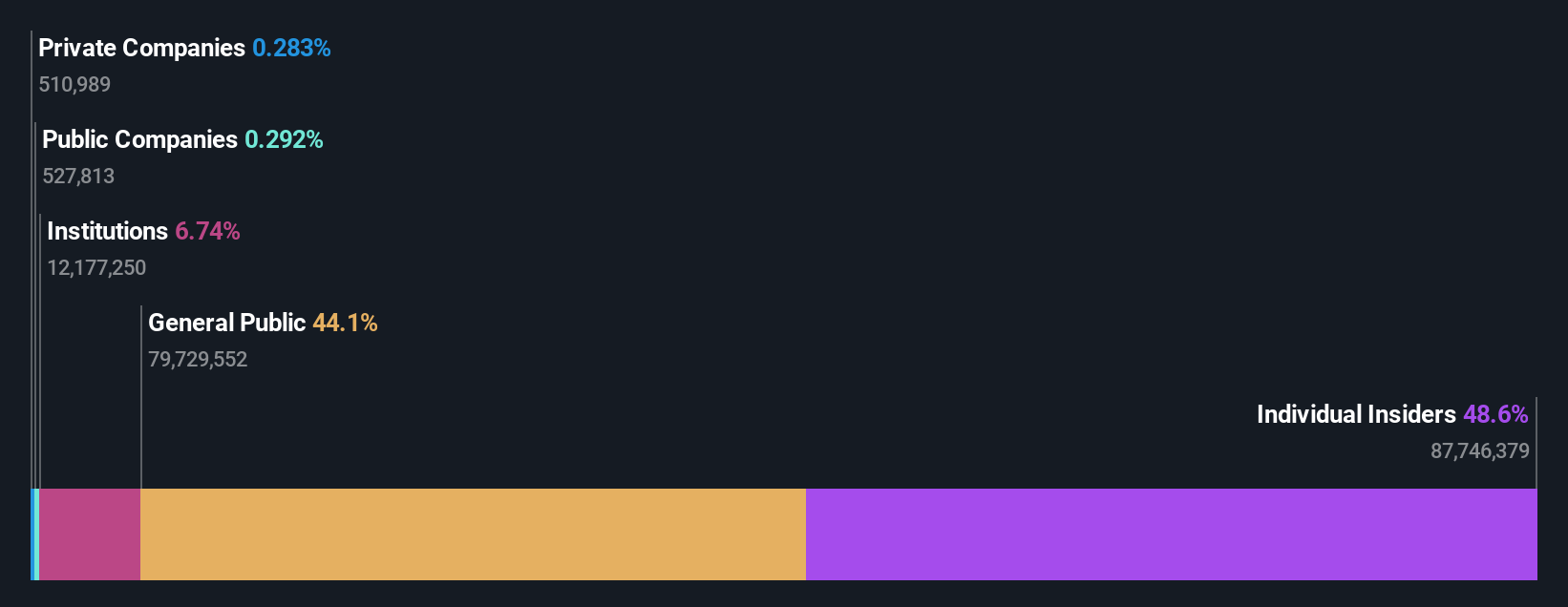

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dicker Data is a wholesale distributor specializing in computer peripherals, with operations that contribute to its market capitalization of A$2.01 billion.

Operations: The company generates revenue primarily from wholesale computer peripherals, with recent figures reaching A$2.24 billion. Its gross profit margin has shown a notable upward trend, increasing from 8.62% in December 2013 to 14.54% by June 2024. Operating expenses have consistently risen alongside revenue growth, impacting net income margins which have also improved over time to reach approximately 3.57%.

PE: 19.7x

Dicker Data, a tech distributor in Australia, shows potential as an undervalued small-cap. Despite a slight dip in recent half-year earnings to A$35.4 million from A$37.6 million last year, insider confidence is evident with share purchases over the past six months. The company faces higher-risk funding due to reliance on external borrowing but maintains a good financial position overall. Earnings are projected to grow annually by 9.36%, suggesting promising future prospects for investors seeking growth opportunities in this sector.

- Click to explore a detailed breakdown of our findings in Dicker Data's valuation report.

Review our historical performance report to gain insights into Dicker Data's's past performance.

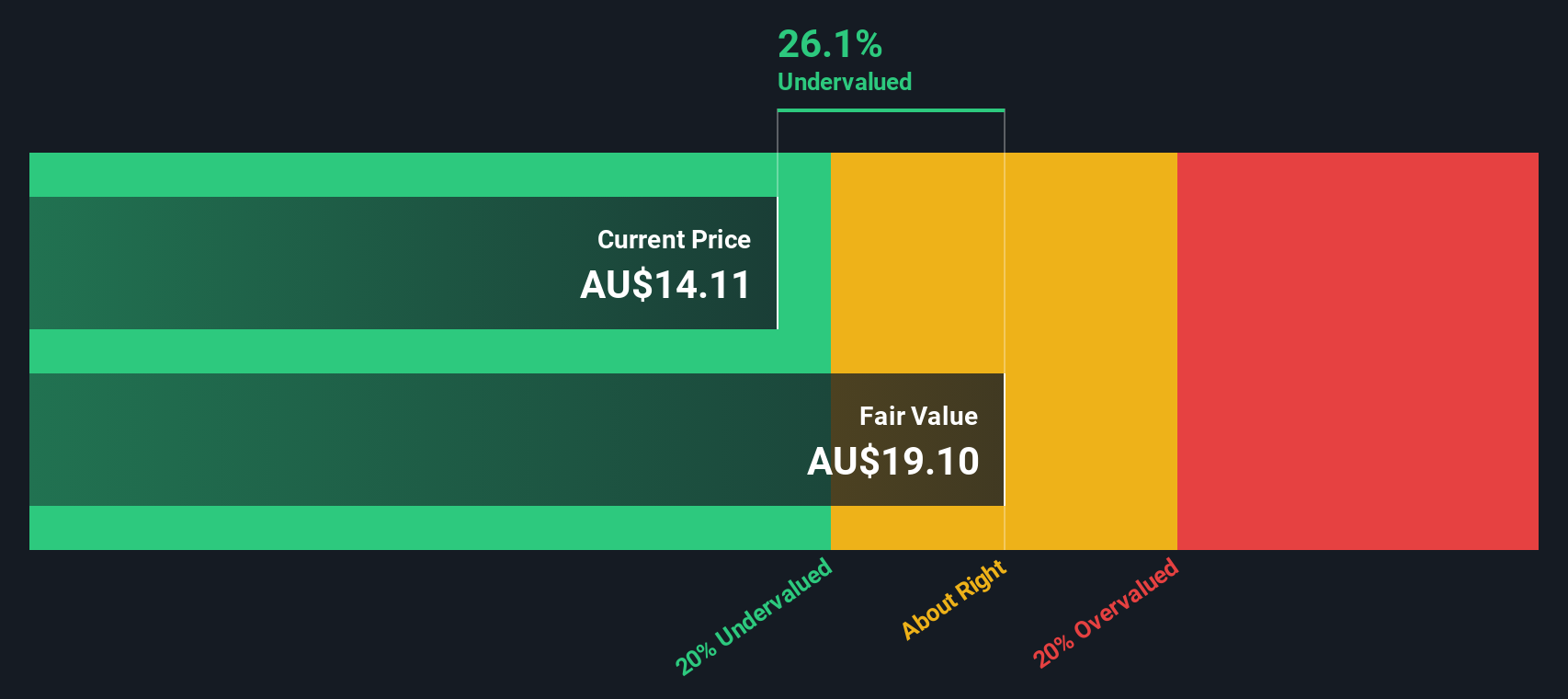

Neuren Pharmaceuticals (ASX:NEU)

Simply Wall St Value Rating: ★★★★★★

Overview: Neuren Pharmaceuticals is a biopharmaceutical company focused on developing therapies for neurodevelopmental disorders, with a market cap of A$1.36 billion.

Operations: Neuren Pharmaceuticals' revenue has seen significant growth, reaching A$193.34 million by the latest period. The company experienced a notable improvement in its gross profit margin, which increased to 82.98%. Cost of goods sold (COGS) and operating expenses have been managed alongside this revenue increase, contributing to a net income of A$117.29 million with a net income margin of 60.67%.

PE: 14.5x

Neuren Pharmaceuticals, a small Australian company, is navigating a challenging landscape with recent earnings showing a decline in sales and revenue for the first half of 2024. Despite this, insider confidence is evident as they have been purchasing shares throughout the year. The company is advancing its clinical trials, including pivotal programs for Phelan-McDermid syndrome and Angelman syndrome. While earnings are projected to decrease over the next few years, their strategic initiatives could potentially unlock future opportunities.

Seize The Opportunity

- Investigate our full lineup of 24 Undervalued ASX Small Caps With Insider Buying right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DDR

Dicker Data

Engages in the wholesale distribution of computer hardware, software, and related products for corporate and commercial markets in Australia and New Zealand.

Good value with adequate balance sheet.

Market Insights

Community Narratives