- Australia

- /

- Hospitality

- /

- ASX:CEH

ASX Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

The Australian market remained flat over the last week, although it has risen by 22% over the past year with earnings forecast to grow by 12% annually. In such a climate, identifying stocks that combine value and growth potential is key, especially within the often-overlooked segment of penny stocks. While the term 'penny stocks' may seem outdated, these smaller or newer companies can still offer significant opportunities when backed by strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.57 | A$65.06M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$128.44M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.825 | A$104.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$300.41M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$842.94M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.715 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$56.64M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.90 | A$115.92M | ★★★★★★ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

AMCIL (ASX:AMH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amcil Limited is a publicly owned investment manager with a market cap of A$370.34 million.

Operations: The company's revenue is derived entirely from its investments, totaling A$10.13 million.

Market Cap: A$370.34M

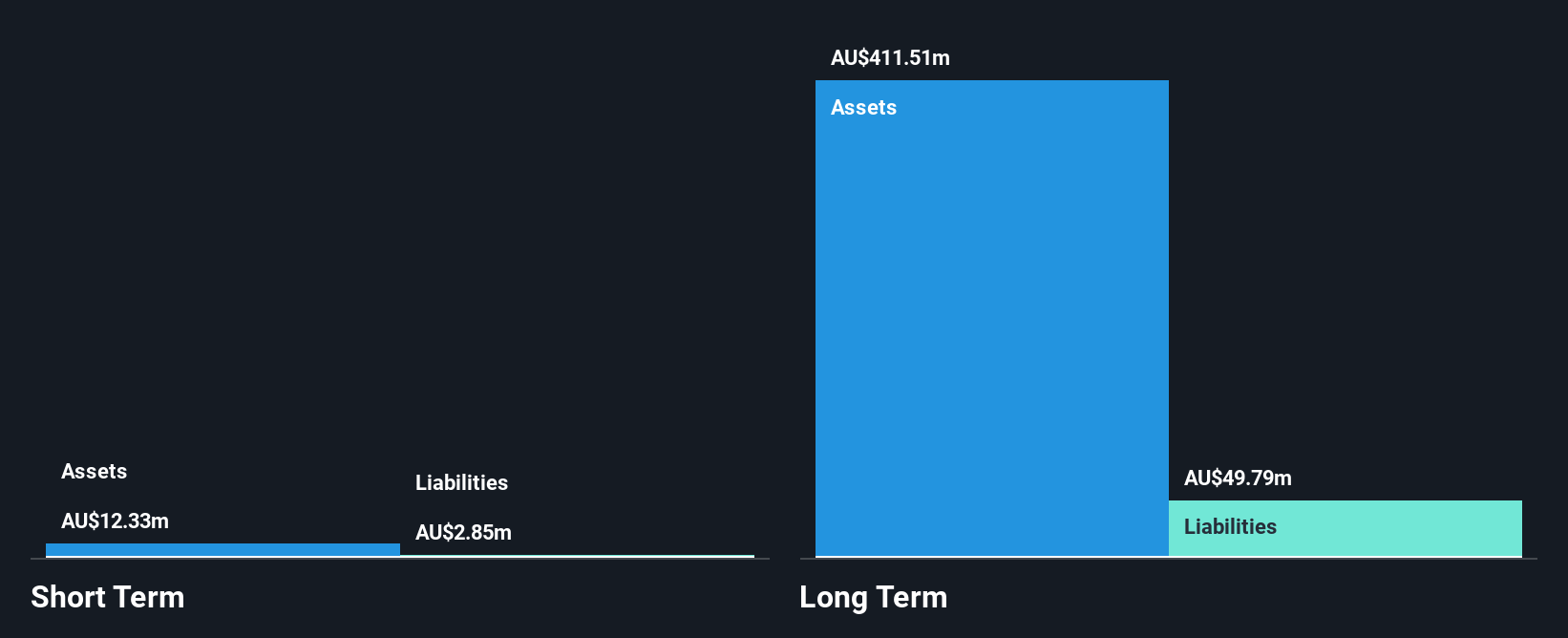

AMCIL Limited, with a market cap of A$370.34 million, has demonstrated financial stability through its debt-free status and high-quality earnings. Despite a slight decline in revenue from A$10.34 million to A$10.13 million over the past year, AMCIL maintains robust profit margins at 73.8%. The company's short-term assets significantly exceed its short-term liabilities, although they fall short of covering long-term liabilities. Recent strategic moves include a share buyback program aimed at capital management and the issuance of fully franked dividends, reflecting an effort to enhance shareholder value despite challenges in earnings growth compared to industry standards.

- Click to explore a detailed breakdown of our findings in AMCIL's financial health report.

- Learn about AMCIL's historical performance here.

Coast Entertainment Holdings (ASX:CEH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Coast Entertainment Holdings Limited invests in, owns, and operates leisure and entertainment businesses in Australia, with a market cap of A$196.66 million.

Operations: The company generates revenue from its Theme Parks & Attractions segment, amounting to A$87.03 million.

Market Cap: A$196.66M

Coast Entertainment Holdings, with a market cap of A$196.66 million, operates in the leisure sector and has shown financial resilience despite being unprofitable. The company reported A$87.03 million in revenue from its Theme Parks & Attractions segment and has successfully reduced losses over five years at a rate of 32.7% annually. It remains debt-free, with short-term assets (A$97.3M) covering both short- and long-term liabilities comfortably. Recent strategic actions include completing a significant share buyback program worth A$22.65 million while facing challenges such as being dropped from the S&P Global BMI Index and undergoing an auditor change to BDO Audit Pty Ltd.

- Click here to discover the nuances of Coast Entertainment Holdings with our detailed analytical financial health report.

- Gain insights into Coast Entertainment Holdings' outlook and expected performance with our report on the company's earnings estimates.

Hearts and Minds Investments (ASX:HM1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hearts and Minds Investments (ASX:HM1) is an Australian investment company with a market cap of A$680.08 million, focused on generating returns through a concentrated portfolio of high-conviction ideas from leading fund managers.

Operations: The company's revenue segment is derived entirely from its investment activities, totaling A$84.39 million.

Market Cap: A$680.08M

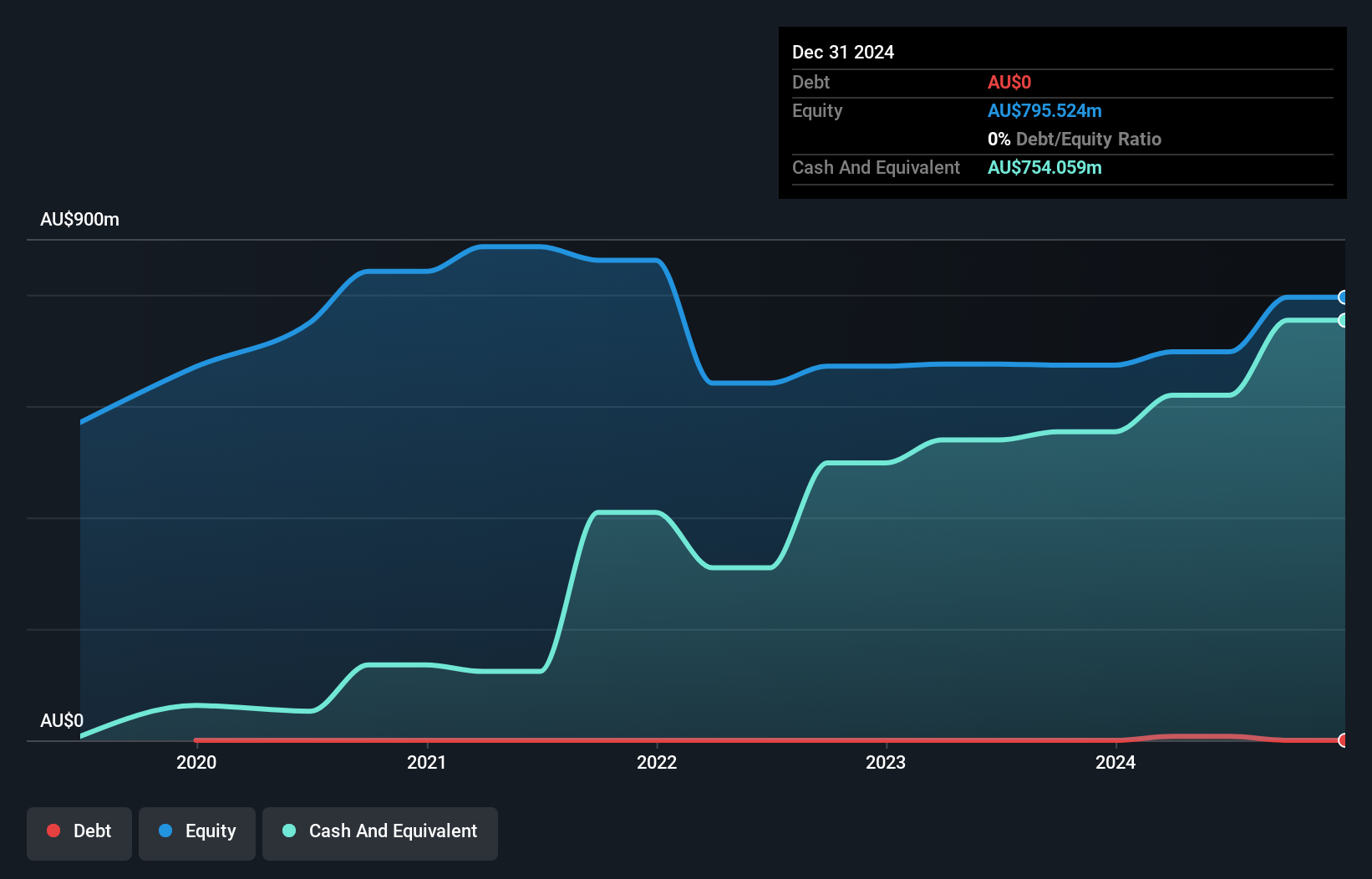

Hearts and Minds Investments, with a market cap of A$680.08 million, has demonstrated robust financial performance through its investment activities, generating A$83.37 million in revenue for the year ending June 2024. The company boasts a strong balance sheet, with short-term assets significantly exceeding liabilities and more cash than debt. Despite an increase in debt-to-equity ratio over five years, interest payments are well covered by EBIT. However, the dividend yield of 4.88% is not fully supported by free cash flow. Earnings growth of 55.6% outpaced industry averages but management's tenure suggests recent changes in leadership experience levels.

- Navigate through the intricacies of Hearts and Minds Investments with our comprehensive balance sheet health report here.

- Examine Hearts and Minds Investments' past performance report to understand how it has performed in prior years.

Make It Happen

- Reveal the 1,027 hidden gems among our ASX Penny Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CEH

Coast Entertainment Holdings

Engages in the investment, ownership, and operation of leisure and entertainment businesses in Australia.

Excellent balance sheet with reasonable growth potential.