- Australia

- /

- Renewable Energy

- /

- ASX:LGI

Betmakers Technology Group And 2 Other ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market is showing a slight uptick as the ASX 200 futures indicate a modest 0.09% rise, amidst global investor anticipation following Nvidia's earnings report. In this context, identifying stocks that offer both value and growth potential becomes crucial for investors looking to navigate the current economic landscape. Penny stocks, though an outdated term, still signify smaller or newer companies that can present unique opportunities when backed by strong financials and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$318.31M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.89 | A$239.61M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.685 | A$825.78M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.495 | A$1.7B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$69.71M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Betmakers Technology Group (ASX:BET)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Betmakers Technology Group Ltd develops and provides software, data, and analytics products for the B2B wagering market across Australia, New Zealand, the United States, the United Kingdom, Europe, and internationally with a market cap of A$111.56 million.

Operations: The company's revenue is primarily derived from two segments: Global Tote, contributing A$54.77 million, and Global Betting Services, generating A$40.43 million.

Market Cap: A$111.56M

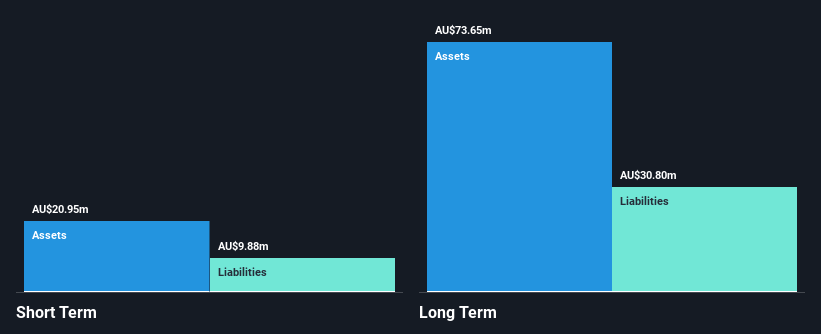

Betmakers Technology Group Ltd, with a market cap of A$111.56 million, reported revenues of A$95.2 million for the fiscal year ending June 30, 2024. Despite stable revenue figures, the company remains unprofitable with a net loss of A$38.67 million and has experienced shareholder dilution over the past year. The management team and board are relatively new with limited tenure experience. On a positive note, Betmakers is debt-free and possesses sufficient cash runway to sustain operations for more than three years based on current free cash flow levels despite being recently dropped from the S&P Global BMI Index in September 2024.

- Take a closer look at Betmakers Technology Group's potential here in our financial health report.

- Evaluate Betmakers Technology Group's historical performance by accessing our past performance report.

LGI (ASX:LGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LGI Limited, with a market cap of A$275.31 million, offers carbon abatement and renewable energy solutions by utilizing biogas from landfills.

Operations: The company's revenue is derived from three main segments: Carbon Abatement (A$14.63 million), Renewable Energy (A$16.15 million), and Infrastructure Construction and Management (A$2.45 million).

Market Cap: A$275.31M

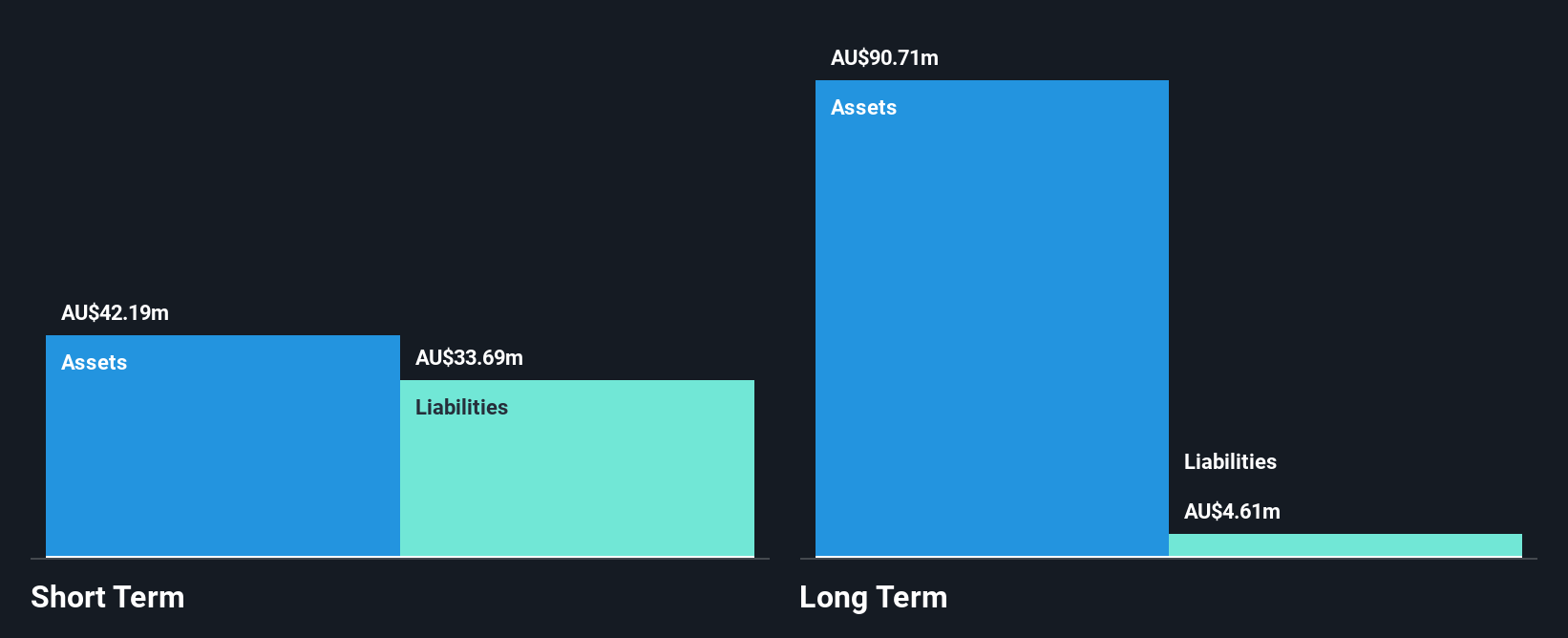

LGI Limited, with a market cap of A$275.31 million, has shown stable weekly volatility and satisfactory debt levels, maintaining a net debt to equity ratio of 3.2%. The company reported revenues of A$33.25 million for the fiscal year ending June 30, 2024, with net income rising slightly to A$6.67 million. Despite its low return on equity at 12.6%, LGI's earnings have grown significantly over five years and are forecasted to continue growing annually by 18.67%. However, short-term assets do not cover long-term liabilities, and the management team lacks experience with an average tenure under two years.

- Click to explore a detailed breakdown of our findings in LGI's financial health report.

- Learn about LGI's future growth trajectory here.

Smart Parking (ASX:SPZ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Smart Parking Limited designs, develops, and manages parking management solutions across New Zealand, Australia, Germany, and the United Kingdom with a market cap of A$318.55 million.

Operations: The company's revenue segments include A$6.28 million from the Technology Division and contributions from Parking Management in the United Kingdom (A$43.99 million), New Zealand (A$4.57 million), Germany (A$2.79 million), Denmark (A$0.11 million), and Australia (A$0.07 million).

Market Cap: A$318.55M

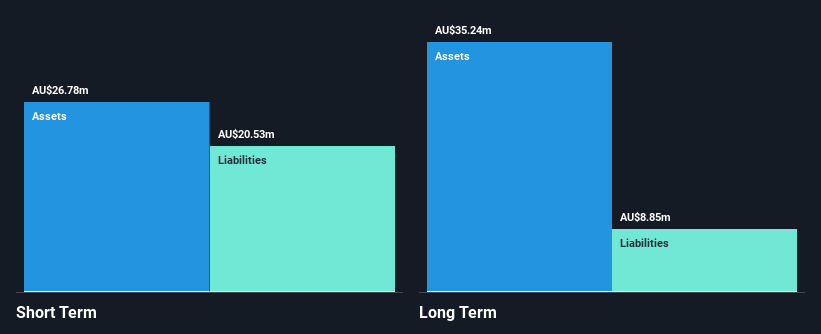

Smart Parking Limited, with a market cap of A$318.55 million, has demonstrated financial stability despite challenges. The company reported A$54.3 million in sales for the fiscal year ending June 30, 2024, though net income declined to A$3.7 million from the previous year’s A$6.4 million. While its earnings growth was negative over the past year, Smart Parking maintains high-quality earnings and adequate interest coverage with EBIT covering interest payments 11.3 times over. Additionally, short-term assets exceed both short and long-term liabilities, indicating sound liquidity management amid recent delisting from OTC Equity due to inactivity concerns.

- Jump into the full analysis health report here for a deeper understanding of Smart Parking.

- Gain insights into Smart Parking's future direction by reviewing our growth report.

Make It Happen

- Access the full spectrum of 1,044 ASX Penny Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LGI

LGI

Provides carbon abatement and renewable energy solutions with biogas from landfill.

Excellent balance sheet with moderate growth potential.