- Australia

- /

- Food and Staples Retail

- /

- ASX:GNC

Improved Earnings Required Before GrainCorp Limited (ASX:GNC) Shares Find Their Feet

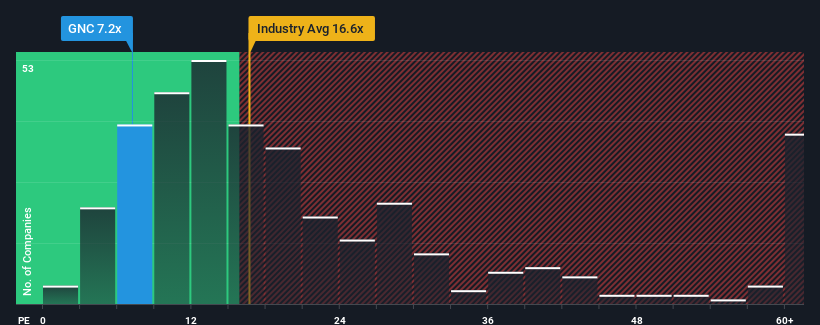

With a price-to-earnings (or "P/E") ratio of 7.2x GrainCorp Limited (ASX:GNC) may be sending very bullish signals at the moment, given that almost half of all companies in Australia have P/E ratios greater than 20x and even P/E's higher than 35x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, GrainCorp's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for GrainCorp

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like GrainCorp's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 33%. Still, the latest three year period has seen an excellent 624% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings growth is heading into negative territory, declining 24% each year over the next three years. Meanwhile, the broader market is forecast to expand by 16% per year, which paints a poor picture.

In light of this, it's understandable that GrainCorp's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On GrainCorp's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that GrainCorp maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware GrainCorp is showing 3 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:GNC

GrainCorp

Operates as an agribusiness and processing company in Australasia, Asia, North America, Europe, Asia, the Middle East and North Africa, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives