- Australia

- /

- Food and Staples Retail

- /

- ASX:COL

Coles (ASX:COL) Valuation Spotlight: How Defensive Strength and Dividends Shape Investor Sentiment

Reviewed by Kshitija Bhandaru

Coles Group (ASX:COL) has come into focus as investors seek out stability amid increased market volatility. The company’s image as a reliable consumer staples stock, with dependable dividends and steady cash flow, is drawing renewed attention.

See our latest analysis for Coles Group.

Coles Group’s share price has climbed 22.8% year-to-date, closing at A$23.18, as investors rewarded its steady performance and defensive appeal. With a one-year total shareholder return of 33.2% and a robust 56% over three years, momentum is clearly building around the stock’s long-term track record and income reliability.

If you’re weighing where else stable growth and ownership are driving results, now is a great opportunity to expand your perspective and discover fast growing stocks with high insider ownership

Yet with Coles trading near its analyst price targets and boasting a strong run, the key question is whether the current share price reflects its true value or if the market is already factoring in future growth. Could there still be a window for buyers?

Most Popular Narrative: 5% Overvalued

According to Robbo, Coles’ fair value sits just below its last close price, hinting at a slight premium in the current market. The narrative frames Coles as a defensive mainstay, but its price tag comes under scrutiny given the company’s modest growth outlook.

Despite its defensive characteristics, strong brand moat, and stable earnings, Coles appears relatively inexpensive as an investment. Its forward PE ratio is around 21 times, and it offers a dividend yield of approximately 4%. While this might seem expensive for a small pharmaceutical company or a gold miner, for a business controlling 30% of Australia’s non-discretionary spending on food and essential goods, it seems quite reasonable.

Want to know why a “boring” supermarket business commands a price tag that rivals some high-growth peers? The core of this narrative is a surprising mix of blue-chip stability and a future profit multiple usually reserved for faster-growing sectors. Curious which classic financial levers support this valuation, and what could tip the scales? Unpack the logic behind these numbers in the full narrative and see just how the story stacks up.

Result: Fair Value of $22.0 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, changing consumer trends or unexpected regulatory hurdles could quickly shift sentiment away from Coles and challenge its blue-chip reputation.

Find out about the key risks to this Coles Group narrative.

Another View: Discounted Cash Flow Suggests Hidden Value

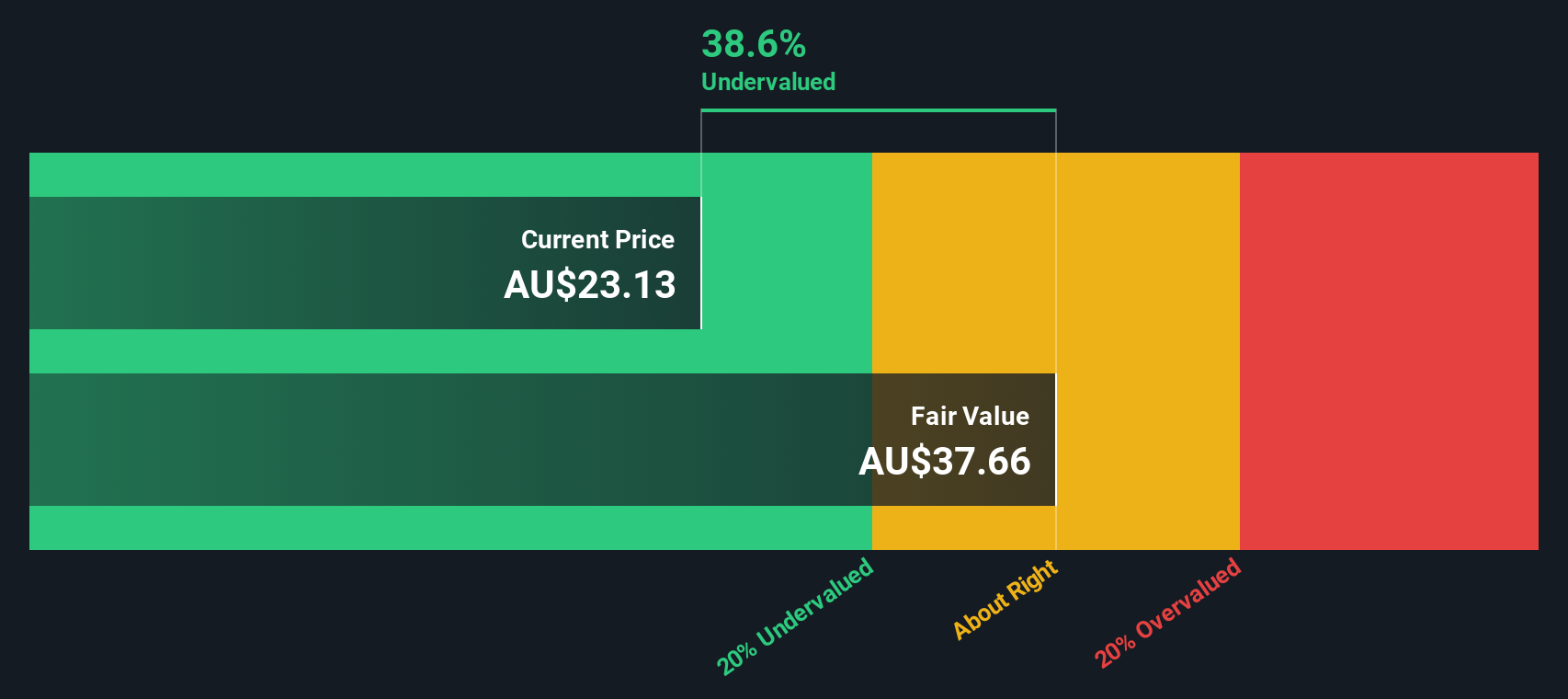

While traditional valuation based on multiples portrays Coles as somewhat expensive, our DCF model presents a different perspective. According to the SWS DCF model, Coles is trading about 38% below its estimated fair value of A$37.75, suggesting that the share price may not fully reflect its longer-term cash flow potential. Which method provides the clearest signal for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coles Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coles Group Narrative

If you prefer to dig into the numbers yourself or want to challenge the consensus, building your own Coles Group view is quick and easy. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Coles Group.

Looking for more investment ideas?

Smart investors always scan the market for advantage. Now’s your chance to handpick new opportunities using expert-built screeners designed to match your investing ambitions. Don’t leave potential gains on the table.

- Start collecting passive income with ease by checking out these 18 dividend stocks with yields > 3% offering reliable yields above 3% and a history of strong distributions.

- Position yourself for explosive growth by tapping into these 25 AI penny stocks shaking up industries with AI-driven innovation and game-changing business models.

- Boost your portfolio’s long-term potential and spot tomorrow’s winners early through these 891 undervalued stocks based on cash flows powered by in-depth cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:COL

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives